2026-1-21 15:20 |

Companies that chose Solana (SOL) as a strategic treasury asset are facing rising losses as SOL price action turned negative in January. Among them, Forward Industries holds the largest SOL position, accounting for more than 1.1% of the total supply.

However, confidence in SOL’s long-term value appears unchanged, despite SOL wiping out its year-to-date recovery.

Forward Industries Faces Over $700 Million in Unrealized Losses as SOL SlidesCoingecko data shows that Forward Industries currently holds more than 6.91 million SOL. The company acquired these holdings at a total cost of $1.59 billion, representing roughly 1.12% of Solana’s total supply.

With SOL trading around $128, the current value of this investment has fallen to approximately $885.59 million. This results in unrealized losses exceeding $700 million, equivalent to a -46% decline.

Forward Industries’ Solana Holding. Source: CoingeckoDespite these challenges, Forward Industries continues to benefit from staking. Since launching its Solana treasury strategy in September 2025, the company has earned more than 133,450 SOL in staking rewards. These rewards helped increase SOL-per-share. Even so, the amount remains small relative to the scale of current losses.

“Since inception, the Company’s validator infrastructure has generated 6.73% gross annual percentage yield (APY) before fees, outperforming top peer validators. Nearly all of the Company’s SOL holdings are currently staked,” Forward Industries reported.

SOL’s downturn has not only affected the treasury but has also dragged down FWDI’s share price. Since announcing its SOL purchases in September 2025, the stock has dropped more than 80%. This decline reflects investor concerns over financial risk.

The sell-off reduced the company’s market capitalization. It also weakened capital-raising capacity and the credibility of the stock market.

Other SOL DATs Also Suffer Losses and Pause SOL AccumulationForward Industries is not an isolated case. Other companies using the digital asset treasury (DAT) model are also posting heavy losses.

Upexi (UPXI) reported unrealized losses of more than $47 million on its SOL holdings, equivalent to a -15.5% loss. Sharps Technology faces unrealized losses exceeding $133 million, or -34%. Galaxy Digital Holdings recorded unrealized losses of more than $52 million, or -38%.

These examples highlight the systemic risks of the DAT model. Price volatility can undermine corporate financial foundations.

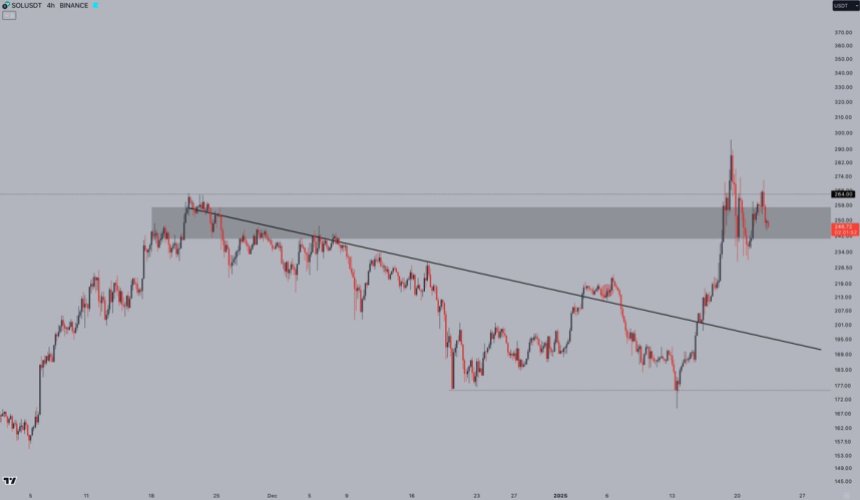

Analysts warn that conditions could deteriorate further. If SOL breaks below the $120 level, a multi-year support zone, the price could fall toward $70. Such a move would significantly amplify unrealized losses.

$SOL has to hold this multi year $120 support level OR we are going back to ~$70 pic.twitter.com/eQYJStTvkR

— Greeny (@greenytrades) January 21, 2026This outlook appears justified. Solana ETFs have recorded their first outflows in four weeks, signaling weakening investor confidence.

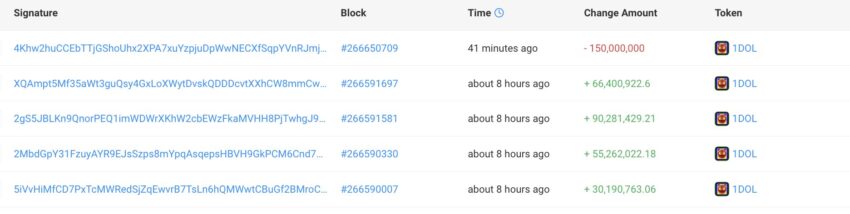

Additional data shows that companies have stopped buying SOL over the past two months. Total SOL accumulated by DATs has stalled at 17.7 million.

Solana Treasury Tracker. Source: SentoraThe slowdown in purchases reflects increasing caution amid growing market fear.

Even so, Forward Industries remains optimistic. The company believes 2026 will be Solana’s year. It points to the most aggressive upgrade roadmap in the network’s history, spanning consensus and infrastructure. The goal is to transform Solana into a “decentralized Nasdaq.”

"Solana's 2026 roadmap may be the most aggressive upgrade cycle in the network's history, overhauling everything from consensus to infrastructure to become the decentralized Nasdaq." – @Delphi_Digital

2026 is the year of Solana. https://t.co/ksMKdYKrcD

At the same time, Token Terminal reports that Solana’s staking ratio has reached 70%, an all-time high. Total staked value stands at approximately $60 billion, strengthening network security.

These positive factors may explain why the market has not yet seen a wave of selling among SOL DATs. SOL’s price action in the coming days could offer clearer insight into how these companies will respond.

The post Solana Digital Asset Treasuries Halt SOL Purchases as Unrealized Losses Grow appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Sola (SOL) на Currencies.ru

|

|