2022-7-6 05:00 |

Zimbabwe, currently faced with incredible inflation and tough sanctions, could massively benefit from increased adoption of the open network of Bitcoin.

The Small Steps To Resilience“Scalability is the essential property of money. It is the ability for a good to be sold easily on the market, without much loss in its value.” —Saifedean Ammous

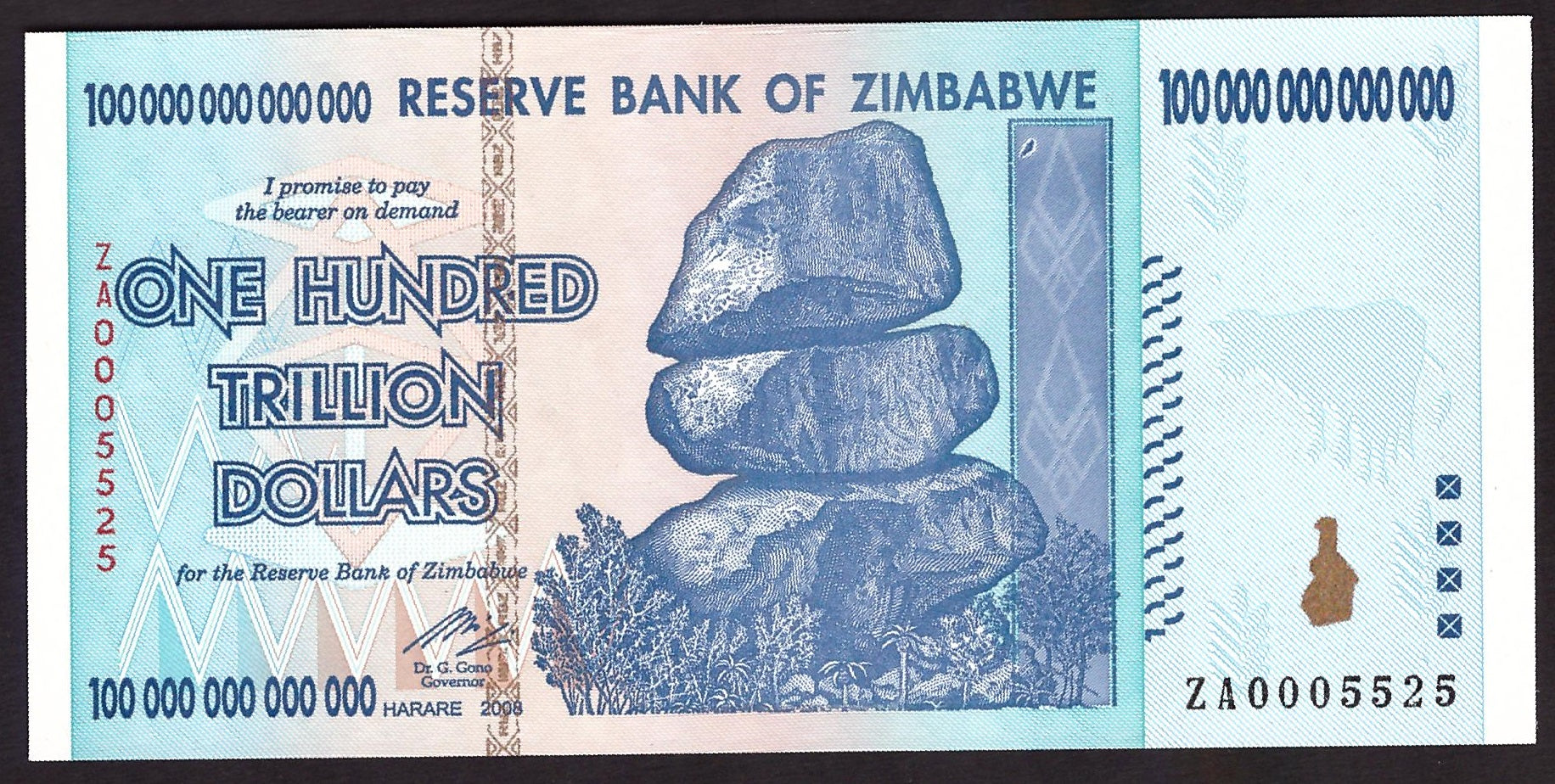

Scalability Through Time And How To Handle Volatility.Zimbabwe experienced an estimated 79.6 billion percent inflation month-over-month, 89.7 sextillion percent year-over-year in mid-November 2008. Zimbabwe once again has the highest annual measured inflation rate in the world. It lacks a currency that is scalable through time.

Bitcoin’s average unrealized capital gains return is an annual 200%. No individual who has sold bitcoin after holding it for a period longer than five years has ever lost money. Bitcoin is a deflationary currency, a currency whose purchasing power appreciates with time — it is therefore a perfect method to store one’s wealth.

However it is still subject to volatility. As of today we have experienced a 70% loss in market value compared to all-time highs. Bitcoin’s prices volatility is always an issue raised, when asked, “how will Bitcoin become a medium of exchange?” It is often the first point of contention, although many today cite that volatility is expected for any new asset still within its “price discovery” years, and that as adoption increases the volatility will settle.

Bitcoin is a distributed software that operates based on peer-to-peer network members who are all equal. This software allows you to operate a payment network between those peers and that payment network has its own currency.

It allows cash finality; the moment at which funds, transferred from one party to another, officially become the legal property of the receiving party.

Bitcoin offers cash finality in 10 minutes, and Bitcoin Layer 2 protocols offer cash finality in under a second.

Scalability Through Space And How To Transact On Both Layers Of Bitcoin.Over the last decade Zimbabwe has lost more than 100 relationships in our correspondent banking relationships network, due to sanctions. This greatly limits the ability to make payments to any one country due to our local bank no longer having relationships with banks outside to clear the payment, preventing the ability of citizens to buy and sell goods across borders.

In addition, our legal tender currency the RTG is a pseudo-currency, meaning it is not a currency tendered in any other country and it can be only traded locally. We lack a financial system and currency that is scalable geographically.

Bitcoin offers the transfer of value to anyone on Earth, without anyone's permission. The cost of doing transactions in an FCA bank account in Zimbabwe at the point of withdrawal has a 2% minimum and may go as high as 15% — while the cost of transacting on Bitcoin (using Layer 2 protocols) is less than 0.1%, to complete a transfer.

Bitcoin has the opportunity to gain massive market share for foreign remittances and local settlements. But only under the condition, I believe, that we mine bitcoin locally. Miners could sell bitcoin at a 1:1 rate or 2% charge, whenever they need fiat currency to pay expenses. But the biggest benefit miners bring is that individuals no longer need to send fiat currency outside at 5-15% charge to buy bitcoin and resell at a higher premium.

EcoCash’s new foreign currency wallet, combined with a Telegram bitcoin bot, may offer a solution to Zimbabweans’ inability to on-ramp and off-ramp into the Bitcoin network.

The Telegram exchange, which is custodial, allows individuals to buy and sell bitcoin to anyone around the world and receive funds through the foreign currency wallet and other fiat currency banks.

Zimbabweans can easily buy bitcoin using Telegram's network without having to use a bitcoin exchange.

I prefer social media platforms, instead of new Bitcoin applications, because so many foreign currency transactions are already done on social media (mainly WhatsApp). WhatsApp has a very strong network established locally, and Telegram is slowly developing one.

ScalabilitySanctions also created a third problem — the storage of foreigners’ currency reserves, which often results in higher inflation. But also this introduces the annoying problem of never having small denominations of money to purchase goods and services. We lack a currency that’s scalable, period.

“ It must be considered that there is nothing more difficult to carry out, nor more doubtful of success, nor more dangerous to handle, than to initiate a new order of things." —Niccolo Machiavelli, 1469-1527

Zimbabwe is in a unique position. Our primitive fiat financial system is repeatedly and consistently failing, we are suffering from two decade-long sanctions and our government deemed bitcoin as an illegal currency, preventing exchanges from operating. Conditions like these have destroyed countless numbers of once-flourishing industries in our country; industries that simply left and flourished in other regions of the globe, denying us citizens the ability to create wealth and achieve a higher standard of living.

The Zimbabwe Bitcoin Community on WhatsApp

P2P Zimbabwe Telegram Bitcoin Exchange Bot

This is a guest post by Alexandria. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|