2024-12-12 19:38 |

One of the most significant factors for the crypto industry lies not in market dynamics, but in the political arena.

Trump’s pro-crypto rhetoric certainly grabbed headlines, but the real catalyst for banks and other financial intermediaries is likely a Republican sweep in Congress, given that most of his pledges would require legislative approval. With strong Republican backing and bipartisan support also showing momentum, crypto-friendly legalisation would be far more likely to pass.

Two developments are central to this shift: dismantling the SEC’s SAB 121 (which has kept much of the financial sector sidelined) and the Bitcoin Act 2024 (which proposes a national bitcoin stockpile).

You're reading<a href="https://www.coindesk.com/newsletters/crypto-long-short/" target="_blank"> Crypto Long & Short</a>, our weekly newsletter featuring insights, news and analysis for the professional investor. <a href="https://www.coindesk.com/newsletters/crypto-long-short/" target="_blank">Sign up here</a> to get it in your inbox every Wednesday.

Revocation of SAB 121

SAB 121 is a contentious accounting bulletin that has created a compliance burden, discouraging banks from offering services like crypto custody — despite the rising demand from customers (and likely from the banks themselves).

Dismantling SAB 121 would remove a major chokehold on banks, allowing them to offer crypto custody services and further diversify their product offerings into staking and other yield-bearing products. This mirrors what we have seen in the ETF market, where institutional involvement fundamentally changes market dynamics.

It would also allow banks to defend their assets under management, retain clients, and increase their share of wallet among existing clients interested in crypto, while attracting a younger generation of crypto-native customers.

This is likely the route towards mainstream adoption as banks could offer retail customers simplified or “all-in-one” financial services.

Bitcoin Act 2024

Trump also promised to push the Bitcoin Act 2024, which aims to establish a strategic bitcoin stockpile as part of U.S. Treasury reserves. Similar initiatives are already underway in Brazil, and U.S. states like Pennsylvania have already introduced their own bitcoin reserve bill.

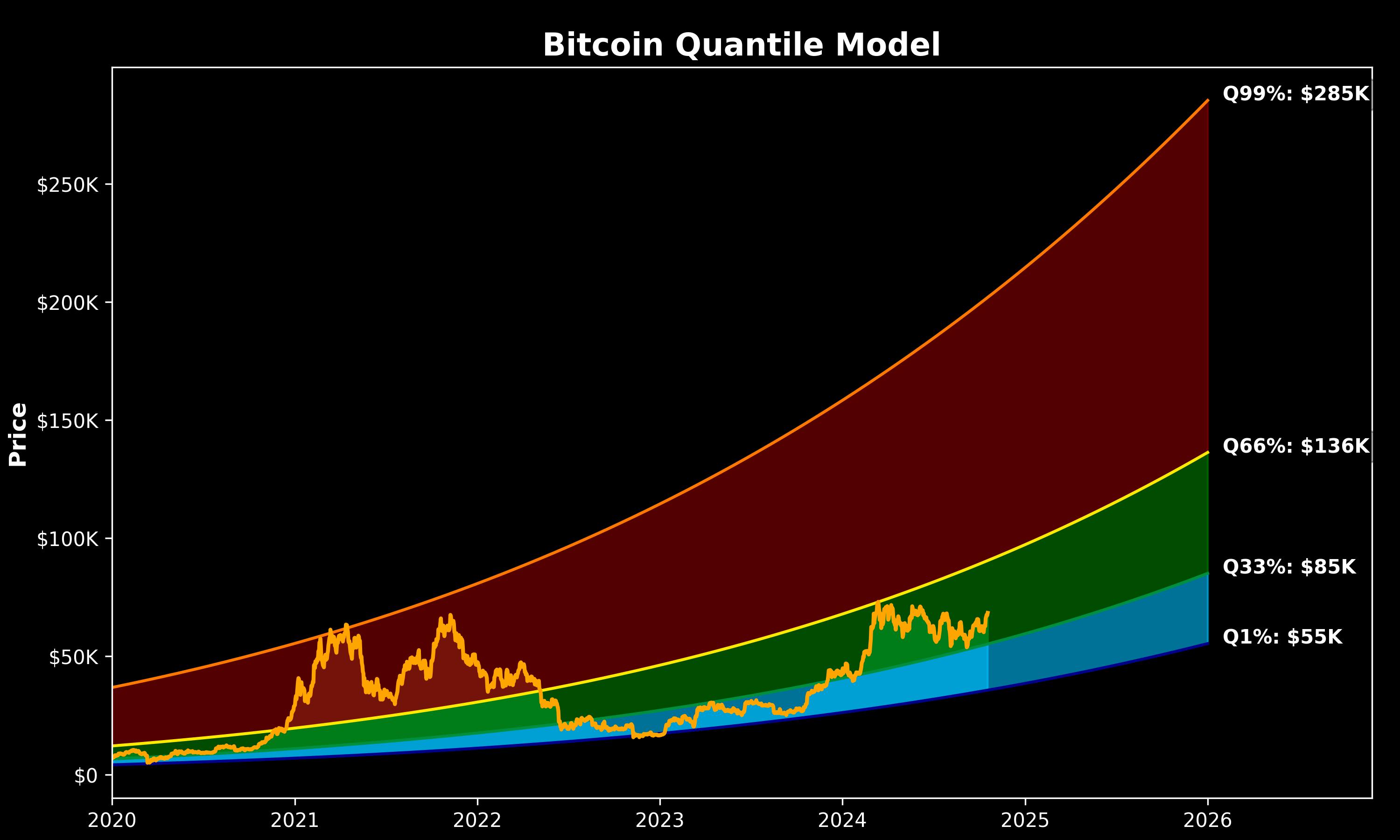

If adopted, bitcoin’s safe haven status would be fully legitimised, and the market implications could be substantial by fundamentally changing how central banks and corporate treasurers approach their allocation strategies.

We have already seen how the involvement of TradFi heavyweights and institutional ETF flows can impact the market, and central bank purchases could amplify these effects dramatically.

Political figures like Senator Cynthia Lummis even suggest the Federal Reserve should reallocate some of its gold reserves to bitcoin, opening up the possibility of bitcoin narrowing its gap with gold’s $17.7 trillion market cap — more than 9x bitcoin’s $1.9 trillion.

Additional pledges

Trump’s broader agenda also targets the shutting down of banking restrictions tied to Operation Choke Point 2.0, a measure alleged to have debanked over 70 crypto firms, according to a16z’s Marc Andreessen.

Meanwhile, Trump’s opposition to a Fed-issued central bank digital currency (CBDC) aligns with Republican efforts to protect privacy through measures like the CBDC Anti-Surveillance Act, which would ban the Fed from using a CBDC without congressional approvals.

Whether the U.S. transitions from a regulatory laggard to a legislative leader remains to be seen. But the opportunity is clear: the U.S. is the world’s largest financial market with the potential to bring substantial change and traction to the crypto economy.

origin »Bitcoin price in Telegram @btc_price_every_hour

Based Money ($BASED) на Currencies.ru

|

|