2023-9-9 01:26 |

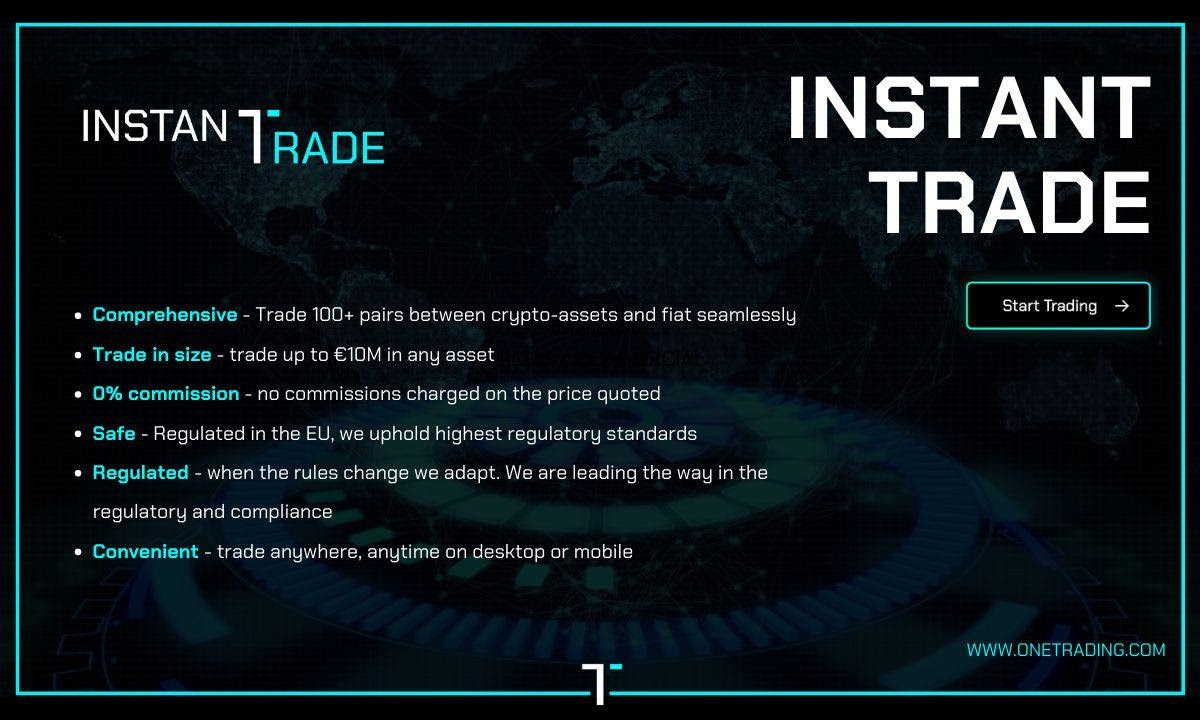

Renowned crypto asset exchange, One Trading (formerly Bitpanda Pro), in an official release, has announced the launch of its Instant Trade product.

“We’re really excited to be unravelling our latest product, Instant Trade, which brings our OTC product, typically reserved for institutional clients, to all customer types,” Josh Barraclough, CEO of One Trading, said while expressing his excitement about the product launch.

According to the announcement, the launch of Instant Trade follows a successful funding round that saw the company raising a substantial €30 million and its complete separation from Bitpanda.

Notably, the backing of influential investors such as Peter Thiel’s Valar Ventures, MiddleGame Ventures, Speedinvest, Keyrock, and Wintermute Ventures has drawn considerable attention to One Trading. The company, spearheaded by TradFi heavyweight and former JPMorgan executive Josh Barraclough, is poised to address the shortage of regulated crypto trading venues in Europe by offering a range of sophisticated crypto products, including derivatives and spot trading, catering to institutional and retail clients.

Instant Trade to Revolutionize Crypto Trading in EuropeRepresenting the company’s latest product, Instant Trade is designed to further diversify and solidify One Trading’s status as a household name in the provision of crypto assets to both retail and institutional investors throughout Europe.

Furthermore, Instant Trade offers seamless trading of over 100 crypto-fiat pairs, complete with fiat on and off ramps and, most notably, zero-commission trading. This fee structure eliminates the typical dealing fees associated with asset trading, providing customers with a cost-effective solution.

One Trading has cultivated a substantial liquidity pool through its strategic partnerships over the years, making it accessible to traders of all scales without trading massive volumes or holding ecosystem tokens. The platform boasts a user-friendly interface, allowing customers to engage in trades of up to ten million euros in a single transaction. Crucially, One Trading holds a VASP license, guaranteeing a secure and regulated service.

In addition to Instant Trade, One Trading is rebranding and implementing significant infrastructure changes. The company is gearing up to launch what it claims to be the fastest and most scalable exchange, with order creation and cancellation times of less than 250 microseconds based on real-world metrics. This initiative aims to cater to retail and institutional audiences by offering low fees, deep order books, and multiple liquidity protections.

Notably, One Trading’s ambitions extend to becoming a utility for large liquidity providers, facilitating risk exchange under a membership model, and transitioning into derivatives trading while maintaining strict regulatory compliance. CEO Josh Barraclough emphasized their commitment to creating a regulated, institutional-grade platform that offers unique product options, fostering a secure and confidence-inspiring trading environment.

One Trading’s future vision includes operating as a MiFID Trading Venue alongside its existing VASP license. This upgrade will enable the platform to offer capital-efficient spot and derivative products for all customer types while implementing stringent anti-money laundering (AML) and Know-your-customer (KYC) procedures. The full-scale MiFID license will also allow One Trading to list financial instruments, eliminating ambiguity over the classification of DLT assets and ensuring robust vetting, transparency, and customer protection.

Furthermore, One Trading provides access to a secure OTC trading service catering to high-net-worth individuals and institutions. This service offers access to various digital assets, competitive fees, and deep liquidity pools.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Instant (BTI) на Currencies.ru

|

|