2023-8-30 18:57 |

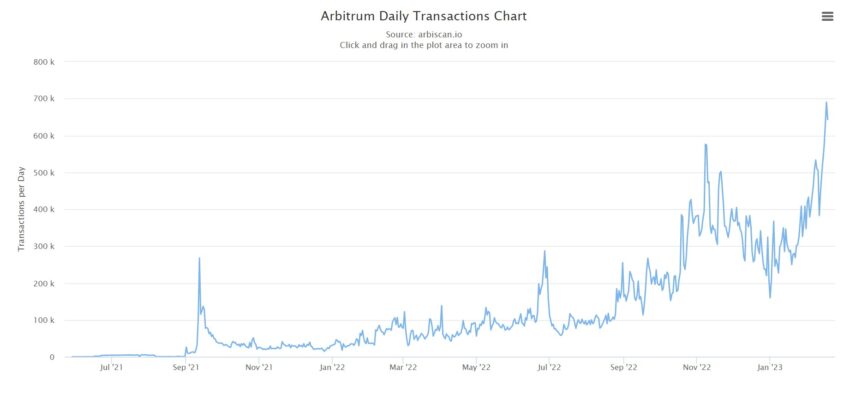

Arbitrum is an Ethereum layer-2 scaling network that’s seeing a spike in activity, thanks to increased traction in the DeFi ecosystem. It’s backed by some of the largest players in the investment space. In terms of adoption, fast, secure, and cheap transactions capability have seen many leading DeFi projects launch on the L2, including perps exchange GMX, lending protocol Radiant, and cross-chain platform Stargate.

The Arbitrum network is also home to several emerging projects cutting across multiple DeFi primitives. The six below are among those that stand out.

DolomiteDolomite is a DeFi money market for lending and borrowing that offers over-collateralized loans and access to native crypto tokens. Dolomite’s smart integrations and an ingenious virtual liquidity system means users can securely tap into a robust protocol for yield.

A notable feature of Dolomite is that staked tokens retain functionality such as voting rights, even when locked for yield.

The project aims to lead the next growth phase of DeFi, with on-chain support for portfolio management and proprietary strategies of yield aggregators, DAOs, protocols, market makers, and hedge funds.

OrbsAs a blockchain-agnostic protocol, Orbs has secured smart contracts across the space since 2017. However, it’s new to Arbitrum and offers a tooling system for other networks, with its Axelar-powered Satellite bridge allowing for transfer of tokens like ETH, USDC, and ORBS.

Development milestones for Orbs include its recent integration of the dTWAP and dLIMIT products for the Chronos DEX. The protocol also supports DeFi notifications for y2k finance. Arbitrum’s growth is therefore likely to spark greater adoption of Orbs’ technology.

Nexera ExchangeAllianceBlock’s Nexera Exchange is a new trading protocol for Arbitrum, offering advanced features such as an on-chain order book and deep liquidity via Uniswap v3 integration.

Nexera Exchange targets providing users access to CEX-like experiences. However, it aims at offering these alongside the advantages of a decentralised exchange (DEX). The platform will offer order-triggering matching, yield-optimised staked orders, and dynamic order book.

HMXHMX is a decentralised perpetual exchange that allows for up to 1,000x leverage on cryptocurrencies, equities, and commodities. Low fees on Arbitrum is helping with traction for HMX, whose trading volume is picking up amid increased usage in the leveraged market.

Darwin ProtocolDarwin Protocol seeks to revolutionise DEX trading, offering users access to much more than what traditional DEXes have. Apart from its eponymous token, there’s multi-chain DEX support for automatic redistribution of tokens on DarwinSwap.

The Darwin protocol supports DeFi innovation via a system that allows for flexible rewards distribution. For example, a project may determine when to collect fees, or selectively refund users in cases where there’s a tax fee attached to ancillary services like liquidity provision.

Parallax FinanceParallax is a yield generation protocol on Arbitrum. It’s an LSDfi protocol – meaning it supports staking of liquid staking assets within the DeFi sector.

The project targets protocols, individuals and DAOs looking for yield generation opportunities via the Arbitrum network. It offers access to this feature through four core products – a yield optimizer dubbed Orbital, a multi-variant yield provider Andromeda, Supernova for “recursive yields” on leveraged LSD tokens, and Black Hole, a liquidity marketplace.

The above six projects are some of the most promising on Arbitrum, whose continuing growth as a top L2 network is helping push DeFi innovation to the next level.

The post Six of the best emerging Arbitrum projects appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

SpaceCoin (SPACE) на Currencies.ru

|

|