2021-7-6 20:58 |

Chainlink LINK/USD incentivizes a global network of computers in providing reliable, real-world data to smart contracts. The LINK cryptocurrency ensures the successful execution of smart contracts which depend on the network.

Chainlink has gained around 5% in value over the past day so now is a good time to take a look at the recent LINK price action and determine if it is still a good buy in July.

Chainlink integrations on the riseOn July 6 we saw DotMoovs become the latest blockchain innovator that integrated ChainLink Verifiable Random Function (VRF). DotMoovs is a competitive platform that works to bring international sports competition within the virtual world.

ChainLink’s VRF will end up being used as a powerful as well as secure oracle infrastructure that provides DotMoovs with a tamper-proof as well as an auditable source of randomness.

When DotMoovs overcomes geographical barriers to sports through a system that rewards its participants with the native MOOV token, we will see a lot of activity on ChainLink as well, which will result in higher demand as well as the value of the LINK token.

We also saw the DeFi Aggregator known as Dot Finance integrate Chainlink Price Feeds on the Binance Chain in order to power its DeFi yield aggregator solution.

Furthermore, even Thales announced their integration of Chainlink Price Feeds in order to secure binary options outcomes.

Thales is a permissionless as well as non-custodial and uncensorable binary options trading platform.

All of these integrations of Chainlink into different projects truly showcases the prowess of its technology and are bound to gather some attention throughout July.

As the demand for LINK increases, so might the value, and as such it makes it a worthwhile investment.

Should you invest in Chainlink (LINK)?On July 6, Chainlink (LINK) had a value of $19.59.

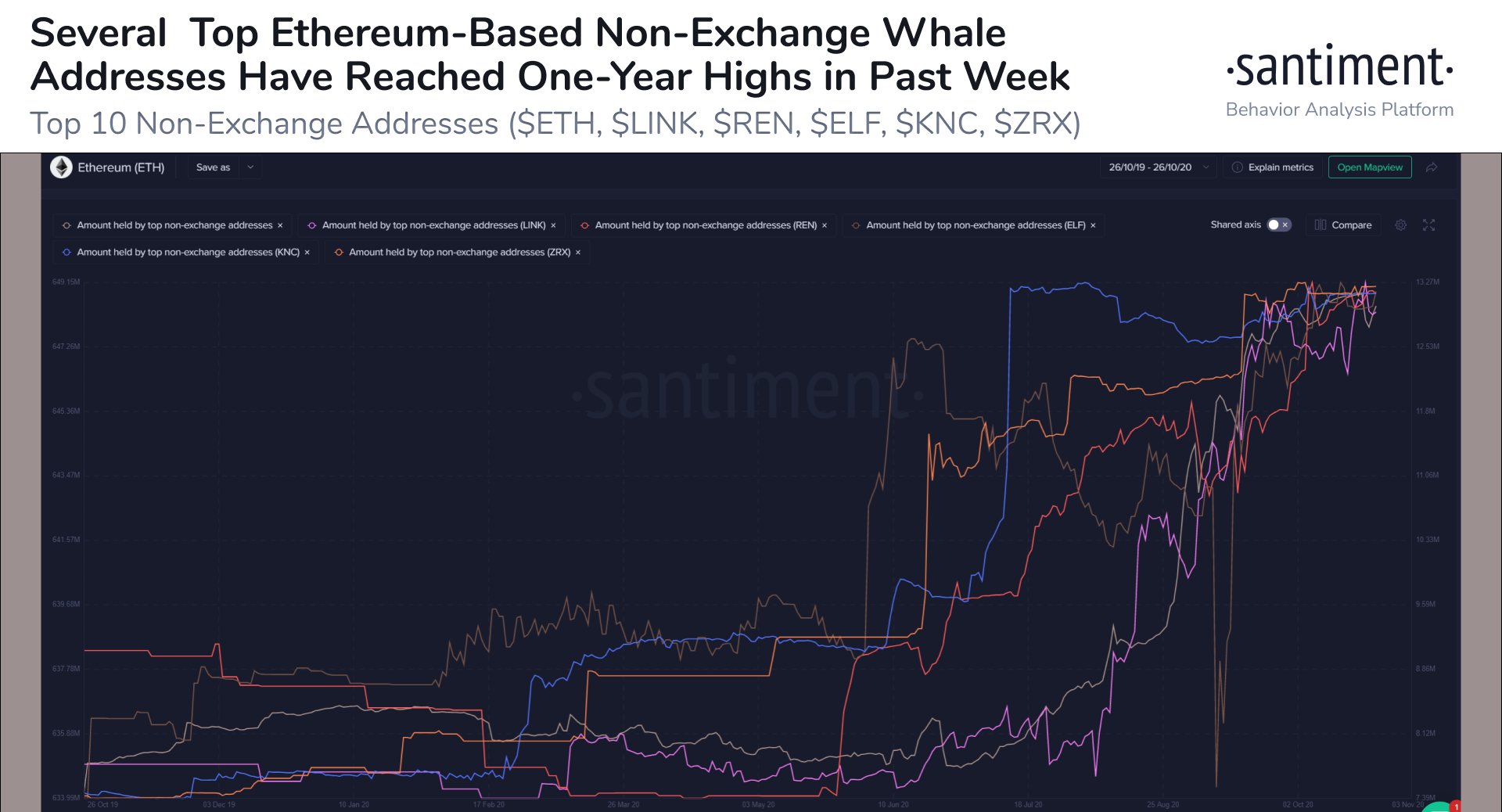

According to data from IntoTheBlock, in the last 24 hours, ChainLink has been up 5%, with 77% concentration by large holders and $121.97 million in total exchange inflows within the last 7 days.

Given the fact that a lot of blockchain-based solutions are starting to implement Chainlink as a solution for their price feeds, in order to offer their users a higher level of security, the LINK token has a lot of potential.

When we look at June, it went up to $31.18 on June 3, while the lowest price point LINK got to was $15.26.

This should give us a clear perspective as to how much we can realistically expect the token to grow in the following month, however, it might even have the potential to rise higher in value.

That being the case, given its recent integration across numerous projects, we can really see LINK going up to the $25 mark by the end of July.

This is the case, assuming the LINK token sees a higher demand and usage as a result of the integrations.

At its current asking price of $19.59, it might be a worthwhile investment long-term.

The post Prediction: is Chainlink (LINK) a good price in July 2021? appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|