2023-6-15 11:44 |

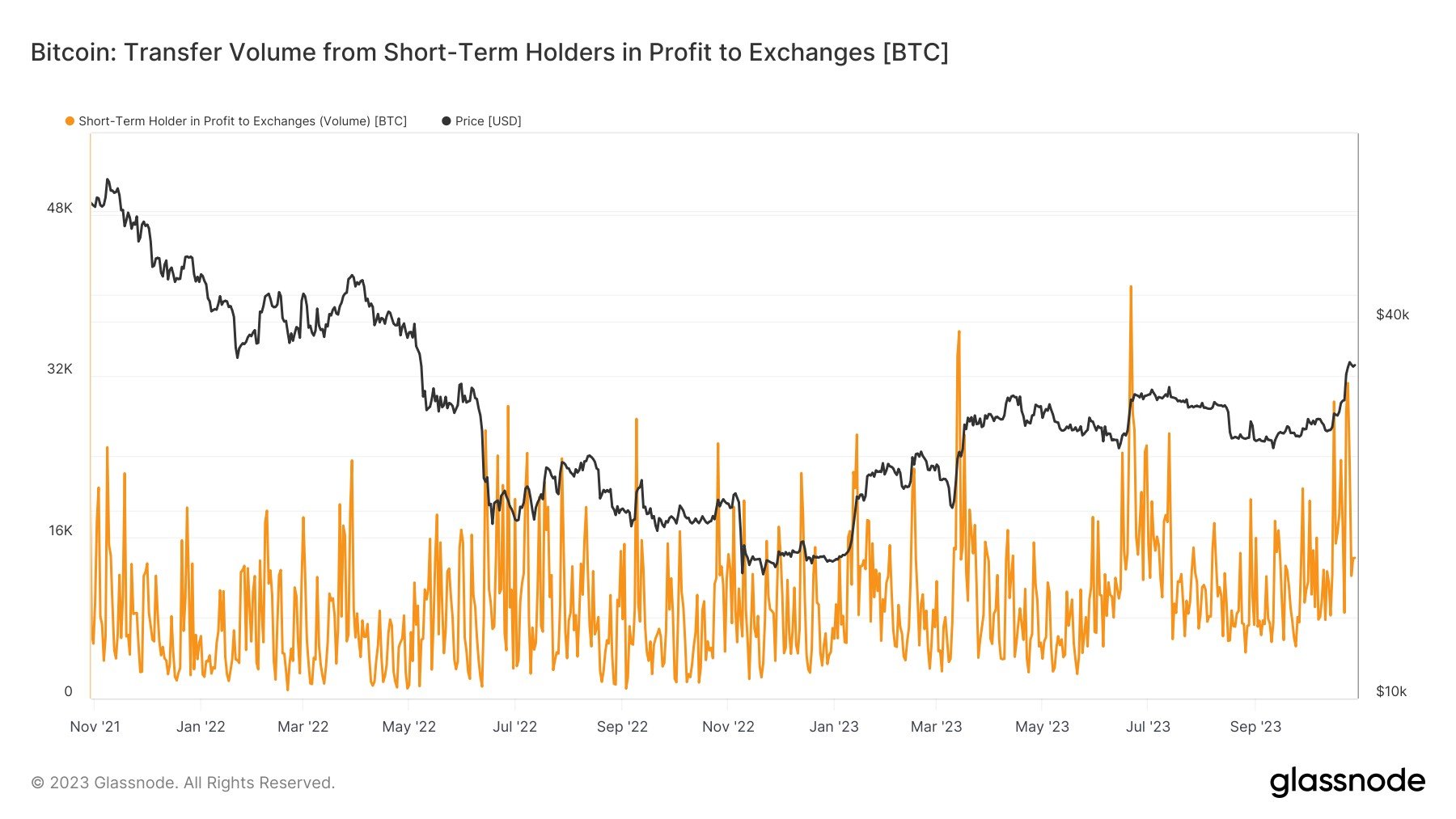

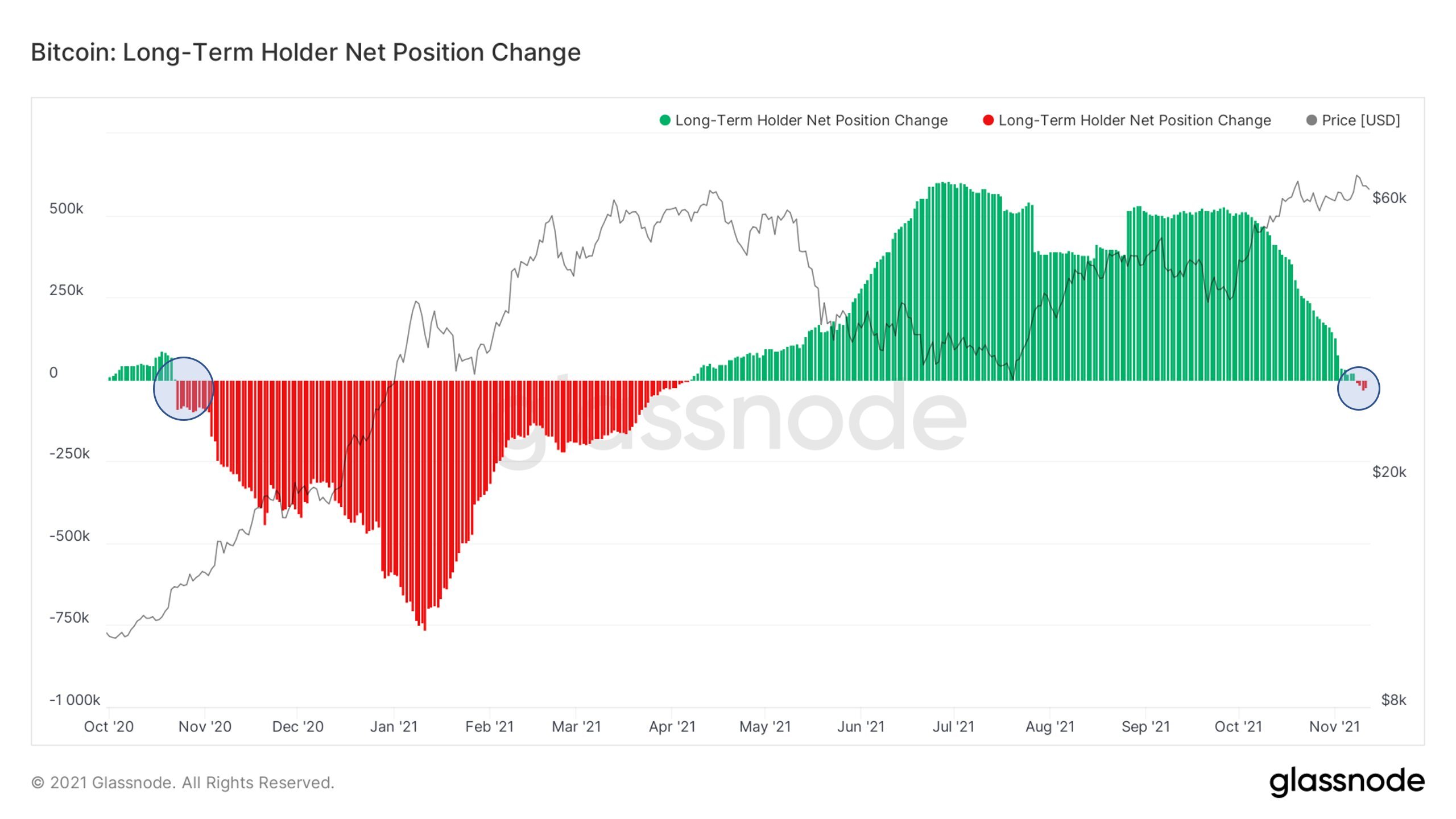

Quick Take Short-term holders are anyone who has held Bitcoin for less than 155 days. Yesterday, June 14, short-term holders sent 17,000 Bitcoin to exchanges at a loss, one of the highest amounts this year. On a 7-day moving average, we are in a highly elevated level of capitulation. Looking at short-term holder supply, there has been an increase of 64,000 Bitcoin, which could be considered smart money picking up cheap Bitcoin. STH Supply: (Source: Glassnode) STH at a loss: (Source: Glassnode)

The post Short-term Bitcoin holders continue to capitulate appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|