2018-10-29 18:49 |

Ethereum World News reported on October 26 CME Group offered expiration of Bitcoin BTC futures contracts. The contracts were expiring that same day and some traders introduced the idea that rather than expiring 4 p.m. London Time, they would expire at 4 p.m. GMT. Even though the time between the two zones is only an hour, it was noticed that expiring contracts did not affect BTC’s price.

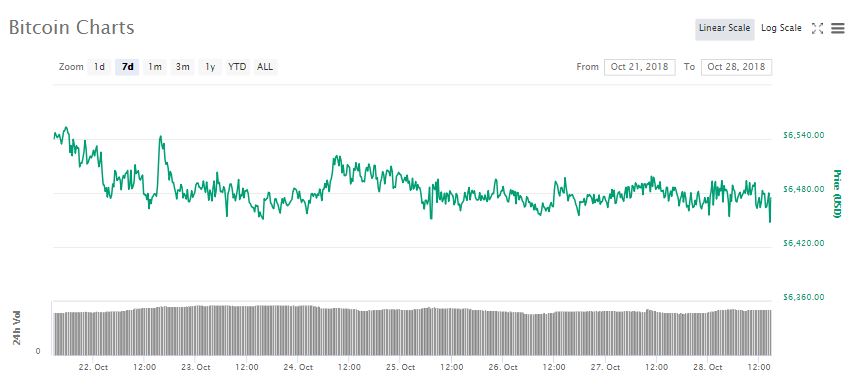

Generally, bitcoin has been pretty stable over the past 7 days, hovering around $6,400. The GME website provided information as to when the futures contracts expire. The website stated,

“Last Day of Trading is the last Friday of contract month. Trading in expiring futures terminates at 4:00 p.m. London time on the Last Day of Trading.”

And looking at bitcoin’s price chart for over the past few months, the stability is clear.

Thomas Lee, Fundrat CEO, made a similar observation but regarding CBOE futures. He stated,

“Bitcoin seems dramatic price changes around CBOE futures expirations. This was something flagged by Justin Saslaw and Raptor Group. We compiled some of the data and this indeed seems to be true. A broader observation is there is significant volatility around these expirations.”

It seems that since last Friday, something unique has happened when it comes to bitcoin futures. BTC’s price seems to have become more stable this time around compared to previous occasions. Further, it is possible that BTC has become immune to the effects. Thus, at this point, it may be best to observe BTC when the next CMT futures contracts expire on November 14th and December 19th. Observing on those days may lead to a more fact-based conclusion concerning bitcoin’s true reaction to the BTC futures market.

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) íà Currencies.ru

|

|