2023-6-12 15:25 |

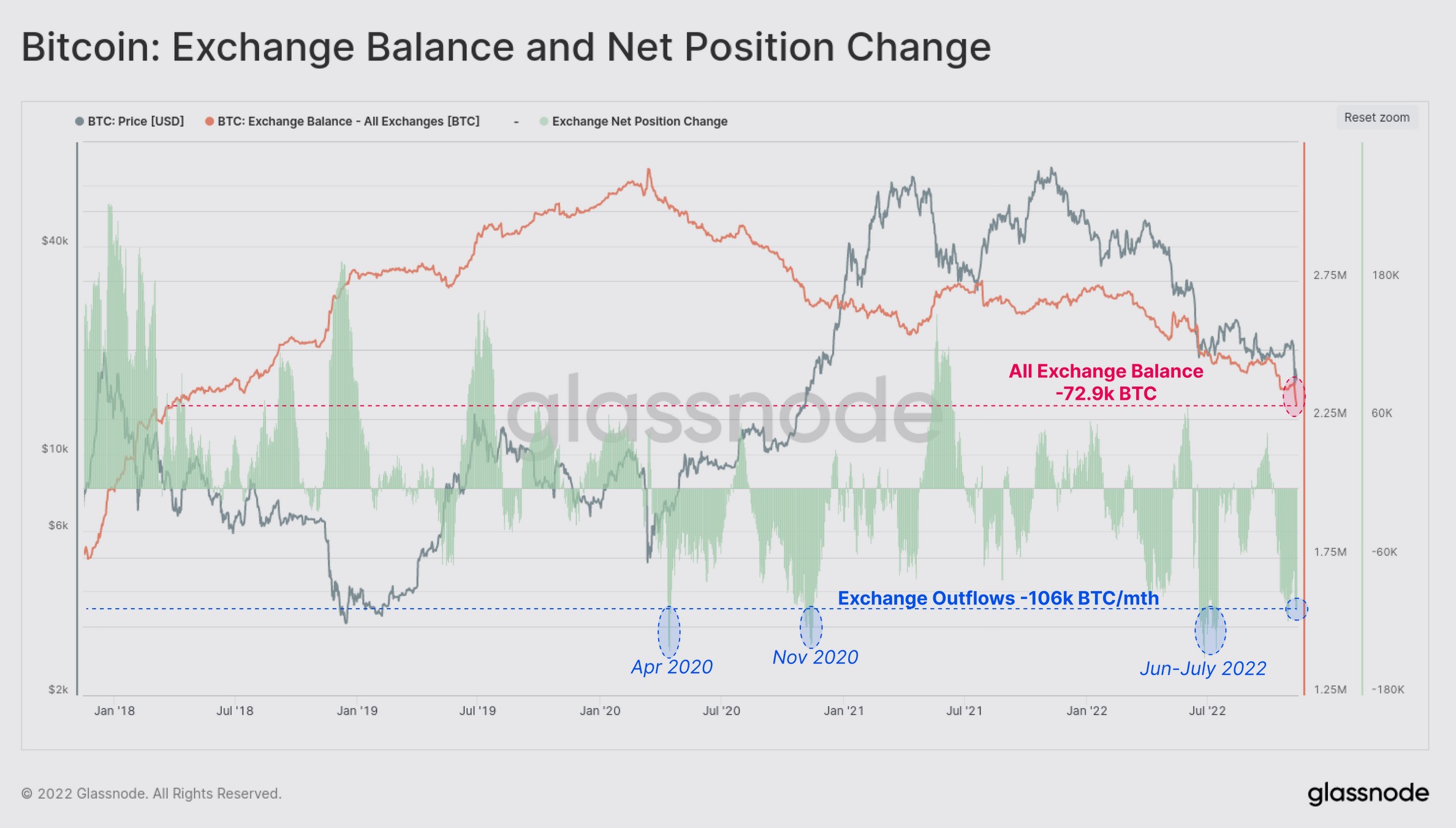

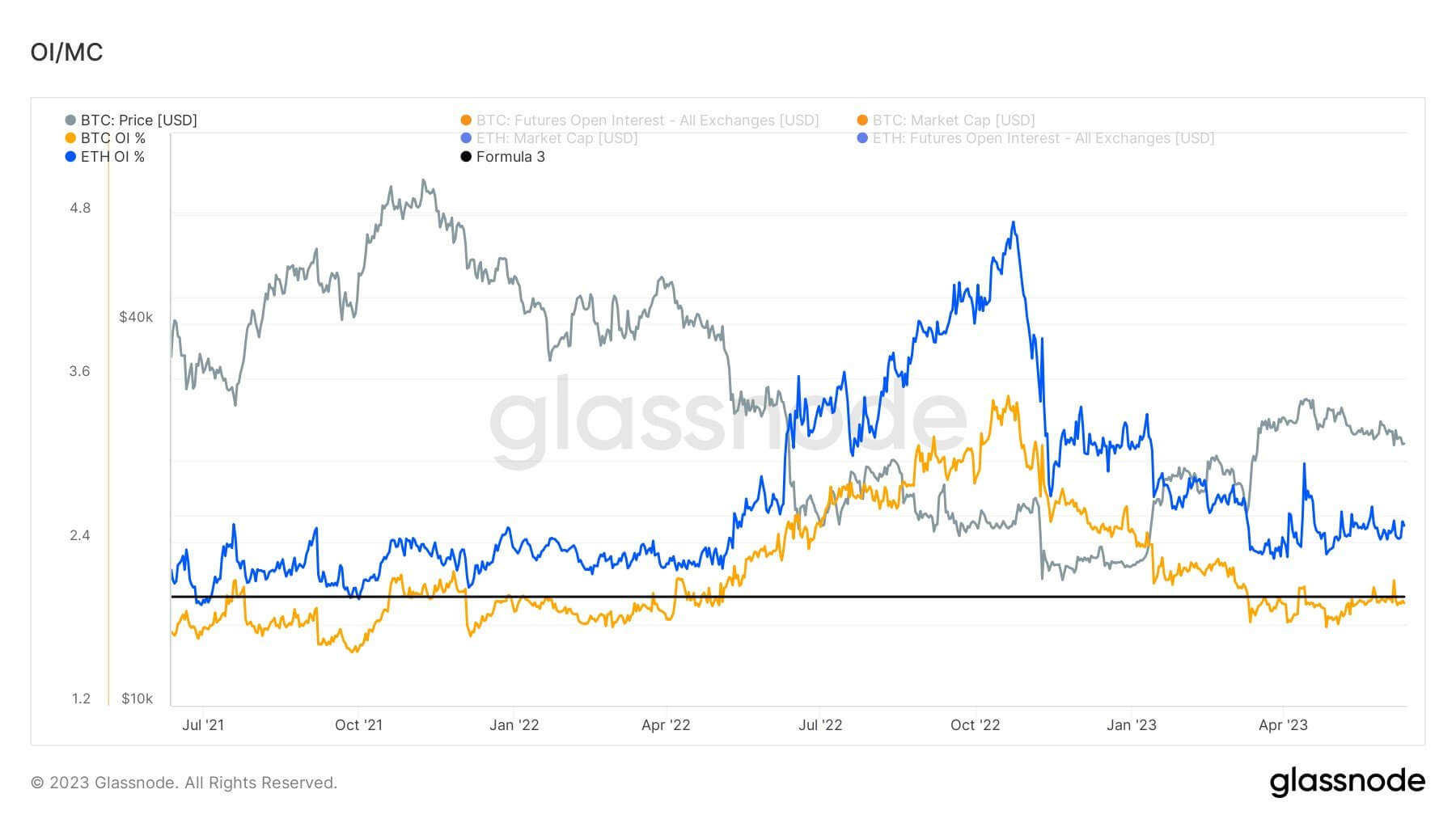

Quick Take In a deflationary collapse, a sell-off occurs that first results in leverage being wiped out first before then affecting panic sellers. Bitcoin open interest is minimal, remaining at or below 2% of the market cap since Silicon Valley Bank’s collapse, while holders remain price agnostic. The current value of the futures open interest is roughly $9.8 billion, while the market cap is just over $500 billion. Ethereum’s open interest is slightly more leveraged than Bitcoin in terms of open interest compared to market cap. Ethereum’s open interest divided by market cap is 2.5%, roughly $5.2 billion in open interest with a market cap of $210 billion. We can also see a lack of long-term holders sending Bitcoin to exchanges since the SVB collapse in March. Open Interest: (Source: Glassnode) LTH to exchanges: (Source: Glassnode)

The post Should we fear a deflationary collapse in Bitcoin? appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|