2019-2-15 23:53 |

The Paradox Of Crypto: Falling Prices Coupled With Record Deals

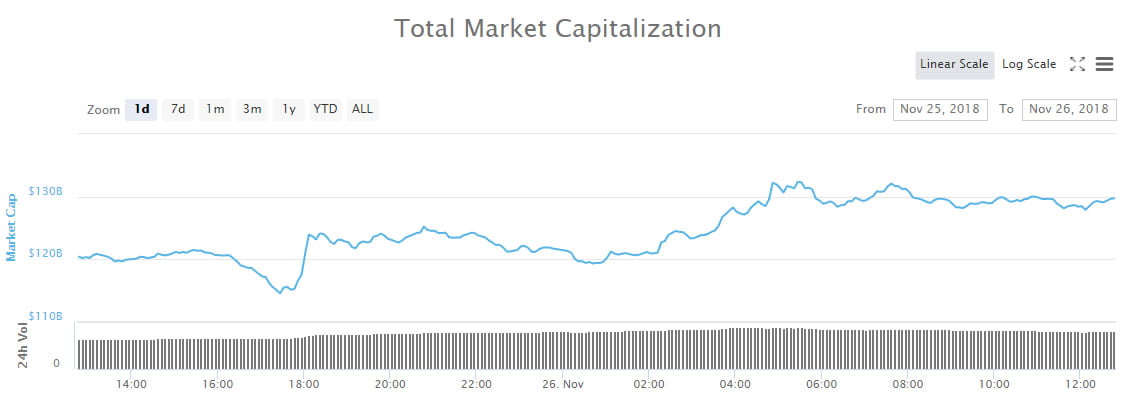

There has been little debate about the possibilities that are offered by the blockchain, unfortunately, there is little agreement about the way to implement it. To compound the misery of the industry, their total market cap, which had peaked in early 2018 at over 800 billion now languishes around $100 billion. Yet the silver lining has been the record merger and acquisitions that have been noted within the crypto-world.

As per reports, Forbes has noted that despite the depressed values of the assets themselves, last year saw the industry looking to consolidate. They infer this by looking at more than half a billion worth of mergers and acquisitions [M&A] deals that were directly related to some sort of cryptos, in the United States alone. As per records from Pitchbook, a financial database for investors, such activity has not been seen since 2010, at that time cryptos had first made any sort of dent and total transactions were worth nearly $300 million.

When the crypto bubble popped early last year, it left a trail of destruction. This also gave the naysayers a platform to spew their hate and scaremongering. Unsurprisingly, most development work and traditional investors have since shied away from the anything blockchain. Yet, the data from Forbes is encouraging as it proves that the cryptosphere has not been sitting idle. These numbers point at astute consolidation of resources and talent, a sure sign of maturity.

Of the top 5 deals, four took place just last year. There were two modest deals of 15 million each; when Blockseer, a blockchain analytics firm was bought over and bitcoin tax firm Node40 was purchased. However, the one that raised eyebrows was when the tasks platform, Earn was taken over for $120 million, by the crypto exchange Coinbase. All this dwarfs in comparison to the deal where the Poloniex cryptocurrency exchange was bought over by Circle Internet Financial, backed by Goldman Sachs for a reported $400 million. While there might be a reason to question the whole exercise if the end result is that exchanges and transactions are still under the very financial institutions that were the architects of the last disaster, still, at the moment survival is of paramount importance.

In terms of numbers, reports from Pitchbook throws some interesting numbers. The US markets have seen over a billion dollars worth of deals since the inception of the blockchain. As mentioned, half of that value was added in the last year with a total of 54 M&A deals. And the forecast is equally bright for this year. Thus far, blockbuster deals have already been done and sealed. Crypto exchange Kraken has acquired Cryptofacilities, a British cryptocurrency futures platform; Coinbase has done the same for a blockchain APIs startup, Blockspring; even Facebook has jumped into the fray by taking over Chainspace, a smart contracts start-up.

While falling prices would be a cause of concern for any field, let alone one that is barely a decade old, there are advantages. Crypto has increasingly become a space where only those who have at least basic knowledge, enter. This gives a huge boost to stability for the entire industry. Now with reports of consolidation doing the rounds, it can only bode well for the industry in the medium to long run.

Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), and BCH Price Analysis Watch (Feb 14th)

origin »Bitcoin price in Telegram @btc_price_every_hour

High Performance Blockchain (HPB) на Currencies.ru

|

|