2020-9-22 20:06 |

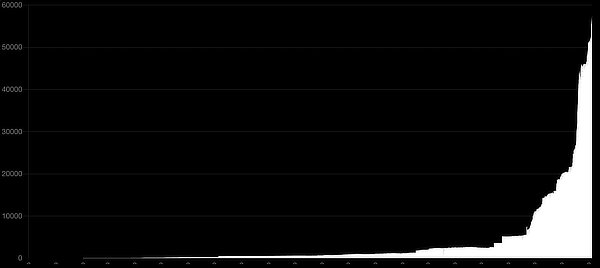

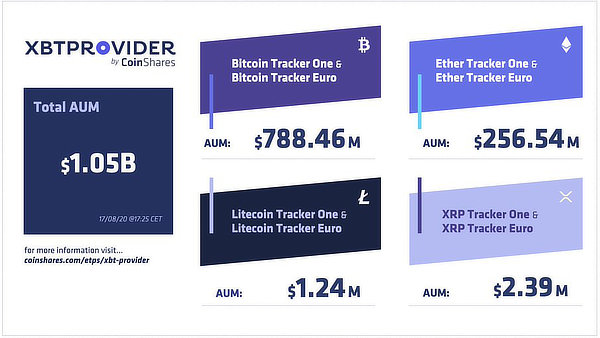

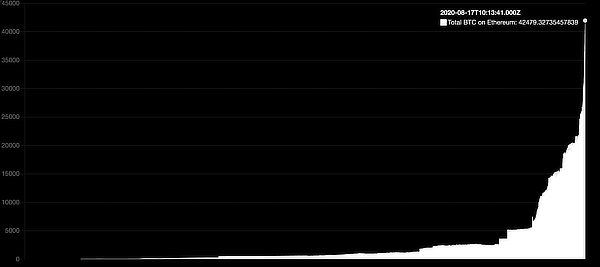

The number of Bitcoins locked on Ethereum continues to hit new records. It has already surpassed $1 billion.

Currently, nearly $1.2 billion worth of Bitcoin has been tokenized on the second-largest platform. At the beginning of 2020, only 1,110 BTC worth less than $7 million were tokenized.

Now, 108,240 BTC are tokenized on Ethereum, representing 0.51% of fully diluted BTC supply, as per Dune Analytics.

The biggest contributor to this is Wrapped Bitcoin (WBTC) that has minted 77,586 tokenized BTC since the project’s launch in early 2019. The largest tokenized bitcoin project represents over 71% of the total tokenized BTC supply at $825 million.

The second-largest tokenized bitcoin project, with dominance, is RenBTC, which has issued 20,766 BTC, worth $224 million, since May.

Other projects contributing to this success include HBTC (4,810 BTC), sBTC (3533 BTC), imBTC (1,408 BTC), and pBTC (136 BTC).

In the growing DeFi sector, which has yet again surged to $9.77 billion (TVL), WBTC is the 6th largest protocol with $827 million in deposits, grown from just $175 million at the beginning of August.

Interesting to see the $WBTC pool be the biggest for $UNI staking

Bitcoiners getting tired of collecting 0% interest on their fossils :)

— moon is tweeting (@MoonOverlord) September 20, 2020

The yield framing mania in the decentralized finance world is driving this demand, and the same is the case for BTC, for which much of the demand is from over the counter. Interestingly, a whopping 70% of WBTC is being minted by FTX CEO Sam Bankman-Fried’s Alameda Research. The firm also lobbied for increasing the amount of collateral, from 0% to 40%, placed on WBTC to earn interest on the DeFi project Compound in July.

The post Over 100k Bitcoin Worth Nearly .2 Billion Tokenized on Ethereum; WBTC & RenBTC Leading first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|