2025-4-22 11:33 |

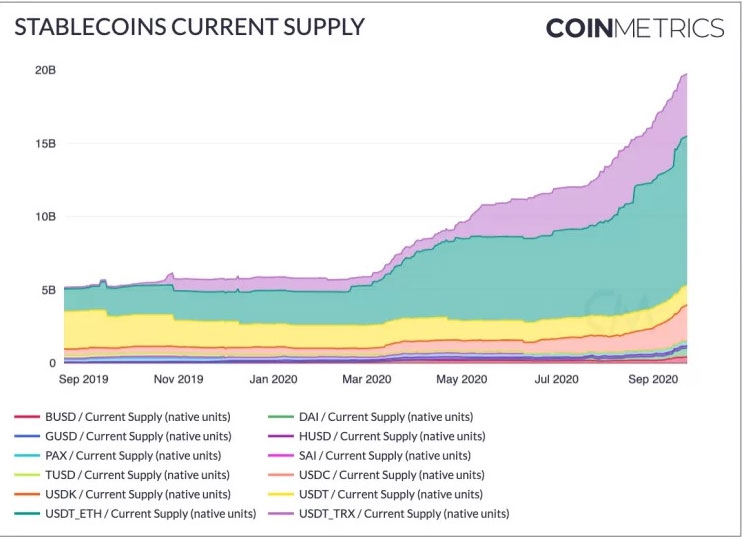

Cryptocurrencies may have failed to do particularly well amidst the tariffs-driven sell-off in financial markets, but Standard Chartered remains bullish as ever on what the future holds for stablecoins.

Geoffrey Kendrick, a London-based analyst at the financial services giant, expects stablecoin assets to hit as much as $2 trillion over the next three to four years if the Trump administration signs legislation that clarifies crypto regulations this summer.

At present, that market is worth around $230 billion. Such a massive growth in stablecoins could drive investors to other crypto assets in 2025 as well, including the up-and-coming project, Bitcoin Pepe.

Bitcoin Pepe presale continues to attract demandBitcoin Pepe is marketing itself as the world’s only Bitcoin meme ICO – a narrative that’s clearly sitting well with the global investors.

During the presale, the meme coin has already raised nearly $6.9 million, which signals significant demand for Bitcoin Pepe.

The crypto platform promises instant transactions and ultra-low fees, which may also be helping drive investors to its native meme coin.

Bitcoin Pepe is currently going for $0.031 only, indicating investors don’t need enormous capital to build a sizable position in this meme coin either.

That’s what makes Bitcoin Pepe even more attractive to own in 2025.

You can visit the project website at this link to learn more about this coin.

Crypto regulation could help Bitcoin PepeStablecoins have grown their market cap by 11% already in 2025, confirming continued demand for digital assets despite broader volatility.

Trading volume in stablecoins has been rising recently, driven by confidence that the Trump administration will provide regulatory clarity.

Combined with expected rate cuts, which typically boost interest in risk-on assets like cryptocurrencies, the outlook for crypto prices this year appears positive.

Moreover, it’s not just Bitcoin and popular stablecoins that stand to benefit from increased crypto interest.

Newer coins, especially those gaining strong demand, such as Bitcoin Pepe, have just as much potential to capitalise on the trend.

Click here to explore ways to participate in Bitcoin Pepe’s ongoing presale now.

Should you invest in Bitcoin Pepe in 2025?All in all, while the US President’s recently announced tariffs have taken the centre stage in recent weeks, his government’s commitment to making America the crypto capital of the world remains intact.

Investors are broadly convinced that the Trump administration will indeed create a clear set of rules and regulations for cryptocurrencies this year, which may drive significantly more investors to the digital assets, including Bitcoin Pepe.

Click on this link to learn more about the project.

The post Stablecoins seen hitting $2 trillion: is that a positive for Bitcoin Pepe? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Formosa Financial (FMF) на Currencies.ru

|

|