2022-4-27 00:08 |

Oppenheimer senior analyst Owen Lau has revealed that he expects increased adoption of crypto in the coming years, which would be a natural boost for the stock value of crypto firms, especially Coinbase. However, Coinbase’s stock price is currently down about 40% year-to-date.

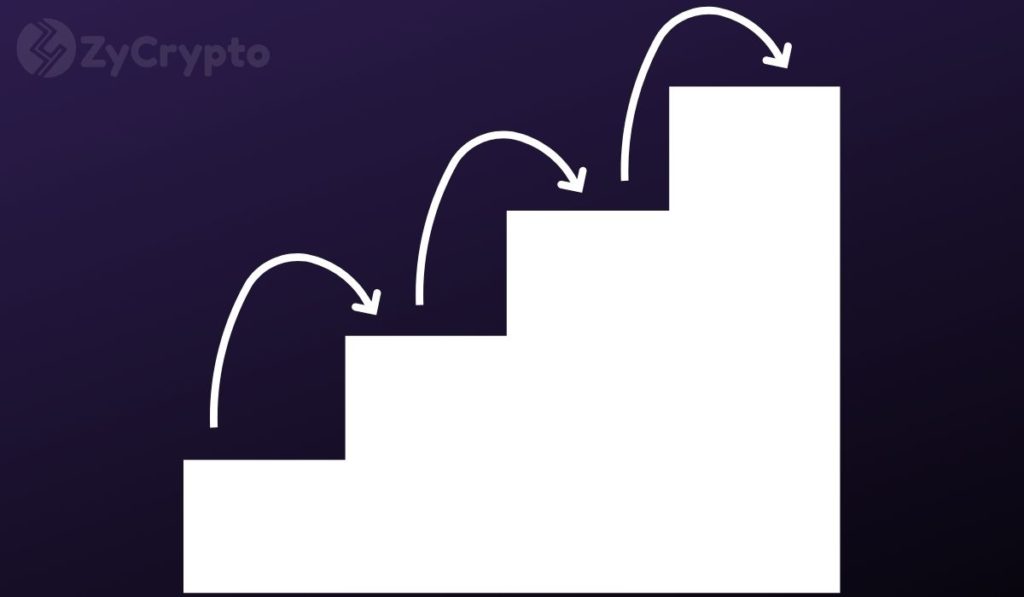

Owen Lau’s Bull ThesisThe stock prices of various crypto-related companies have been struggling alongside the crypto market. Coinbase, for one, is down over 40% year-to-date, presently trading around $127 per share on the Nasdaq. However, Oppenheimer Executive Director and Senior Analyst Owen Lau believes there are certain factors the market is yet to acknowledge and that the stock value will rise again.

“The bull thesis is the long-term crypto adoption,” said Lau on Yahoo Finance Live, adding, “[That’s] number one thing the market has not given Coinbase credit, it’s on the crypto adoption longer term.”

“If you look at a longer horizon, like 3, 5, 10 years from that perspective, if you ask me, do I think more or less people with own digital assets or use digital assets? I would say it would be more,” said the analyst.

Meanwhile, Lau said the present bear market is largely a result of the strong correlation between the price of Bitcoin and the Coinbase stock. The analyst also added that the company’s late entry into the NFT and Derivative markets contributed to the price slump. However, the seasoned financial analyst claims that the stock is highly oversold and currently presents a good entry-level for investors.

Speaking on regulations, Lau disclosed that the undertone behind crypto regulations had changed tremendously over the last 12 months, now more positive than ever. Lau says clear regulations will be good for the developing market and Coinbase.

Lau’s Predictions Last Year And The State Of RegulationsIt’s not the first time Lau has expressed bullish sentiment for the Coinbase stock. In December last year, Lau had tipped the stock to be a top performer in 2022, citing growing institutional interest in the developing market and payment platforms crypto integration as facilitating factors. However, Lau noted that regulations could be an impediment at the time.

While, as Lau stated in his discussion with Yahoo Finance, the regulatory undertone has changed, not much has changed in practice. Clear regulations are yet to be formed, and the U.S. SEC continues to reject spot Bitcoin ETFs effectively limiting institutional adoption.

Notably, the situation is not helped by Bitcoin continuing to move in tandem with risk-on tech stocks as the Fed becomes more hawkish following inflation concerns. Today, the major digital asset by market cap touched 6-week lows dropping below $38.5k.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|