2026-1-22 12:30 |

XRP is back in a familiar spot: social chatter has turned sharply bearish even as the market probes support after an early-January surge. Analytics firm Santiment said its social data shows XRP slipping into “Extreme Fear” after a roughly 19% pullback from its early-month high, a setup it argues has historically preceded rallies.

Santiment wrote on Jan. 22 via X: “According to our social data, XRP has fallen into ‘Extreme Fear’ territory. Small retail traders have become pessimistic toward the #5 market cap cryptocurrency after a -19% drop since the high back on January 5th. Historically, this high level of bearish commentary leads to rallies. Prices move the opposite to retails’ expectations more often than not.”

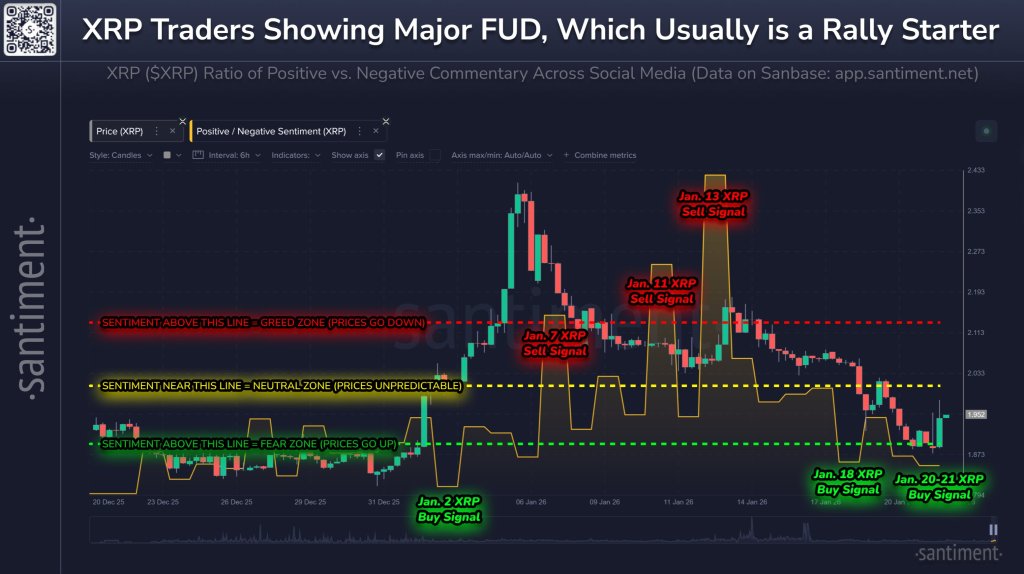

The chart Santiment shared pairs XRP’s 6-hour candles with a social ratio measuring positive versus negative commentary, and overlays three “buy” and three “sell” markers tied to sentiment bands. Those bands are explicitly labeled as a “fear zone” (where prices “go up”), a neutral zone, and a “greed zone” (where prices “go down”).

How Reliable Is The XRP Social Sentiment Signal?To check the timing, daily XRP spot data for the same late-December-to-January window broadly supports the chart’s claim that extreme sentiment readings often show up near inflection points, with an important caveat: not every signal front-runs a turn cleanly, and some arrive early.

The first “buy” marker on the chart is dated Jan. 2. On that day, XRP closed around $2.01 after trading as low as roughly $1.87, and the market proceeded to accelerate into the week’s blow-off move: by Jan. 5 XRP closed near $2.35, and the Jan. 6 session printed a high around $2.42. In other words, the Jan. 2 “buy” call landed ahead of the sharp leg higher that set the period’s high.

The first “sell” marker is dated Jan. 7, immediately after the peak. XRP closed around $2.16 that day and then bled lower across the next sessions, sliding toward the low-$2.00s by Jan. 12. On sequence alone, that sell signal aligns with the market shifting from post-spike distribution into a steadier downtrend.

The second “sell” marker, Jan. 11, is less straightforward. XRP closed near $2.07 on Jan. 11 and dipped again on Jan. 12, but then logged a sharp rebound on Jan. 13, closing around $2.17. Traders treating the Jan. 11 marker as an immediate top signal would have faced a short-term whipsaw before downside resumed.

That brings the chart’s third “sell” marker (Jan. 13) which appears to target that rebound itself. From Jan. 13’s close near $2.17, XRP rolled back over: it faded through mid-month and ultimately slid into the Jan. 20 low around $1.87 (intraday), which maps cleanly to the chart’s contention that “greed-zone” sentiment can coincide with local exhaustion.

On the “buy” side late in the window, Santiment flags Jan. 18 and Jan. 20–21. The Jan. 18 marker arrived early: XRP closed around $1.99 on Jan. 18 but continued lower into Jan. 20 before rebounding. The current Jan. 20–21 marker fits better in the short term, with XRP bouncing from the Jan. 20 close near $1.89 to roughly $1.95 by today. Even so, that rebound has so far been modest relative to the broader drawdown from the $2.4 area peak.

Santiment’s broader point is contrarian: when social feeds tip into one-sided pessimism, marginal selling pressure may already be exhausted, setting up mean reversion. The recent signal history partially supports that while also showing the practical risk: entries can be early, and “extreme fear” can persist if trend conditions remain heavy.

At press time, XRP traded at $1.9498.

origin »Bitcoin price in Telegram @btc_price_every_hour

onG.social (ONG) на Currencies.ru

|

|