2023-11-9 09:48 |

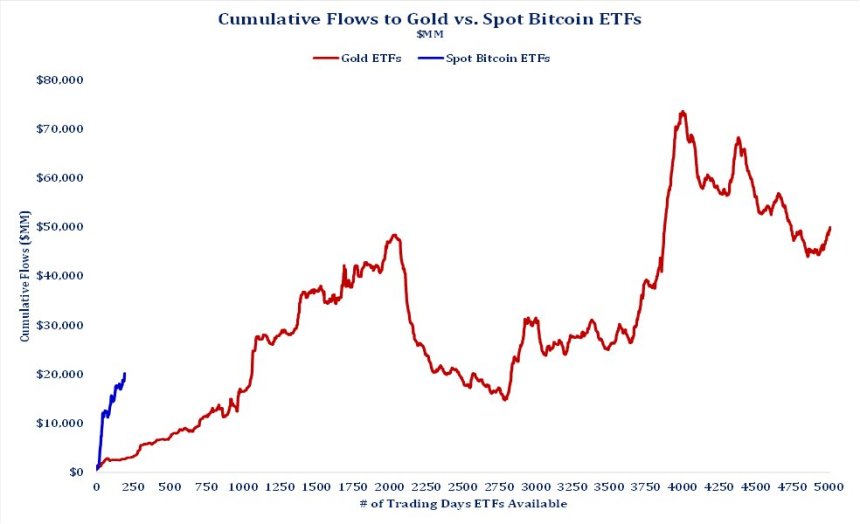

The market is abuzz with anticipation as a key window for the approval of all 12 spot Bitcoin Exchange-Traded Funds (ETFs) opens today. James Seyffart, an ETF analyst at Bloomberg Intelligence, shared his insights, noting, “We still believe 90% chance by Jan 10 for spot Bitcoin ETF approvals. But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants COULD occur.”

This critical juncture follows delay orders issued by the Securities and Exchange Commission (SEC) for several major firms, including BlackRock, Bitwise, VanEck, WisdomTree, Invesco, Fidelity, and Valkyrie. “If the agency wants to allow all 12 filers to launch — as we believe — this is the first available window since Grayscale’s court victory was affirmed,” Seyffart explained the timeline, adding, “This window for all 12 ends by November 17. But theoretically, SEC could make a decision on the first 9 on this list at any point from now until Jan 10, 2024.”

Roadblocks For A Spot Bitcoin ETF ApprovalScott Johnsson, a finance lawyer at Davis Polk, provided further clarity on the process. He explained that 19b-4 approvals do not need to happen on the same date in order to launch on the same date. “Likely to happen that way anyway, but that’s purely optics imo. And for that reason, James Seyffart highlighting this week/next as one of two periods where the SEC can approve everyone is important,” Johnsson remarked.

However, Seyffart added a layer of complexity to the approval process, indicating, there are two different approvals from inside the SEC needed for an ETF launch. “Even if 19b-4 is approved, S-1s still need to sign off from the division of Corporate Finance. No sign that’s done yet. Possible and even likely that there could be weeks or even months between approval & launch,” the Bloomberg analyst speculated.

Johnsson agrees with Seyffart on this topic. According to him, even if an approval is granted soon, it could still take at least a month, or possibly longer, before any ETFs are actually launched. He stated that the “S-1s are still under review and no real hard deadline for that process. Though I consider it more a formality at that stage.”

Johnsson further speculated that the number of comment rounds prior to the approval, meaning “the time between them and extent of changes in each round will be predictive of how long the gap is between 19b-4 approval and launch.”

Eric Balchunas, senior ETF analyst for Bloomberg, also weighed in on the timeline, admitting, “Don’t know for sure tbh, unknowns exist still, but that said best guess the 19b-4s are approved in not so distant future. Then a gap of time while SEC preps things, then they approve S-1s. After that it would likely be days till launch.”

Grayscale Starts Talks With SECIn related news, Nate Geraci, President of the ETF Store, reported on progress between Grayscale and the SEC, stating, “SEC has apparently opened talks w/ Grayscale on GBTC conversion. First sign of any progress since the court mandate.” According to an insider, Grayscale is in talks with both the SEC’s Division of Trading and Markets and the Division of Corporation Finance following its court victory in August.

At press time, BTC was trading at $36,700 and has gained around 4% in the last 24 hours, driven by the renewed speculation surrounding the approval of a spot ETF.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|