2019-7-31 18:30 |

MoneyTap, a mobile application using the RC Cloud 2.0 which implements xCurrent, will incorporate Ripple (XRP) when facilitating global payments. This is according to the latest SBI Group financial report.

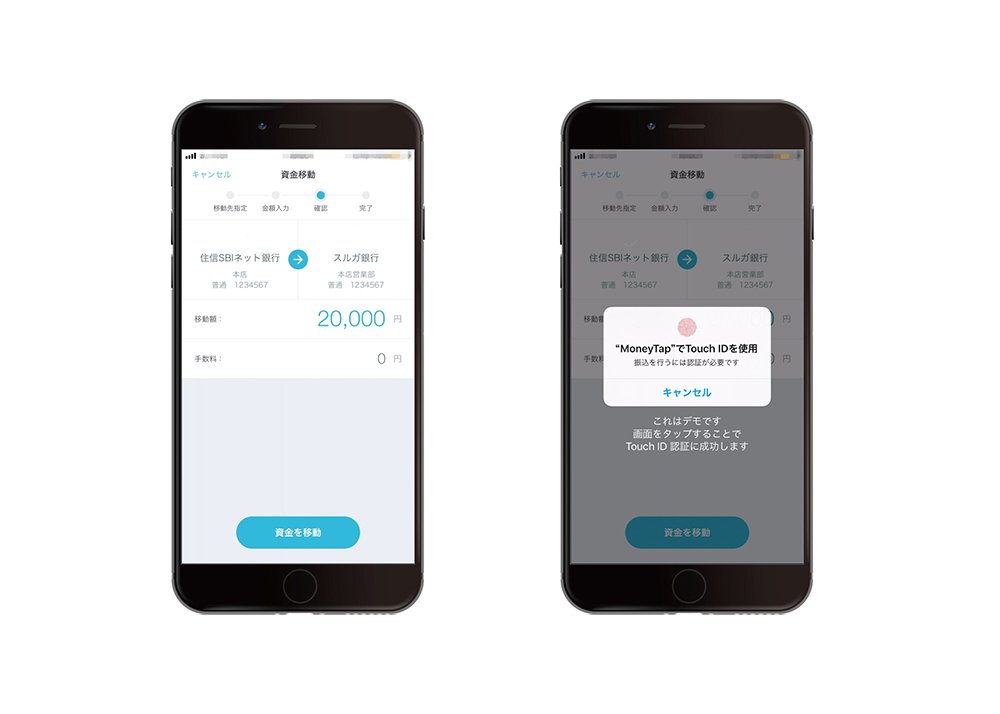

Uniquely, the mobile app has been at the fore for SBI Holdings, a leading financial services company based in Tokyo, Japan. Notably, MoneyTap allows its users to make instant domestic payments. Easing transaction settlement, a user only requires a bank account, QR code, or phone number to effect payment.

According to Yoshitaka Kitao, CEO, SBI:

“We have 25 participating banks, and 8 are API platform connected with Ripple. We want MoneyTap to accommodate international remittance, so we created a mechanism and it may contribute to xRapid using XRP.”

Transition to xRapidInterestingly, MoneyTap has widespread support but presently use xCurrent. The option is one of Ripple’s core product that doesn’t leverage XRP. However, the shift from xCurrent to xRapid has been made easier via the latest update, xCurrent 4.0. With this revelation, it appears that SBI is seeking to “provide financial services with high customer benefit, and contribute to fostering new industries and reducing social costs through cashlessization.”

MoneyTap is supported by a consortium of banks led by SBI Ripple Asia. To point out, the consortium is made of over 60 banks that account for roughly 80 percent of all banking assets in Japan.

As expected, XRP supporters were excited by the announcement that the SBI promoted option will be using the third liquid coin for international remittance. Taking to social media, the excitement was palpable.

For example, according to Redditors:

“SBI is huge, and SBI is […] deep in Ripple. The SBI consortium has 60 banks behind it. Imagine all of these banks implementing MoneyTap. MoneyTap>XRP. … The negative trash people write about XRP is starting to look very stupid. If you’re not bullish or holding XRP, you need a lobotomy ASAP.”

Will this awaken Bulls?Although some saw a bullish wave arising from MoneyTap incorporating XRP, others related the revival of price to the mentioning of XRP by the SBI head. Ordinarily, this wouldn’t be the cause of price movement given the role of Yoshitaka within the Ripple circles and his bullish comments on XRP.

With the cryptocurrency space being haunted by regulatory concerns, Ripple’s senior vice president of marketing, Monica Long, told Bloomberg that:

“Within any industry, there are responsible actors and bad actors. A good regulatory framework sets up responsible actors to innovate and improve efficiencies in the global financial system.”

However, according to Changpeng Zhao, CEO, Binance, the incorporation of XRP adds fuel to the impeding altcoin season.

In a tweet, Zhao said:

“The difference between the 2017 altseason (altcoin season) and the next one is that this new one won’t just have whitepapers. Projects in the next altseason will have products and users. Although they are risky investments, the industry is much healthier now.”

SBI VC Trade is Live, but LateEqually important, SBI is making another stride by launching the SBI VC Trade, a virtual currency-backed exchange using Ripple’s xRapid.

CryptoEri, a Twitter user and a diehard XRP supporter, said:

“Physical trading (the sales board) will be live tomorrow in Japan, July 31st on SBIVC Trade per a briefing today from Kitao. A special XRP campaign (give away) is planned, for both volume & new account opening.”

The launch, though contributing towards XRP and other supported coin’s liquidity, is late by four months. To explain, in March, Kitao noted that there were still regulatory issues that needed to be ironed out before the full operations of the exchange can go live. Significantly, some of the contentious aspects were around security and those stemming from leverage trading.

At the time of writing, SBI had confirmed that the scheduled maintenance had been completed and SBI VC Trade can be “used as usual.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|