2022-6-21 05:00 |

Two community proposals by Solana-based decentralized finance (Defi) protocol Solend were voted on recently to mitigate risks from whales that operate on large margin positions. However, the second proposal has now countered the initial version.

The protocol that facilities lending and borrowing on Solana had first proposed SLND1 to reduce user and market risk. The community was asked to vote on special margin requirements for large whales that represent over 20% of borrowers.

The proposal had argued that “Letting a liquidation of this size to happen on-chain is extremely risky.” Further adding, “DEX liquidity isn’t deep enough to handle a sale of this size and could cause cascading effects.”

SLND1 overturned; here’s whyTherefore, SLND1 would grant emergency power to Solend Labs to temporarily take over the whale’s account to allow over-the-counter liquidations.

Solend had claimed that the proposal was only floated after several attempts to get in touch with the whale. It had said, “Despite our efforts, we’ve been unable to get the whale to reduce their risk, or even get in contact with them. With the way things are trending with the whale’s unresponsiveness, it’s clear action must be taken to mitigate risk.”

However, after much criticism and despite 97.5% community support for the proposal, SLND1 was overturned.

This is the textbook difference between #Bitcoin Proof of Work, unalterable by stakeholders

and

Proof of Stake projects, which can be shut down, changed, censored or deleted at anytime by the stakeholders/founders https://t.co/4G4TcO8tzs

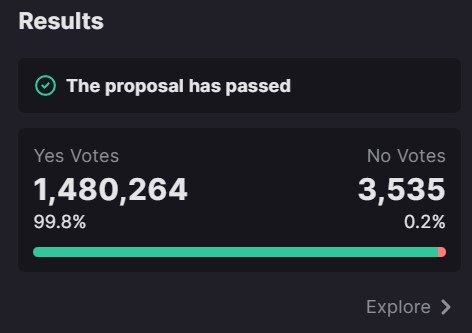

That said, a whopping majority of 99.8% of users within the community instead supported the proposal under SLND2, which looked at invalidating SLND1. Furthermore, the new proposal also increased governance voting time to one day, while removing emergency powers to take over an account by Solend Labs.

Source Majority support SLND2 as a better alternativeThe platform stated, “We’ve been listening to your criticisms about SLND1 and the way in which it was conducted. The price of SOL has been steadily increasing, buying us some time to gather more feedback and consider alternatives.”

That said, a user who approved SLND2 commented that while “changing margin requirements is fine, taking over the account is a big no-no.” Contrarily, another user who disagreed with the overturning of the initial proposal remarked, “Proposal 1 passed. Didn’t like it, but you can’t ignore it now. Even if legal says so.”

At the time of writing, Solend has a market cap of over $13 million, with a total value locked (TVL) of around $267 million. The token ranks 721 on CoinGecko and is hovering between the price levels of $0.64 and $0.68 at press time.

The post Solend Community Passes Counter Proposal After SLND1 Criticism; Forfeits Emergency Powers to Overtake Accounts appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Waves Community Token (WCT) на Currencies.ru

|

|