2023-5-1 22:41 |

Ethereum (ETH) slipped from its 11-month high above $2,100, now struggling below $2,000 with more users accessing their staked assets on exchanges.

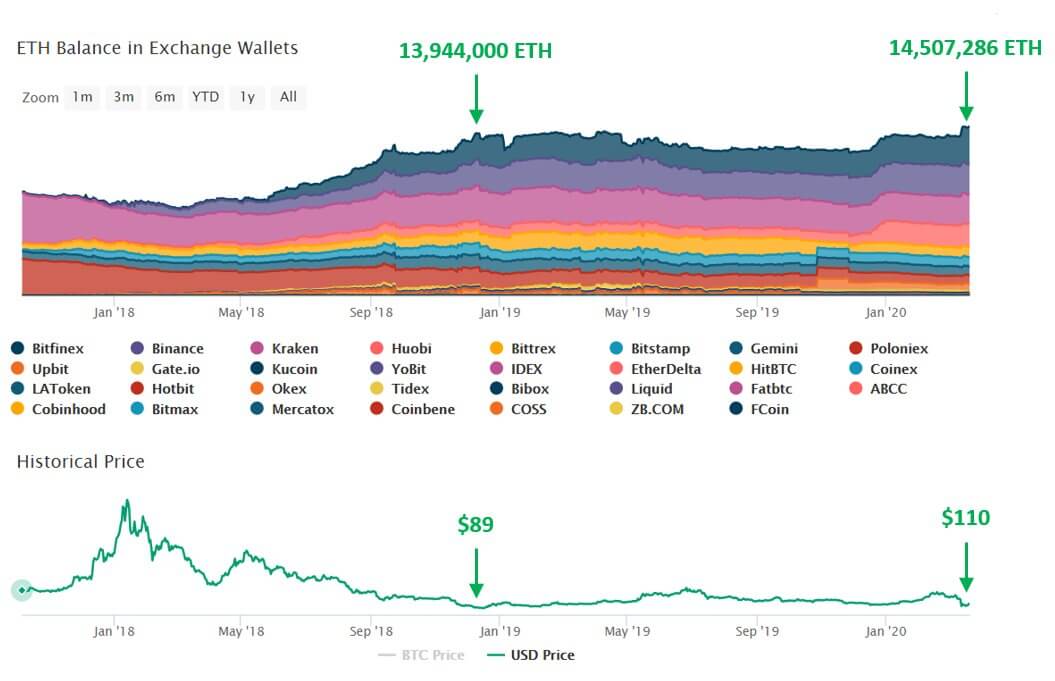

According to recent data from CryptoQuant, a total of 1,101,079 ETH were deposited into digital asset exchanges, while 921,579 ETH was withdrawn in four days post-Shanghai. The net inflow of 179,500 tokens between April 13 to 17 becomes the largest recorded in a four-day window.

Huge transfers of assets to exchanges are an indicator of investors’ preparation to sell, which reduces the asset’s value, although this is not always the case.

The Shanghai upgrade, also known as Shapella, was implemented on the Ethereum network on April 12, giving validators access to their staked assets and rewards for the first time since the Merge event of last year, which transitioned it to a proof-of-stake (PoS) network.

With over 18 million ETH worth approximately $36 billion staked on the network, several analysts expected a price drop as validators get access to their assets for the first time in months. The reverse happened after ETH hit an 11-month high above $2,100.

A price drop below $2,000 coupled with investors transferring assets to exchanges may have a bearish outlook to many. However, several others opine that in the long run, more assets will be staked following Shanghai.

More withdrawals expectedSequel to the price jump of ETH days after the upgrade, users sold their assets across several platforms. Coinbase, among the first exchanges to give users access to their staked assets following the upgrade, has recorded over $28 million in sell orders.

Due to the legal challenges, Kraken faced with the SEC leading to a $30 million settlement, including shutting down its staking service, Kraken now leads the de-staking queue. On-chain data shows that the exchange leads the pack with over 60% of withdrawal requests.

Digital asset market research platform Kaiko stated that as Binance now allows users to withdraw staked assets, it could “result in more sale pressures.” On April 19, Binance began processing user requests to withdraw staked ETH on its platform.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|