2020-8-13 19:05 |

Despite soaring 50% at the end of July, the price of XRP continues to trade under $0.30 and down 93% from its all-time high.

This has been despite Ripple unveiling that it is buying XRP in the secondary market at market prices and may further continue to do so in the future, trying to quell the accusations of dumping the digital asset on investors.

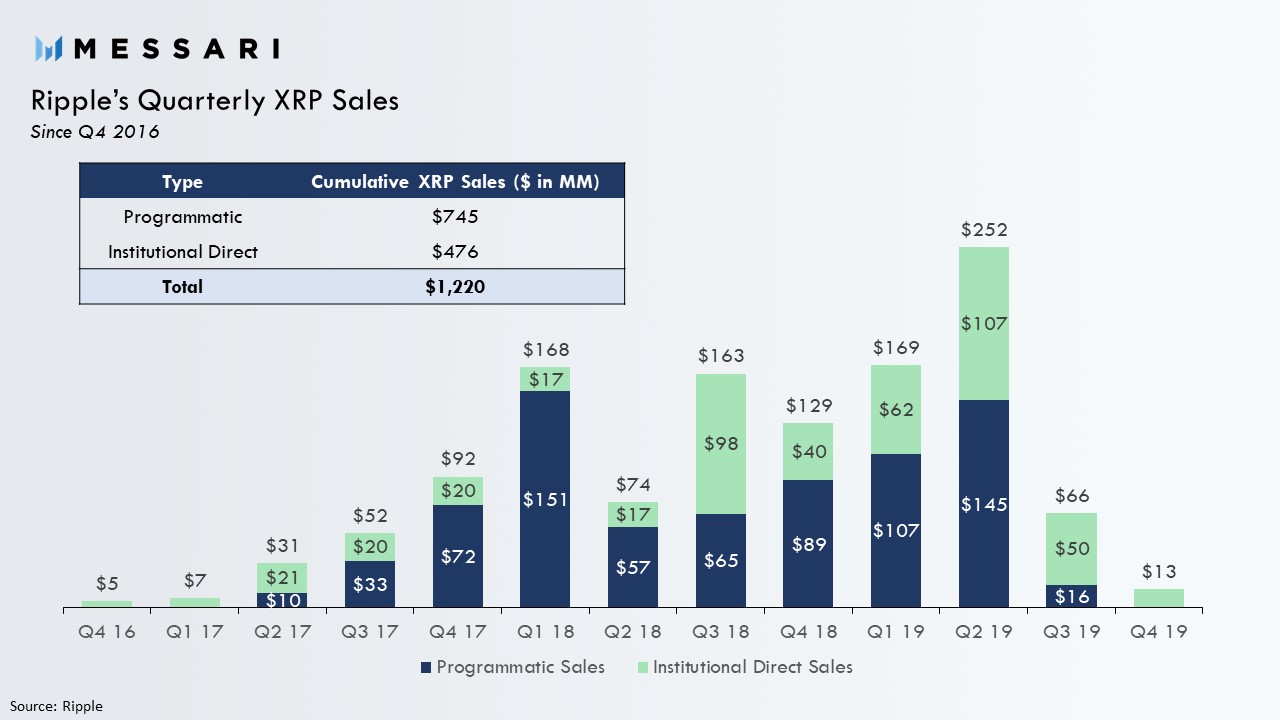

Ripple currently sits on about 55% of XRP’s total supply worth about $16 billion after having to cash $1.2 billion of its holdings since early 2017. It is the third-largest cryptocurrency after Bitcoin and Ethereum by a market cap of nearly $12 billion.

“We are a capitalist, we own a lot of XRP,” said Ripple CEO Brad Garlinghouse. “So do I care about the overall XRP market? 100%.”

The company aims to “deliver a lot of utility through XRP”; however, it could take “years,” he said.

Still Finding Use CasesAccording to a report by FT, the San Francisco-based fintech start-up launched in 2012 is still trying to find use cases for its blockchain technology underpinning XRP. In this attempt, it is aiming to become the Amazon of the crypto world.

When Garlinghouse took the CEO position five years ago, the company focused on payments but is now trying to produce tools for developers to build their own applications on their blockchain.

According to Garlinghouse, this latest effort will put Ripple in the same position as a broader blockchain platform as Amazon has become a platform for e-commerce.

“Amazon started as a bookseller and just sold books. We happen to have started with payments,” he said. “Two years from now, you’re going to find that Ripple is to payments as Amazon was to books.”

But Ripple hasn’t been hit with its first application and has also been facing lawsuits over claims they sold unregistered securities, and bears a big question mark on the (security) nature of its digital asset.

Cutting Back on HandoutsRipple gained much attention for attaining over 300 banking and financial institutions as its partners include some big names. Santander is one of its “largest and most important customers,” but like many other partners doesn’t use XRP rather only some of Ripple’s software. This is because the digital asset wasn’t active in enough markets to support the bank’s needs.

Not only trying to be close to the bank gets them “a lot of hate in the crypto world,” this whole situation is like “Uber trying to disrupt the taxi industry by working with the taxis,” said Michael Arrington, TechCrunch founder.

This year, it was also found that Ripple has been using its crypto reserves to draw more users and partners. The company handed MoneyGram $31 million worth of XRP in “market development fees” to encourage them to use its cryptocurrency.

Ripple also distributed about $500 million, much of it in XRP, through its Xpring fund to see new applications using its blockchain technology. One such effort involved Coil that received $260 million, which generated little in returns.

Ripple has since cut back on Xpring handouts, and the company has now moved from “writing cheques to writing code,” said Ethan Beard, SVP at Ripple.

Ripple (XRP) Live Price 1 XRP/USD =$0.2803 change ~ -0.53%Coin Market Cap

$12.13 Billion24 Hour Volume

$420.96 Million24 Hour VWAP

$024 Hour Change

$-0.0015 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~XRP~USD"); origin »Ripple (XRP) на Currencies.ru

|

|