2024-12-19 08:00 |

On-chain data shows a massive amount of the stablecoin USDT has been moving to exchanges recently, potentially acting as fuel for the Bitcoin and wider cryptocurrency rally.

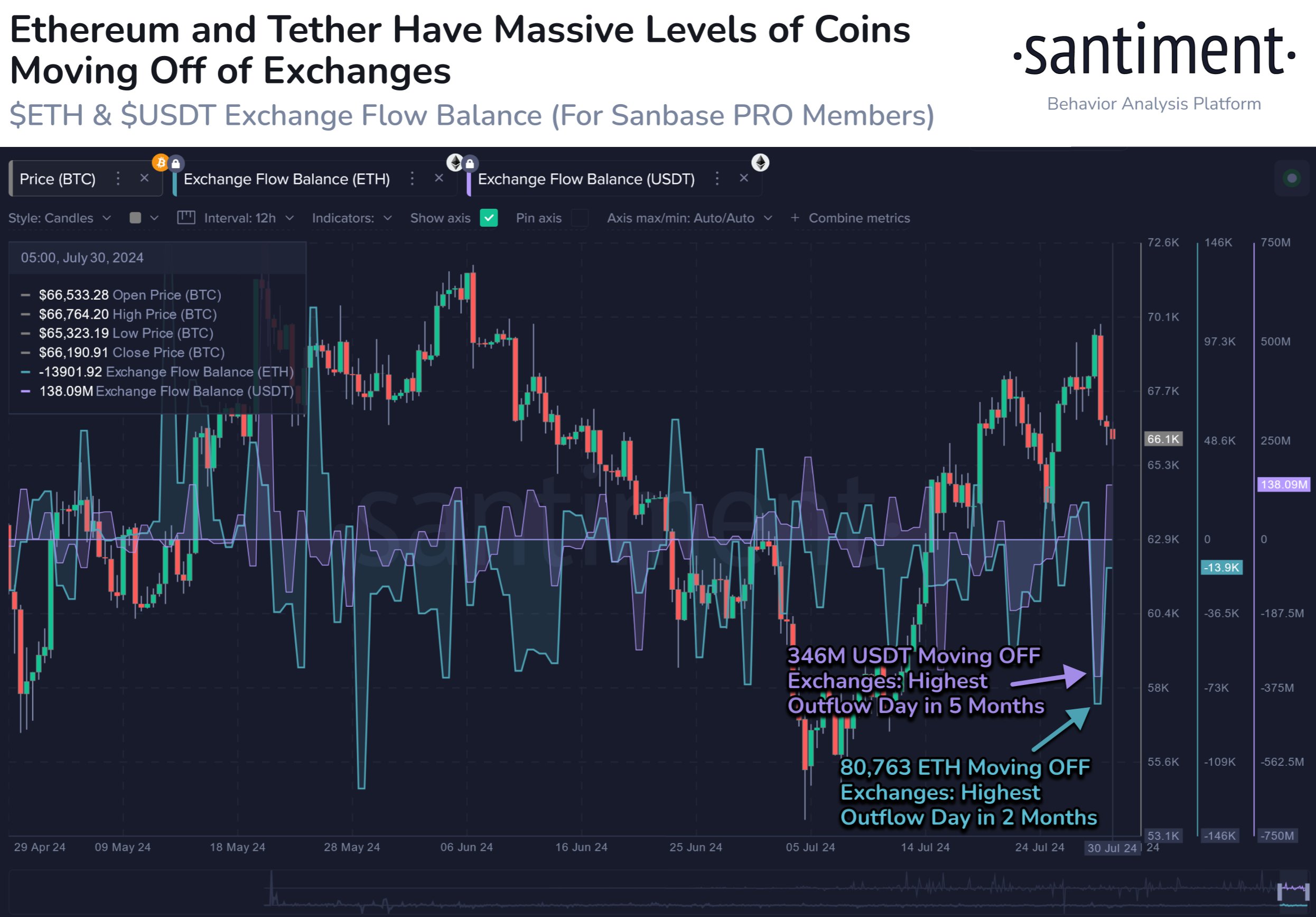

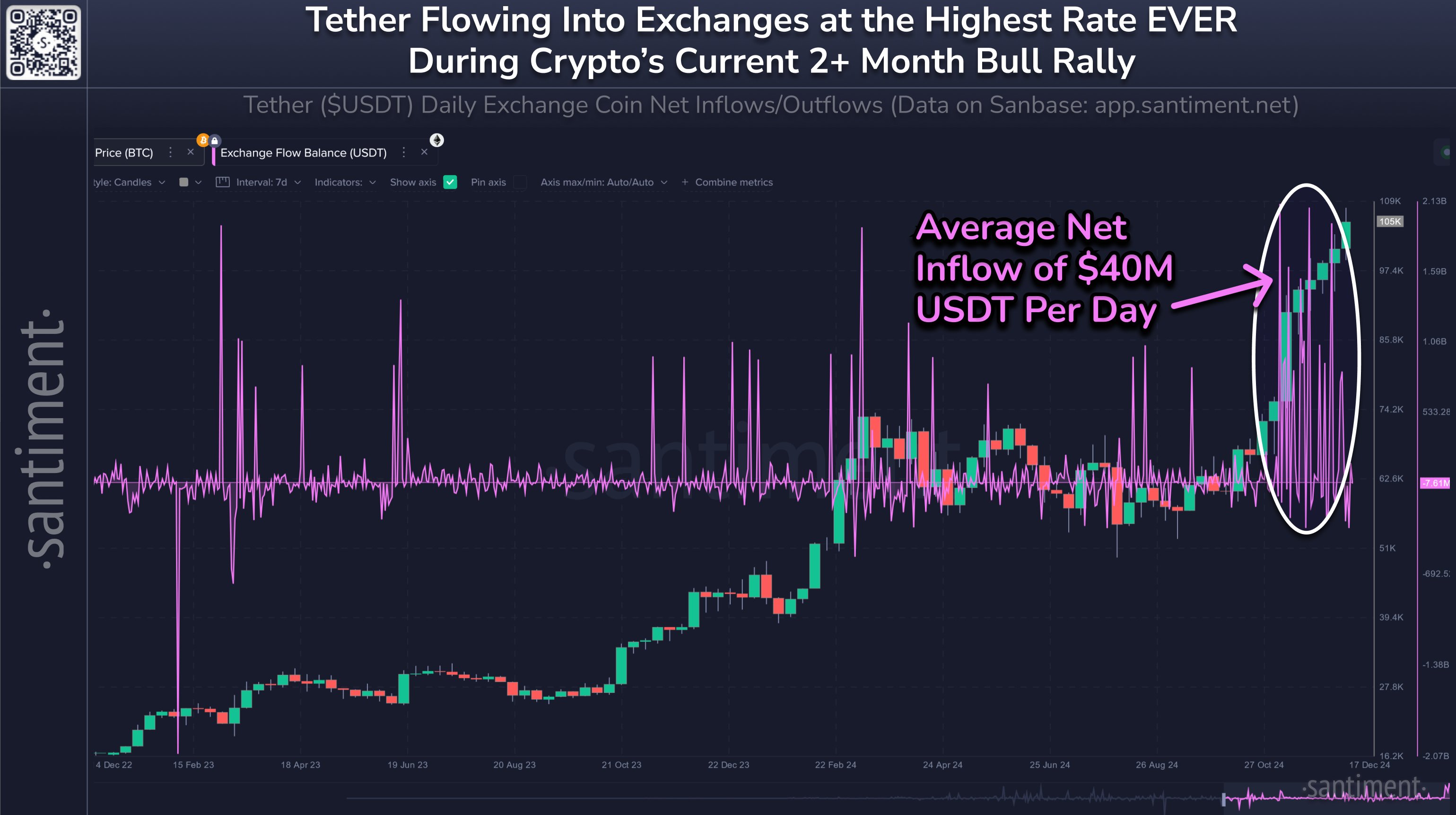

USDT Exchange Inflows Have Remained High RecentlyIn a new post on X, the on-chain analytics firm Santiment discussed the trend in the Exchange Flow Balance for Tether’s USDT. The “Exchange Flow Balance” here refers to an indicator that keeps track of the net amount of a given asset entering or exiting the wallets associated with centralized exchanges.

When the value of this metric is positive, it means the inflows outweigh the outflows, and a net amount of the coin is entered into the exchanges’ wallets. Such a trend is usually a sign of demand among investors for trading away the cryptocurrency.

On the other hand, the negative indicator implies the holders are withdrawing a net number of tokens from these platforms. This kind of trend suggests the market is in a phase of accumulation.

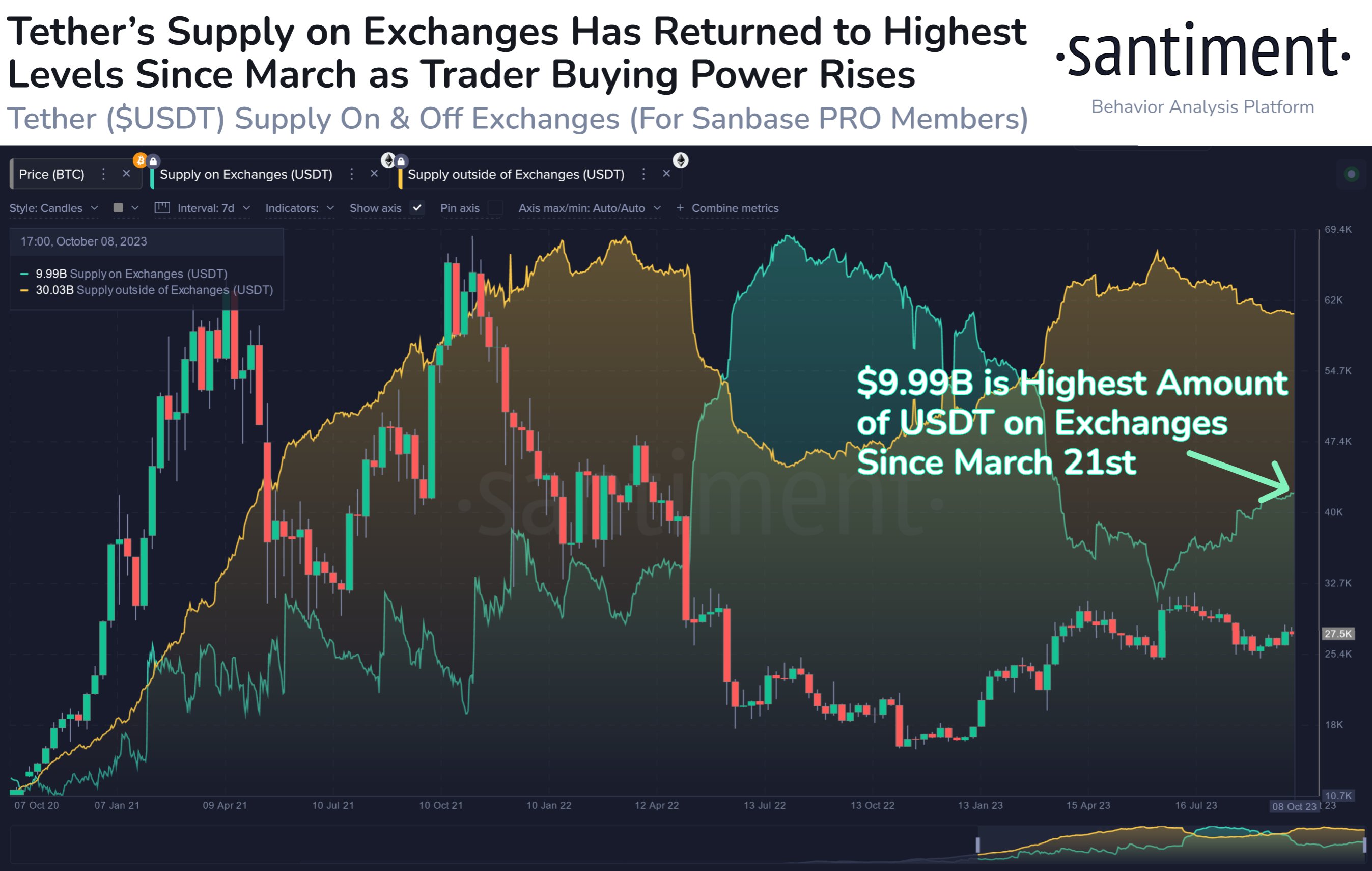

Now, here is a chart that shows the trend in the Exchange Flow Balance for USDT over the last couple of years:

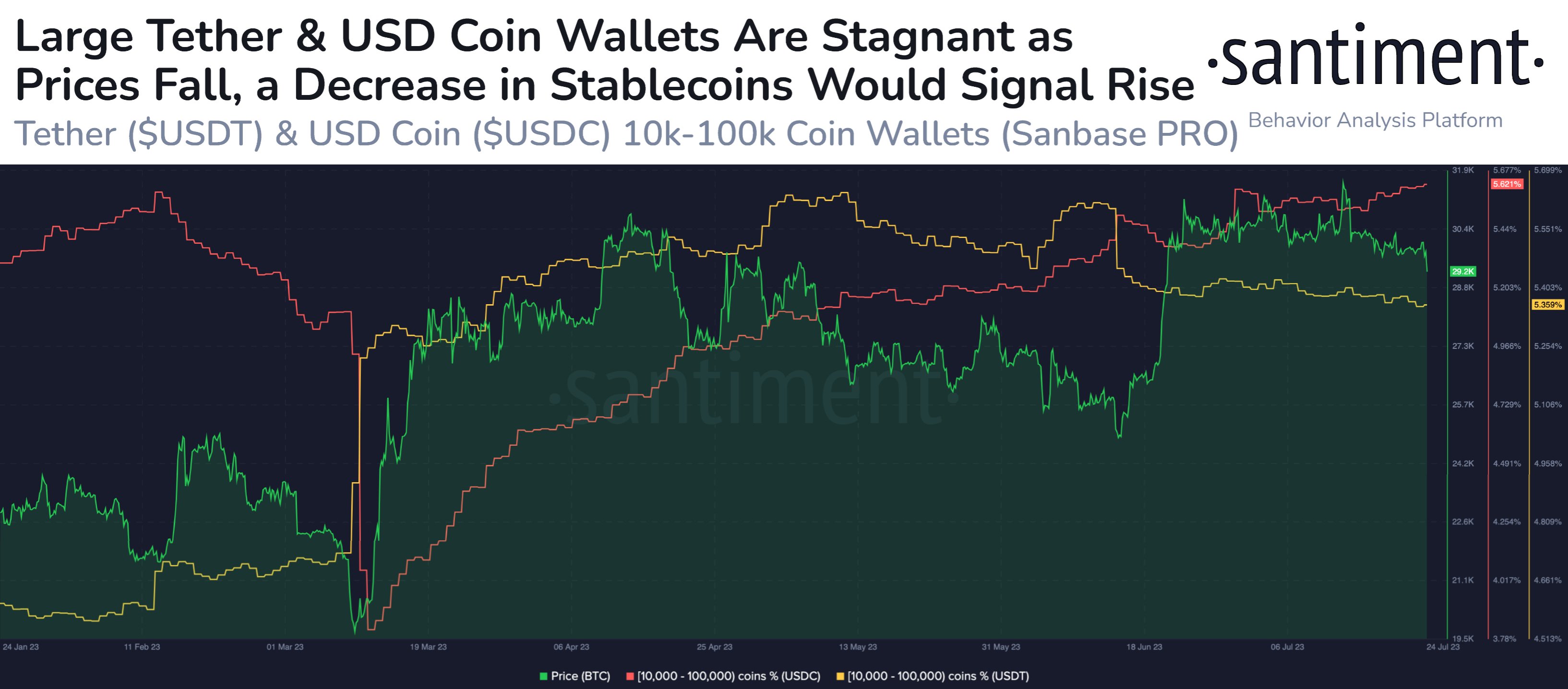

As displayed in the above graph, the Exchange Flow Balance for USDT has observed several large positive spikes over the past month, implying that large investors have been depositing their tokens.

For assets like Bitcoin, a positive Exchange Flow Balance can be a bearish sign, as it could suggest the holders are planning to sell. However, the same isn’t true when the asset involved is a stablecoin.

Investors generally store their capital in these fiat-tied tokens to avoid the volatility of Bitcoin and other cryptocurrencies. Such users eventually plan to venture into the volatile side once they feel the conditions are right.

And when the time comes, they naturally transfer to exchanges to swap to Bitcoin or whatever desired coin. This act of selling USDT does not affect its value since the coin is, by definition, always stable around the $1 mark.

On the other hand, The asset they are shifting to does witness fluctuations from the purchase. As such, stablecoin exchange inflows are usually considered a bullish sign for Bitcoin and other assets.

During the last eight weeks, exchanges have received a net average of $40 million USDT. “Helping to fuel this bull rally and the many historic crypto pumps, look for stablecoin ‘dry powder’ to continue flowing in during this final stretch of 2024,” explains the analytics firm.

Bitcoin PriceBitcoin set a new all-time high (ATH) beyond the $108,000 mark yesterday, but the coin appears to have seen a pullback since then, as its price is now trading around $104,500.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|