2021-6-3 20:36 |

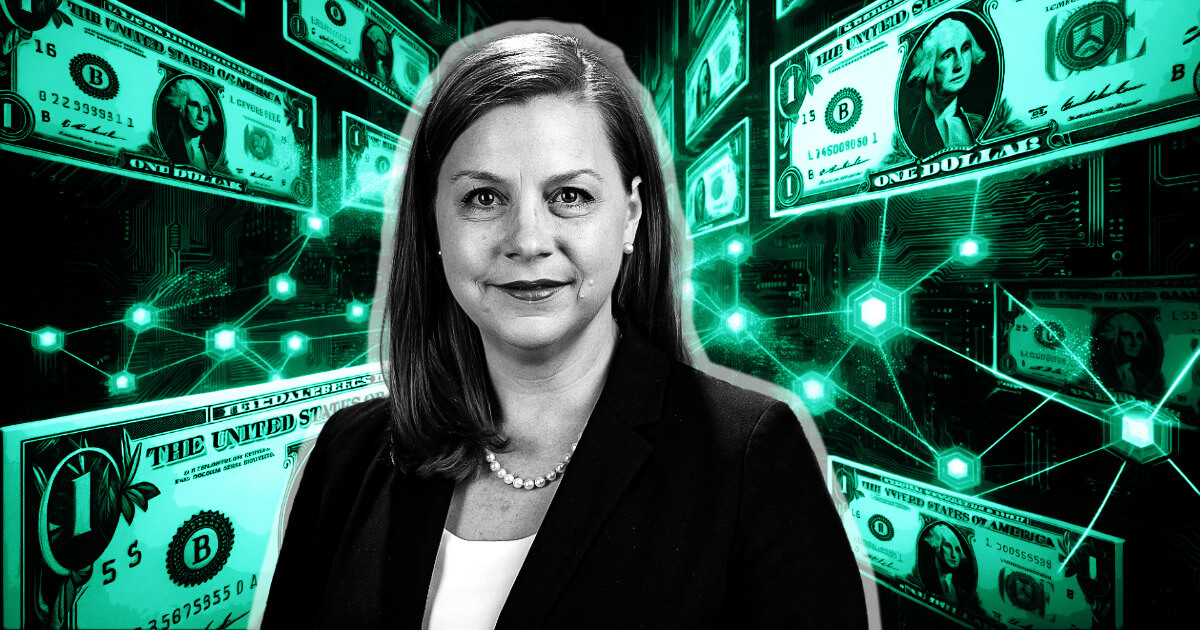

Russia’s Central Bank Chief Elvira Nabiullina said her country's decision to create a central bank digital currencies (CBDC) is due to its perceived benefits.

Digital Ruble Prototype Would Be Launched This YearSpeaking in a CNBC interview, the apex bank governor said Russia aims to roll out its Digital Ruble prototype by the end of this year.

Nabiullina said the consultation paper on the digital ruble was published in October and that the bank plans to pilot and test the CBDC next year.

Speaking further, Nabiullina said she strongly believes that digital currencies will be the future of financial systems. According to her, there is a great need for fast, cheap payment systems, and CBDCs can fill that gap.

However, the central bank governor predicts that there will be challenges in cross-border payments using the CBDCs developed independently by different central banks.

“If each bank creates [its] own system, technological systems with local standards, it will be very difficult to create some interconnections between these systems to facilitate all cross-border payments.”

Nabiullina also discussed the persistent risk of US sanctions and how policies are shaped to manage that risk.

The US has imposed sanctions on Russia over the years for allegedly interfering with elections and numerous cyberattacks.

On cryptocurrencies, Nabiullina said she believes cryptocurrencies pose several risks, including money laundering due to its anonymity and lack of transparency.

Up until January this year, Cryptocurrencies were illegal in Russia. The country had previously banned all activities involving cryptocurrencies, terming them as criminal, under its anti-money laundering regulations.

Although the ban has been lifted, cryptocurrencies are not allowed to be used for payments in the country.

Central Banks Progress With CBDC PilotsNumerous countries are moving forward with their CBDC plans.

According to a Bank of International Settlements (BIS) survey, 86 percent of 65 apex banks interviewed are in the opening stages of creating a CBDC, while 15 percent are embarking on pilot programs.

However, China has made its intention to establish itself as a central player in the emerging global digital currency market clear.

The country started working on the initiative in 2014 and has already conducted massive trials in major cities like Shenzhen, Chengdu, and Hangzhou, and commercial institutions.

Countries like Norway have begun exploring CBDCs, too, and even disclosed that it would start testing technical CDBC integrations.

In the UK, the Bank of England and HM Treasury have collaborated to create a CBDC task force to coordinate the exploration of a potential UK CBDC.

On the other hand, the US is still taking a cautious approach towards testing or exploring CBDCs with no firm announcement on the matter yet.

The post Russia’s Central Bank Chief Says CBDCs Are Necessary For Financial Systems first appeared on BitcoinExchangeGuide. origin »Time New Bank (TNB) на Currencies.ru

|

|