2021-4-17 11:00 |

Not a day goes by without another decentralized finance (DeFi) startup announcing big venture capital investment, and the latest to do so is Pendle.

The DeFi startup has raised $3.7 million in a private funding round led by Mechanism Capital.

Other contributors included some of the usual suspects in DeFi investment. Those include Crypto.com Capital, Hashkey Capital, Spartan Group, imToken, DeFi Alliance, LedgerPrime, and a number of others.

As with most DeFi protocols, there will be a native token distributed among the team, investors, the ecosystem itself, and the rest going towards liquidity incentives.

1/ We’re excited to announce the investors supporting Pendle’s vision for creating the next layer of DeFi yield markets.

Led by @MechanismCap, we’re grateful to have raised $3.7M in our seed and private rounds, with support from an amazing group of funds and individuals. pic.twitter.com/W8b4MA3c0E

By interoperating with existing DeFi protocols, Pendle aims to support the creation of a credit derivatives market within the sector, akin to interest rate derivatives in traditional finance, the explanatory blog post stated.

The protocol was started with the goal of creating yield markets across DeFi platforms by allowing users to separate future yield from their base yield-bearing assets.

There will be an automated market maker (AMM) for trading these future yield tokens (XYT), which it claims will form a new DeFi primitive.

“Depositing a future yield token on a typical constant function AMM would result in guaranteed losses for liquidity providers over time. Pendle’s novel AMM takes this depreciation into account by incorporating a dynamic curve that normalizes risk exposure.”

Some of the mechanics were inspired by bond strips, where yield is “stripped” from the bond, and selling that strip is essentially exchanging future yield for cash. This can be applied to any DeFi related asset such as stablecoin deposits, liquidity provider tokens, synthetic tokens, and vault strategies.

Hedgers can sell these tokens to lock in profits and receive upfront cash. At the same time, traders can buy these tokens for a capital-efficient way to gain exposure to fluctuating rates:

“Pendle looks to build the next layer of DeFi on top of all yield assets. The nature of our AMM allows the seamless creation of yield markets for yield-bearing tokens.”

The protocol launched to Ethereum’s (ETH) Kovan testnet on March 20, but there was no indication of the official launch date for the mainnet.

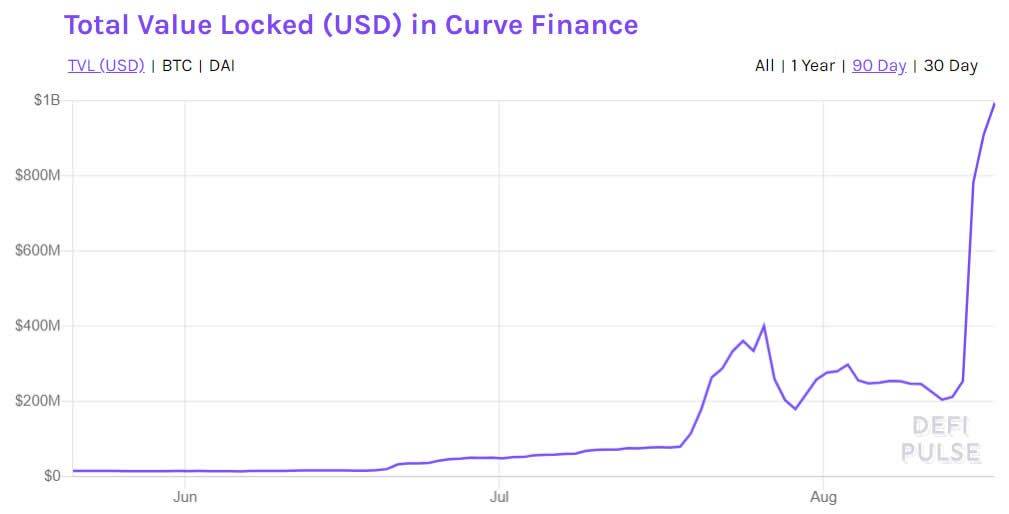

DeFi TVL at new highAccording to DeFiPulse, the total value locked across the industry hit an all-time high of $60 billion on April 16. Compound Finance tops the list with $11 billion locked, and there are now 13 protocols with over a billion dollars in collateral.

The post Pendle Raises $3.7M for DeFi Future Yield Token Markets appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|