2020-11-21 23:00 |

Bitcoin is nearly at $20,000 once again and to the surprise of the crypto community, Google Trends search data now still doesn’t anywhere nearly compare to the search interest back then. However, digging deeper into search engine volume using a plethora of search engine marketing tools, there’s a very different “story” to be told.

Here are the reasons why search volume and related terms suggest that there is far more interest now in Bitcoin than there was at the height of the crypto bubble.

Bitcoin Blows Up But Fails To Boost Google Trends Search InterestThe latest price action is giving crypto investors a flashback of what it was like the last time Bitcoin was trading at these prices.

It was also around Thanksgiving 2017, and the first-ever cryptocurrency had just surpassed $10,000 for the first time, piquing the curiosity of average Joes who were left wondering what the heck a Bitcoin even was.

Related Reading | Bitcoin Approaches Top Of Accumulation Zone, Parabolic Phase Begins With Breakout

To find out, before clicking that buy button on their Coinbase app, they turned on Google to take in all the info they could find.

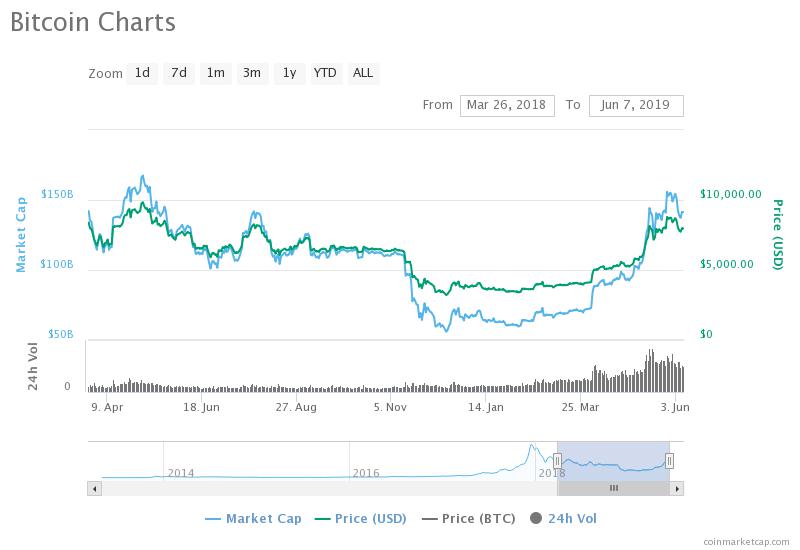

Bitcoin took off on Google Trends as sharply as its parabolic price pattern, and just as fast, crashed back down to previous lows. And as the Google Trends chart below shows, superimposed over the current BTCUSD price chart, interest just still hasn’t returned. Or has it?

Google Trends data layer behind a Bitcoin price chart | Source: BTCUSD on TradingView.com SEMRush SEO Tools Tell A Different Story, According To eToro Exec

Marketing is a broad term used to define various strategies for driving sales, visibility, traffic, or conversions of any kind. Without marketing, it is challenging to let the world know something exists.

That’s part of what makes Bitcoin so magical. It has corporate backing, and no marketing department to help spread the word – yet its users are more than happy to handle that for the cryptocurrency.

The tools such marketing departments use to drive traffic and conversions on the web include cost-per-click search engine marketing or focus on search engine optimization. SEO is essentially the practice of trying to get picked up on Google organically, while SEM is when marketing departments pay for the reach instead.

Related Reading | Bulls In Control: Total Bitcoin Market Cap Achieves New All-Time High

These marketers use these tools to specifically target certain subsets of users or behaviors – “cryptocurrency users”, for example.

According to eToro marketing exec Brad Michelson explains that SEMRush – one of the analytical services markets rely on for search engine dominance – paints a lot more bullish of a picture about Bitcoin than Google does.

He claims the total monthly global volume of related Bitcoin search terms, is more than three times as much as the December 2017 figure. The volume is spread across a variety of terms, which could suggest that there’s no need to search just Bitcoin now, and people are instead digging deeper into it.

The more websites that relate to a keyword, the higher the SERP (Search Engine Results Pages) will be for those keywords. It's basically the number of search results that Google shows for a search term.

They also include the the "featured" results, like the screenshot below.

/6 pic.twitter.com/abTuP4gotJ

— Brad Michelson (@BradMichelson) November 19, 2020

Terms more common now include the root Bitcoin keyword plus other terms like “mining,” “price,” and “news.” There are also nearly three times as many website pages indexed by search engines.

For whatever reason, Google Trends isn’t picking this up. But there’s also no denying that something is going on with Bitcoin that’s causing the sudden increase in price.

And if it isn’t the retail investors that drove up prices that last time around, then they’ll soon be here after Bitcoin sets a new all-time high – which at this point could be any day now.

Featured image from Deposit Photos, Chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Helper Search Token (HSN) íà Currencies.ru

|

|