2020-6-10 02:00 |

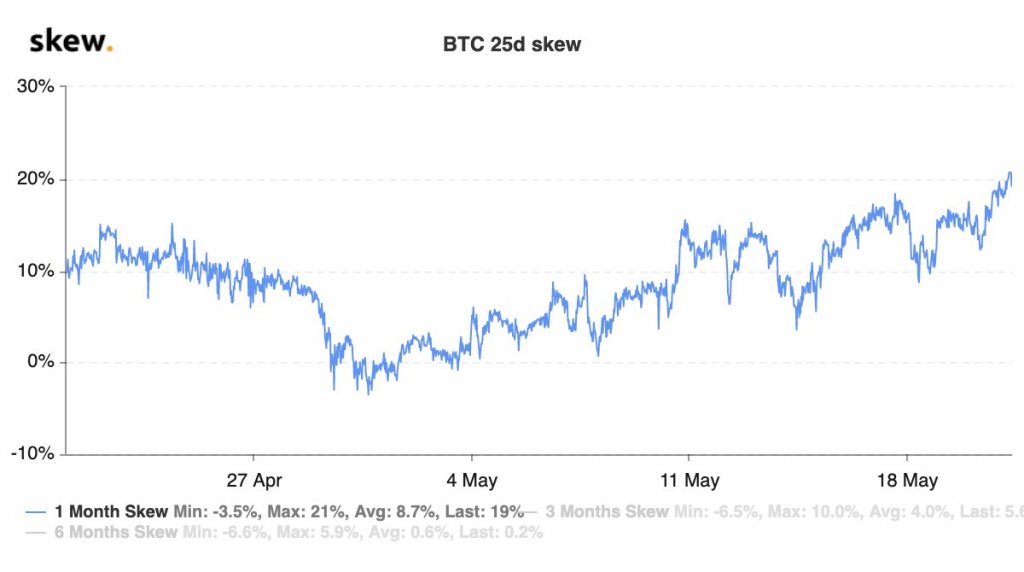

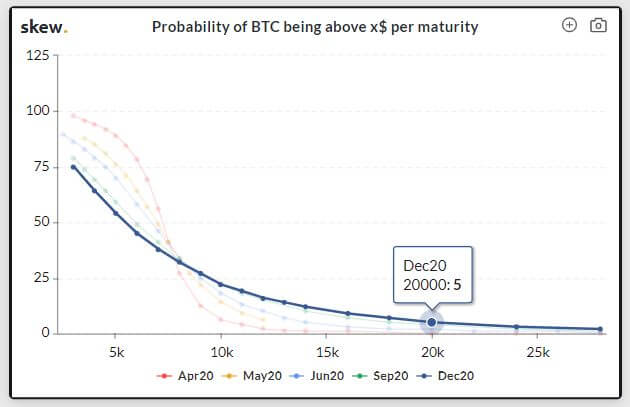

Bitcoin’s week-long bout of consolidation appears to be leading options traders to grow increasingly bullish on the cryptocurrency Data shows that options traders are nearly all anticipating BTC to see further upside in the weeks and months ahead There are multiple factors, however, that suggest it is poised to see downside in the near-term These factors include rising funding, a high quantity of underwater long positions, and its multiple failed attempts to break above $10,000 Bitcoin has been seeing lackluster price action as of late. It has largely been consolidating over the past week, with buyers being unable to catalyze and upside movement due to the resistance at $10,000. Analysts do believe that BTC is positioned to see further weakness due to a few key factors. One such factor is the fact that funding has flipped positive on most exchanges – meaning it is costly to be in a long position. Additionally, last week’s fleeting movement past $10,000 trapped a massive amount of long positions, and this could provide sellers with significant fuel to catalyze a sharp downside movement in the weeks ahead. Options traders don’t seem to be too concerned about these factors, however, as data reveals that options open interest on the CME is almost entirely comprised on calls – meaning investors are anticipating upside. CME Bitcoin Options Traders Flip Long as BTC Consolidates Bitcoin has been caught within a firm bout of consolidation over the past several days and weeks. This has caused it to hover right around its current price of $9,700, which is in the middle of its current trading range between $9,400 and $9,900. Overnight, traders pushed Bitcoin to both the upper and lower boundaries of this trading range, cleansing the market of overleveraged longs. This volatility, however, did not help BTC establish any type of near-term trend. One interesting factor to keep in mind is that professional traders, institutions, and leveraged funds trading options on the CME are all positioning for the benchmark cryptocurrency to see further upside. Su Zhu – the CEO of Three Arrows Capital – spoke about this trend in a recent tweet, saying: “CME BTC options open interest is nearly entirely in calls (upside moves).” Image Courtesy of Su Zhu (Data via CME) These Factors Suggest Options Traders May Have It Wrong Options traders on the CME may be gravely mistaken about the cryptocurrency’s near-term outlook. As Bitcoinist reported just one day ago, Bitcoin’s positive funding and the high quantity of underwater long positions are both grim signs for where it goes next. “I flipped neutral for now. Funding has gone positive everywhere and there are a bunch of BFX longs underwater,” one previously bullish analyst stated. Image Courtesy of Byzantine General A triple top formation formed by the three rejections Bitcoin has seen in the mid-$10,000 region over the past several months could also help guide it lower in the near-term. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

United Traders Token (UTT) на Currencies.ru

|

|