2020-8-13 19:25 |

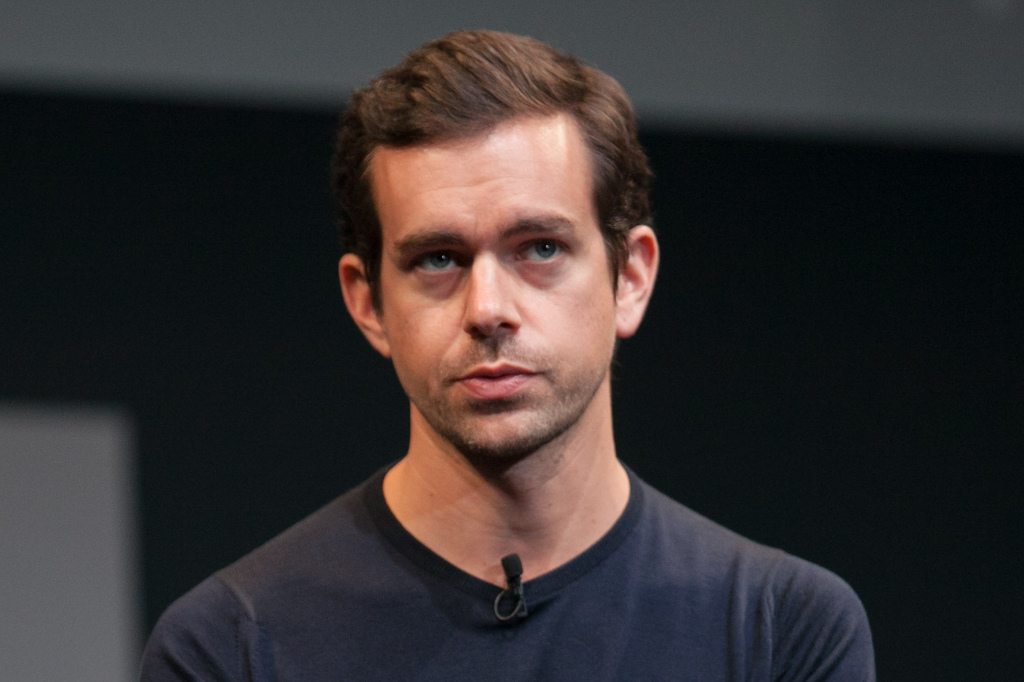

Jack Dorsey’s Square might soon be offering loans of up to $200 through its P2P service platform, CashApp. This revelation follows a recent report by TechCrunch, which highlighted that the firm is testing the new feature with about 1000 users as of press date.

Notably, Square attributed this strategic move to some factors, including the uncertainty of a second U.S stimulus. According to the firm, the market demand for loans between $20 and $200 might expand significantly as a result.

Users who qualify for these loans will be given a one-month payback period with a 5% flat fee charged on leveraged funds. Calculated annually, the interest translates to around 60%. However, it may seem quite high; it is more favorable compared to average payday loans in the U.S, which in some cases are charged as much as 700%.

Should the borrowing parties default, Square intends to put a one-week grace period, after which a non-compounding interest of 1.25% will be added to the cost every week. With the testing still in play, a CashAPP spokesperson mentioned that they are looking forward to feedback from the 1,000 clients featured:

“We look forward to hearing their feedback and learning from this experiment.”

Square’s BTC Streak ContinuesOther than its prospectus loan product, Square has been making headlines in the crypto scene and is now positioning itself as the go-to platform for Bitcoin purchases. The company’s Q2 revenue from Bitcoin totaled $875 million, with $17 million as the gross profit from BTC related transactions.

These stats are up by 600% and 711% YoY, respectively. Going by these stats, a move towards loan issuance might even expose a more significant population who initially couldn’t afford a stake in the crypto market.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|