2024-1-11 12:38 |

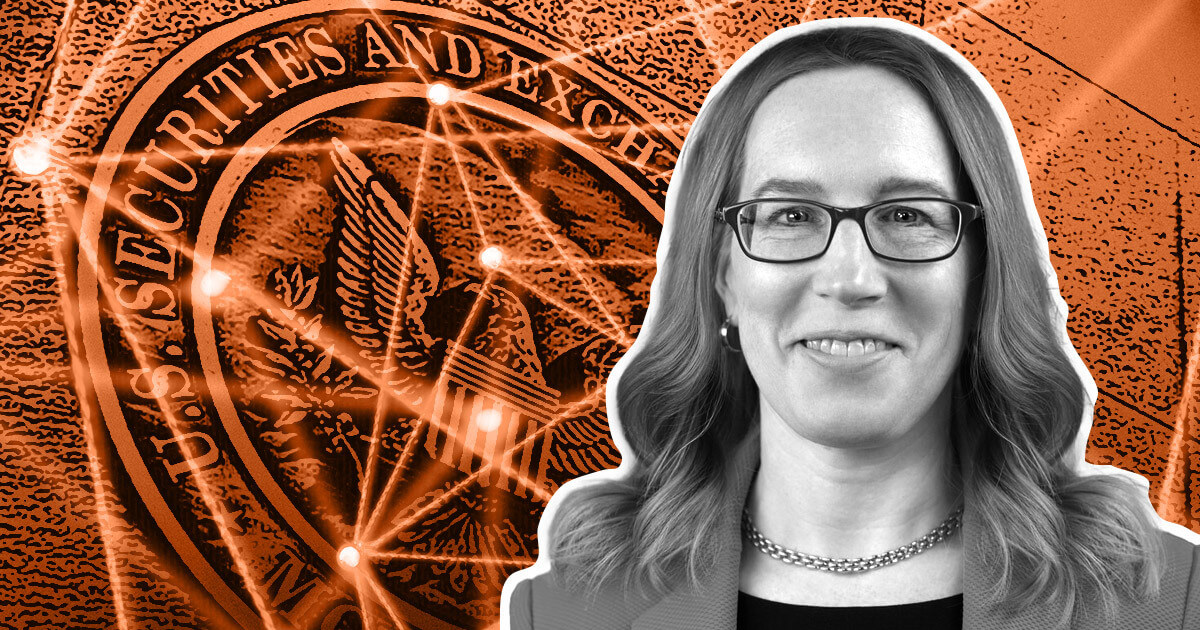

After a decade of anticipation and regulatory hurdles, the United States has finally given the nod to spot Bitcoin exchange-traded Funds (ETFs). This groundbreaking decision was announced Wednesday afternoon by the Securities and Exchange Commission.

These much-awaited financial products will make their debut in major U.S. markets, including the NYSE, Cboe Global Markets, and Nasdaq, backed by significant trading firms poised to enhance liquidity.

Early trading hours set the stageTrading of these innovative ETFs could commence as early as 4 a.m. ET (10:00 UTC), well before the traditional opening ceremonies of U.S. stock exchanges. This move marks a significant step towards integrating cryptocurrencies into mainstream financial markets.

Revolutionizing retail and institutional investmentThese ETFs are set to transform the landscape for retail customers and traditional financial institutions alike. Customers can now access Bitcoin’s (BTC) price movements through conventional brokerage apps and accounts. Meanwhile, institutions can invest in Bitcoin without navigating the complexities of crypto exchanges.

Goldman Sachs, in a report, said the approval of spot bitcoin ETFs could be advantageous for institutional investors as these ETFs offer a practical proxy for trading, featuring low management fees. Moreover, they present opportunities for institutions to more effectively participate in arbitrage strategies and options hedging.

Sheila Warren, CEO of the Crypto Council for Innovation, says,

The introduction of a spot Bitcoin ETF isn’t just about market dynamics, it’s a catalyst for regulatory evolution. It necessitates a framework that accommodates the unique nature of crypto, potentially leading to more appropriate and informed regulatory policies in the crypto space.

A spot Bitcoin ETF is a precursor to a plethora of innovative financial products and services that straddle the line between traditional finance and cryptocurrencies, expanding the horizon for what’s possible within the crypto ecosystem.

Prepared liquidity poolsWith 11 spot Bitcoin ETFs set to launch – and billions in assets already aligned for their debut – liquidity providers and market makers have been diligently preparing. The NYSE’s liquidity programs and natural hedges for market makers are expected to ensure a dynamic and liquid market.

BlackRock and Coinbase partnershipBlackRock, through its partnership with Coinbase, is poised to make a significant impact in this new market. Although specific figures on assets under management for its Bitcoin ETF are undisclosed, a notable $100,000 seed investment has been made, highlighting the firm’s long-term commitment to this venture.

The post Spot Bitcoin ETFs approved, now what to expect today? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|