2019-6-13 15:30 |

Ripple’s CTO, David Schwartz, spoke at Future Fintech and outlined his ideas and views about how digital assets and blockchain technology are trying to make payments efficient by getting get rid of traditional systems and intermediaries.

CB Insights tweeted a thread quoting David Schwartz at the event,

As the first break of the day winds down, head over to the Rose Theater to hear from @JoelKatz, #CTO of @Ripple, chatting with @jeffjohnroberts of @FortuneMagazine. #FutureFintech

— CB Insights (@CBinsights) June 12, 2019

There are many industries in the blockchain space specializing in improving payments, both in the domestic and foreign spheres. One such company is Ripple. Ripple is a payments company that focuses on on enabling efficient cross-border payments for enterprise customers. Schwartz said,

“Part of the problem is that payments systems are not capable of instantaneous settlement…payments companies are much more aggressive than banks… Ripple is working on getting enterprise customers together to negotiate together, circumventing SWIFT and traditional systems.”

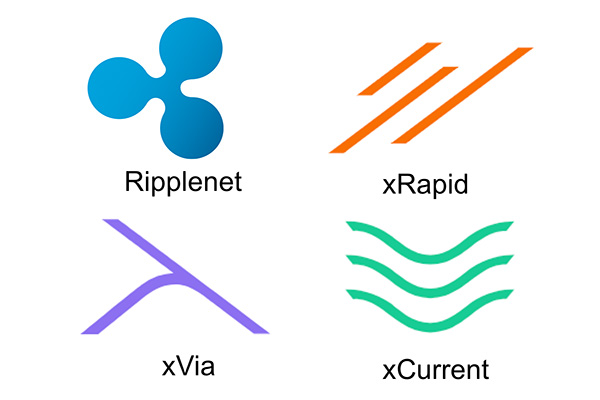

Ripple has built three specific solutions to make payments easier and more accessible to every customer out there namely, xCurrent, xVia, and xRapid. The end game with Ripple is that it wants to enable internet-of-money/internet-of-value by bringing every customer on to something called RippleNet. RippleNet is an interconnection of banks, payment providers and others using Ripple’s payment solutions in conjunction with each other, which makes payments move just like information does over the internet.

Schwartz also spoke about how stablecoins could play a vital role in achieving this particular vision of “internet-of-money.” He said,

“If the vision is an internet of money, collateralized stablecoins will be a part of that vision… It [Facebook’s new crypto] looks like a collateralized asset, and whomever owns the collateral can make the rules.”

Schwartz also said that Ripple was a company that owned “a significant fraction of XRP,” adding that “if you’re concerned about scarcity, it’s the governance that controls scarcity.”

Speaking about the regulatory uncertainty revolving around digital assets, the CTO added,

“I would say one of the biggest problems to making digital assets is this fear of governments turning around and saying this isn’t legal… The jury is still out on the decentralized finance space. There’s a real shortage of actual use-cases. Payments we all know needs to be better, that’s really concrete. But the further away you get from that, the more speculative it gets.”

Schwartz comments can be taken in light of the Indian and Chinese governments rumoured to be planning a ban on Bitcoin and other cryptos, while being excited about blockchain in general.

The post Ripple working on getting enterprise customers to circumvent SWIFT & traditional systems, says CTO David Schwartz appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) íà Currencies.ru

|

|