2021-3-30 18:06 |

One of the biggest stories in the cryptocurrency industry in 2020 was the announcement from PayPal that they would be facilitating cryptocurrency-related transactions on their platform.

PayPal is one of the biggest fintech platforms in the world, with over 330 million users and tens of millions of merchants. Its public acceptance and financial endorsements of cryptocurrency were signs of just how far the industry had come and also opened crypto utility to a wider audience.

Now, PayPal seems to have gone a step further as it was announced on March 30, 2021, that users can now spend their bitcoin at merchants with PayPal.

Checkout With BitcoinThe ability to pay with bitcoin at checkouts with PayPal’s estimated 29 million merchants means that cryptocurrency use is now easier than ever before. The service, according to PayPal’s CEO, will be rolled out in the coming months of 2021.

“This is the first time you can seamlessly use cryptocurrencies in the same way as a credit card or a debit card inside your PayPal wallet,” President and CEO Dan Schulman said.

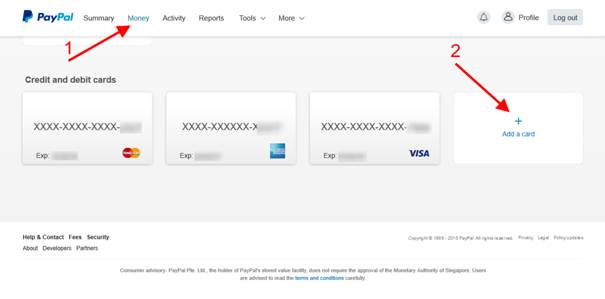

How this will work is that Paypal users who hold bitcoin, litecoin, ether, or bitcoin cash will be able to convert these tokens to fiat currencies at checkouts and then make their payments.

This announcement makes PayPal the largest private payments platform to allow for cryptocurrency transactions and is a major milestone for the industry. This comes just after Tesla announced that it would be accepting bitcoin as payment for its products.

Bitcoin has particularly seen a triumphant few months following its bull run which began in 2020. After falling to around $3,000 at the beginning of the covid-19 pandemic in 2020, bitcoin has seen a new all-time price high of over $60,000.

BTCUSD Chart By TradingViewNow, bitcoin enthusiasts are predicting a price of around $100,000 by the end of the year even as bitcoin soars in universality.

Despite all of this, there is still some concern about the volatility of bitcoin and other cryptos, though PayPal hopes to address this with the conversion to fiat currency.

“We think it is a transitional point where cryptocurrencies move from being predominantly an asset class that you buy, hold and or sell to now becoming a legitimate funding source to make transactions in the real world at millions of merchants,” Schulman said.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miner One token (MIO) на Currencies.ru

|

|