2020-7-20 14:29 |

Shortly after PayPal’s recent news that it’s working on a feature to support digital assets, sources familiar with the matter have disclosed today that the fintech giant will be working with Paxos, according to Coindesk.

In a move that will see one of the biggest mainstream fintech companies enable the supply of digital assets, PayPal will now be competing on the crypto market with other services like Robinhood and Square.

Paxos, which is regulated in one of the toughest spots (New York) for offering physical/digital assets services in the US, also recently partnered with British fintech company’s US branch Revolut US to offer Bitcoin trading.

While the digital assets to be offered are still unknown, the source confirmed that further information will be rolled out with the upcoming official announcement.

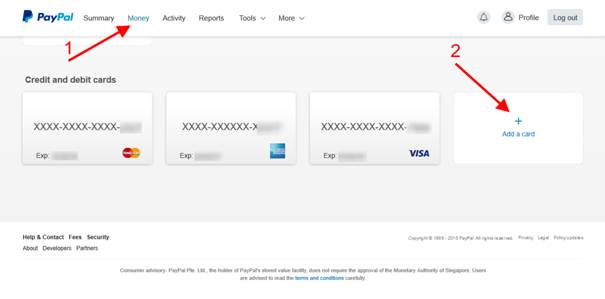

Paypal Users Will Be Able To Buy and Sell Crypto Directly From the PlatformThe new partnership will bring digital assets to more than 325 million worldwide active users on PayPal. As the leader of the online mobile and payment market, PayPal enables payment services across many e-commerce markets and content-based platforms.

PayPal’s decision to develop crypto facilities feature started with its involvement in the early stages of the Libra project which it later withdrew from, after Facebook’s prolonged regulatory battle with US SEC and other official authorities.

AS ZyCrypto reported, PayPal’s letter to the European Union is in line with its new partnership with Paxos, which will make it easier to avail digital assets trading with already regulated financial services, to avoid regulated hurdles. In the letter, Paypal stated:

“First a clear set of definitions on various crypto activities should be put in place to ensure that companies engaged in such activities are properly licensed and regulated. Lack of clarity and the regulatory expectations for such activities creates uncertainty that may discourage companies from actively participating.”

PayPal’s Role in Mass Crypto AdoptionThe far-reaching Paypal services and its legal integration with local financial institutions and money transfer services will play a big role in accelerating cryptocurrency mass adoption.

The platform has established trust with millions of people and businesses that transact through its services on a daily basis. The crypto community is appreciating the role of mainstream fintech companies in bringing crypto closer to the general public.

The failure of Telegram’s Gram project and initial Libra design woke the crypto community to the reality of working with established and regulated institutions rather than starting from scratch in such an insufficiently regulated space.

As the first regulated Trust company to offer digital assets, Paxos allows users to tokenize, settle, and trade assets. Apart from supporting Bitcoin trading, Paxos also offers Binance USD stablecoin through its Paxos Standard (PAX) native token.

origin »Bitcoin price in Telegram @btc_price_every_hour

Paxos Standard Token (PAX) на Currencies.ru

|

|