2024-6-27 13:28 |

Futures traders who anticipated a rally and bought Solana (SOL) have recently faced liquidations as the coin’s value continues to decline.

At press time, the altcoin’s value had plunged by 19% in the last month to $135.56.

Solana Long Traders Count Their LossesIn an asset’s derivatives market, liquidations occur when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations happen when an asset’s value drops unexpectedly, forcing traders with open positions in favor of a price rally to exit.

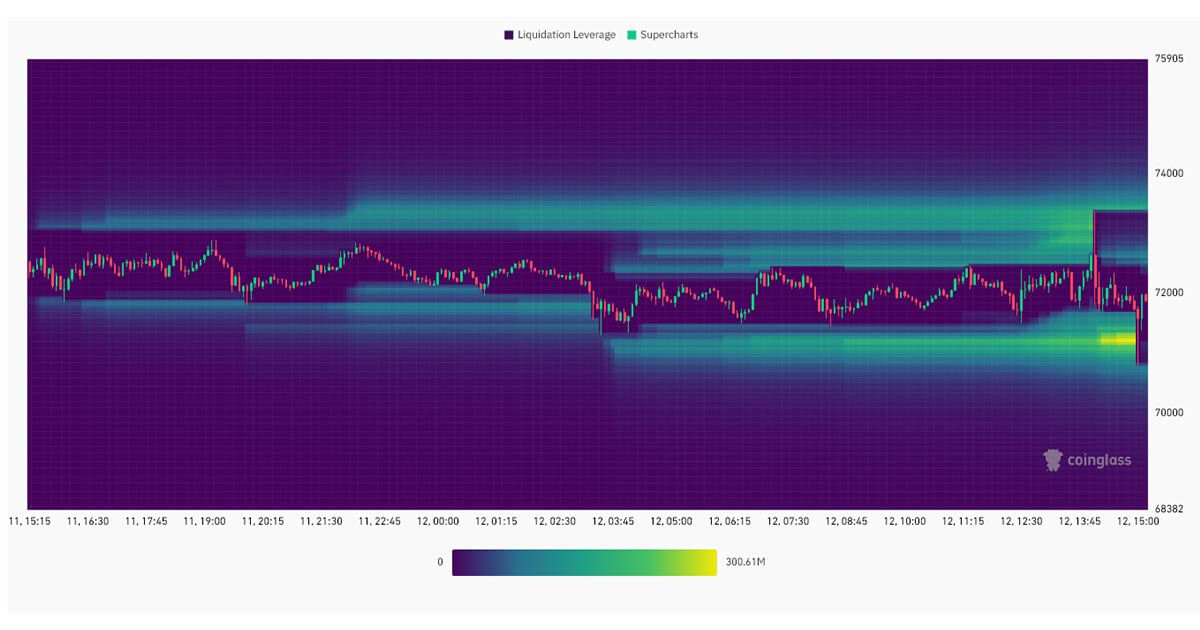

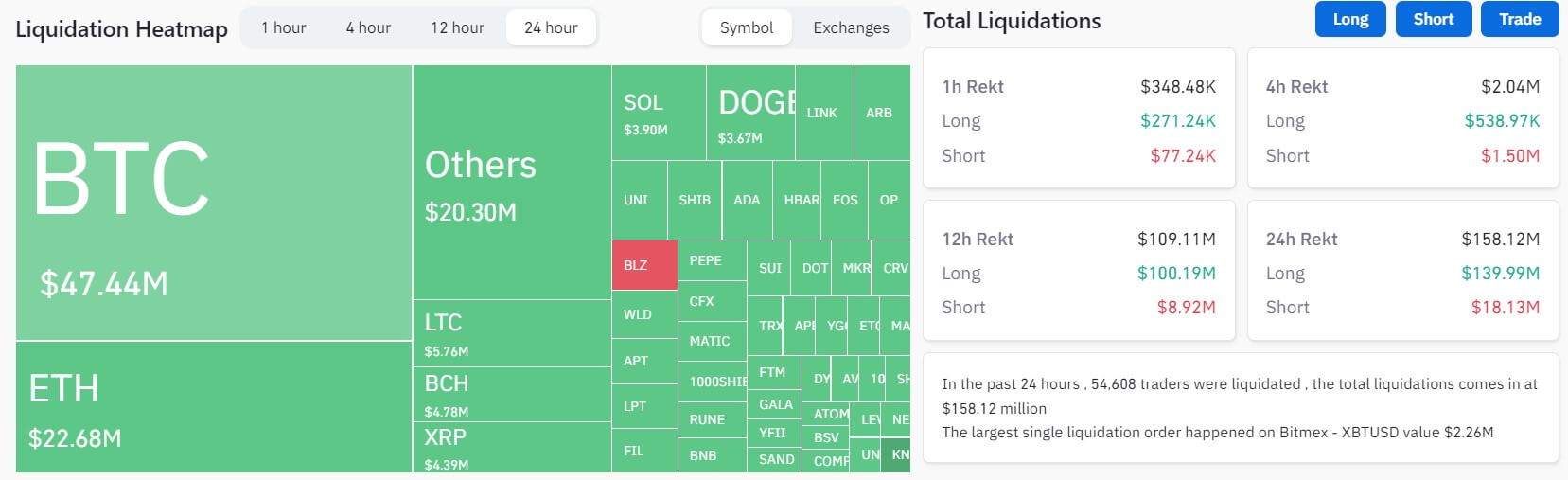

Due to SOL’s steady price decline, long liquidations have totaled $27.36 million in the past six days alone.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

Solana Total Liquidations. Source: CoinglassHowever, market participants’ demand for long positions has remained strong despite this. SOL’s funding rate has remained predominantly positive. As of this writing, this is 0.0063%.

Solana Weighted Funding Rate. Source: CoinglassFunding rates are used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When an asset’s funding rate is positive, it suggests a strong demand for long positions. This means more traders are buying the coin expecting to sell it at a higher price than those purchasing it in anticipation of a price decline.

SOL Price Prediction: Drop to $122.80 or Rally to $148.15?For SOL’s long traders, it is key to point out that the altcoin remains at risk of further price decline. Readings from its Chaikin Money Flow (CMF) show a steady liquidity outflow from its spot market.

This indicator measures the flow of money into and out of an asset. A negative CMF value indicates distribution, meaning the selling pressure in the market outweighs accumulation.

When both the price of an asset and its CMF decline, it suggests that the current downtrend may continue or strengthen. Traders interpret this as a signal to go short and exit long positions.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

Solana Analysis. Source: TradingViewIf this distribution trend continues, SOL’s price may plummet further to exchange hands under the $130 price level. It may trade at $122.80.

However, if market sentiment shifts from bearish to bullish and accumulation skyrockets, the coin’s price may climb toward $148.15.

The post Solana (SOL) Sees Uptick in Long Liquidations as Price Decline Continues appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|