2018-12-3 05:22 |

xRapid could be used by major banks by the end of the year said Ripple’s CEO Brad Garlinghouse. Earlier this year, Mr. Garlinghouse talked about the future of Ripple and how different companies are starting to embrace the services and products the company is developing.

Crypto and XRP enthusiasts have been waiting for a bull run in the market since the whole 2018 was very negative for the whole space in term of price action. Most of the virtual currencies lost more than 50% and the market cannot still recover from it.

As the xRapid product developed by Ripple uses the XRP virtual currency, the community expects the price of XRP to grow over time and reach new highs in the future. And this generates positive expectations about the future of Ripple and XRP.

It is clear that XRP will not reach new all-time highs during this year. The same is happening to other coins. Most of them are not going to reach new highs in the next weeks.

Earlier this year, Garlinghouse commented:

“By the end of this year, I have confidence that major banks will use xRapid as a liquidity tool, this calendar year. By the end of next year, I would certainly hope we would see in the order of magnitude of dozens.”

Several banks using xRapid would be a very good thing for the crypto market, Ripple and XRP. XRP would work as a liquidity tool and there will be more investors and enthusiasts using XRP. Although Garlinghouse seemed very positive about xRapid and its growth and expansion in the market, there are no banks that have publicly embraced this product. However, there are some signs that would let us suppose that there are some customers ready to start using this solution.

These institutions that have been confirmed by Ripple are Viamericas, Cuallix, IDT, and MercuryFX. According to Garlinghouse, one of them will be using xRapid by the end of this year. As some analysts point, these institutions have already spoken very positively about xRapid.

Nicolas Palacios, the CFO of Cuallix, said that with Ripple, the company can source liquidity using the XRP and settle cross-border payments in just a few seconds. Additionally, Paul Dwyer, the CEO and Founder of Viamericas, mentioned that assets such as XRP will be playing an important role in the future of cross-border payments.

And the list of positive comments about XRP continues from individuals from other banks. According to Ripple, the product allows for 40% to 70% lower fees while making transactions that settle in less than ten minutes.

There are also four different virtual currency exchanges working with XRP with the intention to provide liquidity pools for xRapid. These exchanges are Bittrex, that works with USD, Bitso for Mexican Pesos, Coins.ph for Philippine Pesos and SBI Virtual Currencies for JPY.

With this information, it is possible to see that xRapid settlements can take place between these corridors.

It might be possible for Viamericas to start using xRapid in the near future since it has the necessary infrastructure to send and receive payments between some of the aforementioned corridors.

Another company that could implement xRapid is the telecommunications operator called IDT. They use xRapid for their ‘BOSS Revolution’ trying to help populations without access to bank accounts.

On the matter, they commented:

“IDT Telecom’s Retail flagship service is BOSS Revolution. BOSS Revolution helps immigrants and the under-banked to conveniently and affordably communicate and share resources around the world. BOSS Revolution is a collection of communication and payment services.”

The company has also offered services to transfer funds to Mexico and the Philippines. Because of the price that each transaction cost, it is possible to see that they are not using the xRapid product.

Although no major bank or financial institution started using xRapid, we can see that there are some companies ready to embrace this service provided by Ripple.

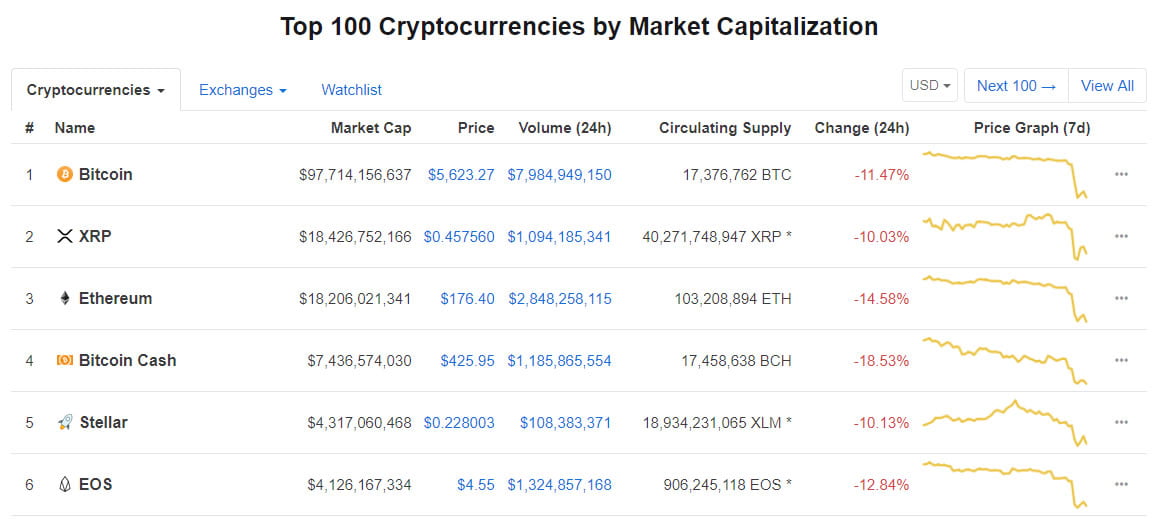

At the time of writing this article, XRP is the second largest virtual currency in the market with a price of $0.371 per XRP. It also has a market capitalization of $15 billion. If several companies start using XRP, the effects on XRP’s price could be very positive and have a positive effect on other virtual currencies as well.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|