2019-1-12 21:02 |

Ripple is currently at the Silicon Valley Japan Platform (SVJP) working so as tobridge the gap between the Valley and Japan.

Emi Yoshikawa, Global Ops & Partnership at Ripple discussed how Ripple and the Japan Bank Consirtium are disrupting the payment industry in the country.

At Silicon Valley Japan Platform (SVJP), an initiative to bridge the gap between the Valley and Japan, @emy_wng discussed how Ripple, along with Japan Bank Consortium, is disrupting Japan's payments industry with #blockchain. pic.twitter.com/RiwPzE4emO

— Ripple (@Ripple) January 10, 2019

The Silicon Valley Japan Platform is an initiative that is promoted by the U.S.-Japan Council (USJC) and the Japan-based Asia Pacific Initiative (API). The SVJP was created back in 2014 with the intention of searching for niche markets overseas, new business partners and state-of-the-art technology.

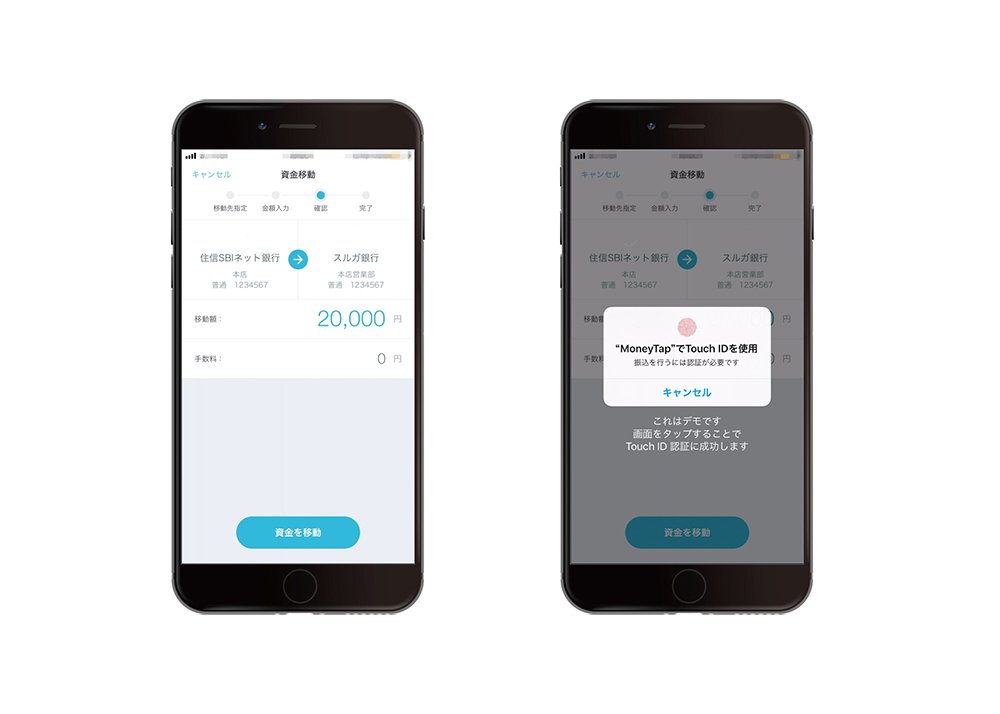

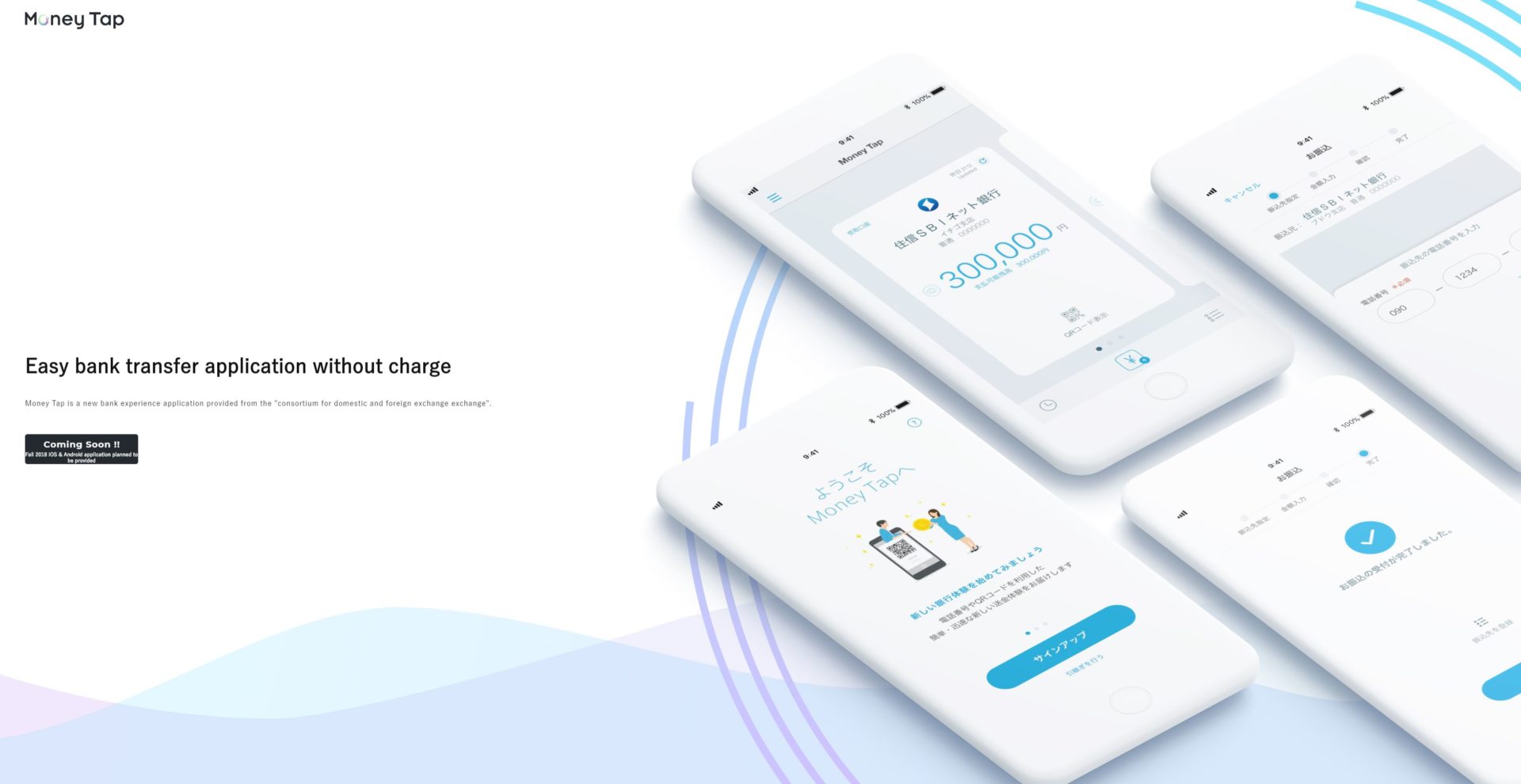

Ripple has been trying to expand its network for payments that can be used by financial companies and banking institutions. This would help them have a cheaper way to process transactions and reduce times.

At the moment, and as it was recently unveiled by Ripple, there are more than 200 companies working with RippleNet. Additionally, dozens of companies have started to use the xRapid solution, while some of them are now embracing XRP to process faster payments and reduce costs.

According to the Japanese Lawmaker, Takeshi Fujimaki, which is a former banker working as a politician, Japan is lagging behind in terms of development in digital assets.

Japan is has implemented hard regulations on digital currencies and companies operating in the space. During the last year, several hacks and problems occurred in the country related to digital currencies. However, the country is trying to regulate the space to avoid these issues in the future.

There are other countries around the world that are also starting to implement regulations regarding digital assets and the crypto market. In the last years, as cryptocurrencies expanded, several scams and fraudulent activities damaged investors that were placing their funds in different projects.

origin »Bitcoin price in Telegram @btc_price_every_hour

Japan Brand Coin (JBC) на Currencies.ru

|

|