2021-6-18 01:59 |

If the US Securities and Exchange Commission greenlights the Bitcoin BTC/USD ETF VanEck applied for, people with IRAs and self-directed 401(k)s will be able to conveniently gain exposure to Bitcoin as part of their retirement portfolio. Famed financial journalist Roger Lowenstein argued in a MarketWatch op-ed this is not a positive development.

The main issue with investors adding Bitcoin to their retirement funds is that “no one has ever invested in Bitcoin,” rather “they speculate” in the digital currency, he wrote.

Lowenstein: Bitcoin investments shouldn’t be tax-deferredRetirement funds are tax-deferred investment tools that are specifically designed to encourage savings. If we see one more Bitcoin ETFs , a new wave of retail investors could rush to gain new exposure to the digital coin.

Of course, everyone has the freedom to invest their money how they see fit. No one is saying that investors can’t add Bitcoin to their retirement investment portfolio. Rather, Lowenstein argues that exposure to Bitcoin doesn’t fit the classic definition of investing. As such, it should not be subject to favorable tax breaks that traditional investments like stocks offer.

Wall Street guru Benjamin Graham defined investing as something that promises a solid return and safety of the initial investment. Lowenstein further argues:

Crypto currencies, which fell 20% one day in May and 50% over a single cycle of the moon, do not promise safety.

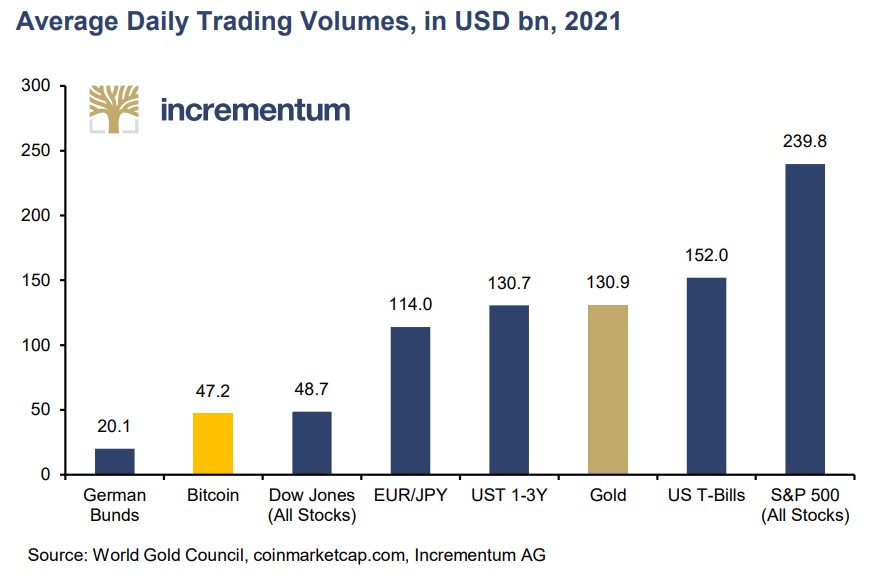

Bitcoin ‘is not a currency’Bitcoin has been likened to gold, including by VanEck, one of the handful of operators hoping to oversee an ETF. Perhaps in one way, the fund operator is right as Lowenstein argues gold is not an investment either. Gold does not produce income and there is no real rational way to derive its value.

But that is where their similarities end. Gold has an industrial function, has intrinsic value, and has been used as some form of currency for thousands of years. While many argue that Bitcoin can very much act as a currency, Lowenstein isn’t buying this argument either. He writes:

It is not a currency and it is not equipped to serve as a currency. It is far slower than the systems used to process Mastercard and Visa (Bitcoin processes 4.6 transactions per second, versus 1,700 for Visa). It is way too volatile to serve as a measure of payments.

BoE: buy Bitcoin if you can stomach full lossThe proponents of the Bitcoin ETF recommend investing in the coin to diversify your portfolio, but buying something with no value cannot improve security. VanEck points to increasing demand from institutional investors as an argument for owning Bitcoin. This shouldn’t be seen as a valid argument because demand can drop just as quickly, leaving investors in for some pain.

Finally, the journalist criticizes both Wall Street and the media for being so supportive of cryptocurrencies in general. Both sides will merely caution investors to understand that Bitcoin is volatile but it might be safe for a small allocation as part of a diversified portfolio.

Meanwhile, Bank of England Governor Andrew Bailey is taking a harsh stance on Bitcoin and cryptocurrencies, noting investors should “buy them only if you’re prepared to lose all your money.”

Lowenstein’s advice to Gensler is to fulfill his promise to Congress when he was nominated as CFTC chair:

After the 2008 crash, Gensler — nominated as CFTC chair — told Congress he would work to make sure that another financial failure didn’t occur. Neither he nor anyone can stop crypto from blowing up. But he can make it a lot less painful. Crypto does not deserve Uncle Sam’s blessing

The post Roger Lowenstein: Bitcoin doesn’t belong in your retirement portfolio appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|