2021-8-13 15:47 |

The Monetary Authority of Singapore (MAS) has approved DBS Vickers to provide trading services for digital payment tokens.

DBS Vickers is the brokerage arm of Singapore-based DBS Bank, which also operates the crypto exchange DBS Digital Exchange (DDEx). Vickers hopes to directly support asset managers and companies in trading digital payment tokens through the DDEx. DBS added that Vickers is working through the necessary follow-ups in order to meet MAS’ requirements for a license.

DBS Digital ExchangeMeanwhile, DBS also announced that its members-only platform for institutional and accredited investors would also operate round the clock from Monday. According to DBS, this will be “to cater to increasing trading volume amidst growing client demand.” It also remarked it would enhance its members’ ability to seize opportunities and manage risks associated with changes in cryptocurrency spot prices. The exchange had previously operated only during Asian trading hours.

DBS group head of capital markets Eng-Kwok Seat Moey highlighted potential compounding effects of these developments. She strongly believes the pairing of Vickers’ approval and DDEx’s new hours could help accelerate the exchange’s growth.

“We are confident of doubling our investor base by the end of the year,” she said. “This bodes well for our ability to provide integrated solutions across the digital asset value chain notably in the form of security token offerings (STOs), leveraging DBS’ expertise in deal origination to tokenization, listing, distribution, trading and custody.”

Launched in October last year, around 400 investors have joined DDEx to trade by the end of June. It also recorded close to $180 million in total trading value in the second quarter of this year. DBS also remarked that it has more than $130 million in digital assets in its custodial services.

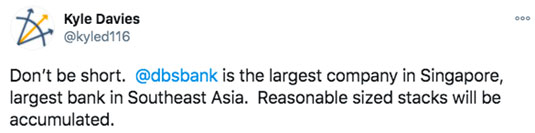

DBS BankDBS is among one of the larger financial institutions to embroil itself in cryptocurrencies. Earlier this year, the bank partnered with JPMorgan and Temasek to launch the payment platform Partior. The partnership aims to introduce a blockchain platform to “reduce current frictions and latency for cross-border payments, trade transactions, and foreign exchange settlements.”

Meanwhile, analysts from DBS Bank earlier declared that Bitcoin was no longer a “fringe asset.” After performing an analysis, they were able to determine that major swings in Bitcoin’s price had effects on the external markets. As a consequence, the analysts suggested that it “may be wise to keep an eye on developments in this space.”

The post Singapore Monetary Authority Approves Crypto Trading for DBS appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Singapore Dollar (SGD) íà Currencies.ru

|

|