2022-5-30 22:45 |

USDT issuer Tether holds an undisclosed percentage of its assets in a boutique Bahamian bank.

With USDT issuer Tether’s reserves of cash and other instruments coming under increasing scrutiny, individuals familiar with the matter disclosed to the Financial Times that an undisclosed percentage of Tether’s reserves are held in a boutique bank in the Bahamas, Capital Union.

Liquidity not a problem, says CTOTether is a private company that has issued stablecoins tied to fiat currency in the USA, Mexico, Europe, and China, but has thus far, within its rights, declined to disclose its partners. “Our counterparties are not public. We are not a public company,” said a senior executive to the Financial Times. Founded in 2014, USDT provides cryptocurrency traders and investors a convenient way to buy other cryptocurrencies without leaving the digital asset ecosystem. One USDT can be redeemed for one U.S. dollar.

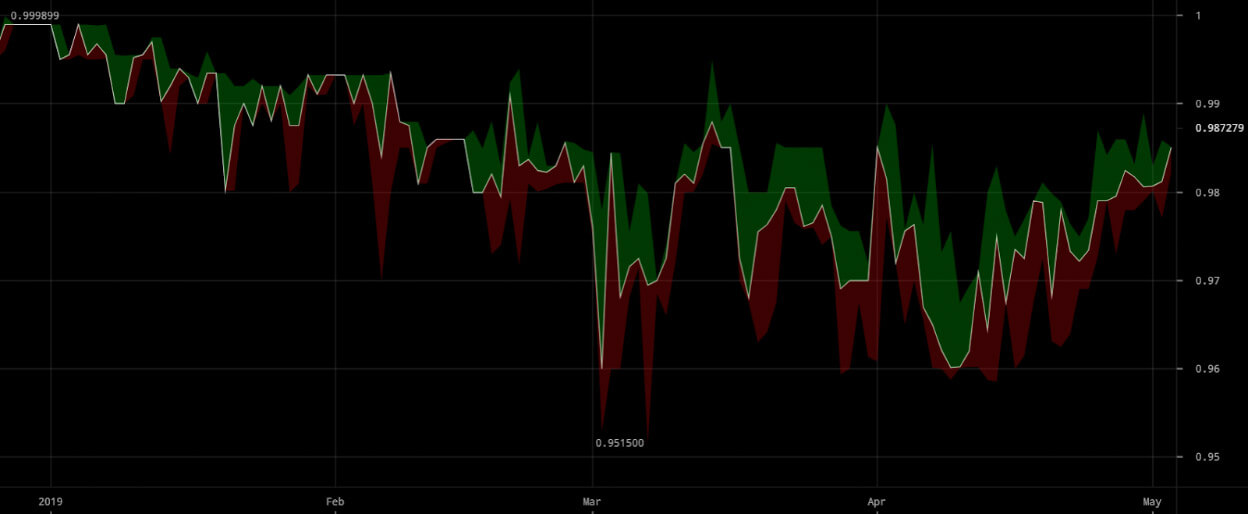

Following Tether’s recent plunge to $0.95, which is considered a de-pegging event in the stablecoin market, holders rushed to convert their USDT to fiat currency. Tether fulfilled $10B worth of redemptions, which according to the Chief Technology Officer Paolo Ardoino, proves that the company has sufficient liquidity to back up its stablecoin.

Tether’s partners revealedTether has thus far refused to comment on its reported links with Capital Union bank, with bank officials stating, “the only information we make publicly available about our company is contained in the annual report.” Capital Union was founded nine years ago, holding $1B in assets as of 2020. Tether did however confirm links to another Bahamian bank, Deltec Bank & Trust since 2018, whose leader confirmed to Bloomberg in 2021 that the bank only held 25% of Tether’s reserves as cash and bonds. Ardoino said in a statement to the Financial Times earlier in May 2022 that the company held cash deposits in two Bahamian institutions, and has “strong banking relationships” with multiple banks globally.

Last year, Capital Union hired a digital asset manager, and in April this year had begun using compliance software written by analytics firm Chainalysis.

Tether was fined $41M by the Commodities and Futures Trading Commission last year for falsely claiming that it held cash reserves in banks to maintain the peg of its stablecoin. The company settled with the CFTC without confirming or denying the allegations.

What do you think about this subject? Write to us and tell us!

The post One Location of Tether’s Mysterious Reserves Revealed appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|