2026-2-20 23:30 |

Ondo (ONDO) is starting to look like one of the most serious players in the tokenized stock space. The project is stacking major partnerships and showing up in the same conversations as Wall Street giants.

Fidelity recently joined Ondo’s verifier network, helping secure more than $2.7 billion in tokenized assets across chains. Ondo also held a high-profile summit tied to the broader institutional push for on-chain equities, with support linked to BlackRock and government figures.

On the retail side, MEXC expanded tokenized stock trading pairs connected to Ondo, launching them with zero fees. All of this is happening as tokenized equities become one of the fastest-growing parts of the RWA sector.

However, the ONDO price is still trading at just $0.2578, which is why many traders are starting to pay closer attention.

ONDO Is Quietly Dominating Tokenized StocksCrypto analyst CryptoED pointed out something that has flown under the radar for most of the market. In less than six months, ONDO has captured around 60% of the tokenized stock market. That is a huge number.

It means Ondo (ONDO) now holds more value locked in tokenized equities than all competitors combined. The platform already supports over 200 tokenized stocks and is live across Ethereum, Solana, and BNB Chain.

This is not a small niche anymore. Tokenized stocks are quickly becoming one of the most important real-world asset categories in crypto.

However, one of the most important points from CryptoED’s tweet is how new markets tend to form. Liquidity does not spread evenly across ten different projects. It usually flows into one or two leaders first. That is what seems to be happening here.

Ondo is building the deepest liquidity, the widest stock coverage, and the strongest institutional backing in this category.

When the next wave of capital comes into tokenized equities, the projects already controlling the infrastructure are likely to benefit the most. That is why ONDO’s position right now matters.

$ONDO is doing something most people aren’t fully paying attention to yet.

In less than 6 months, it captured 60% of the tokenized stock market.

That’s more TVL than all competitors combined.

200+ tokenized stocks.

Live on $ETH, $SOL, and $BNB Chain.

Tokenized equities are… pic.twitter.com/MxFspj9wt8

The Fidelity partnership is not just a headline. It adds credibility and security to Ondo’s cross-chain asset model. These are the kinds of connections that traditional finance cares about when moving real assets onto blockchain rails.

The Ondo Summit also reveals that tokenized equities are no longer a crypto story. The involvement of major financial institutions and regulators in the conversation could lead to faster adoption than previous cycles.

Additionally, with the expansion of exchanges such as MEXC, tokenized stocks are now being introduced to both institutional and retail markets simultaneously.

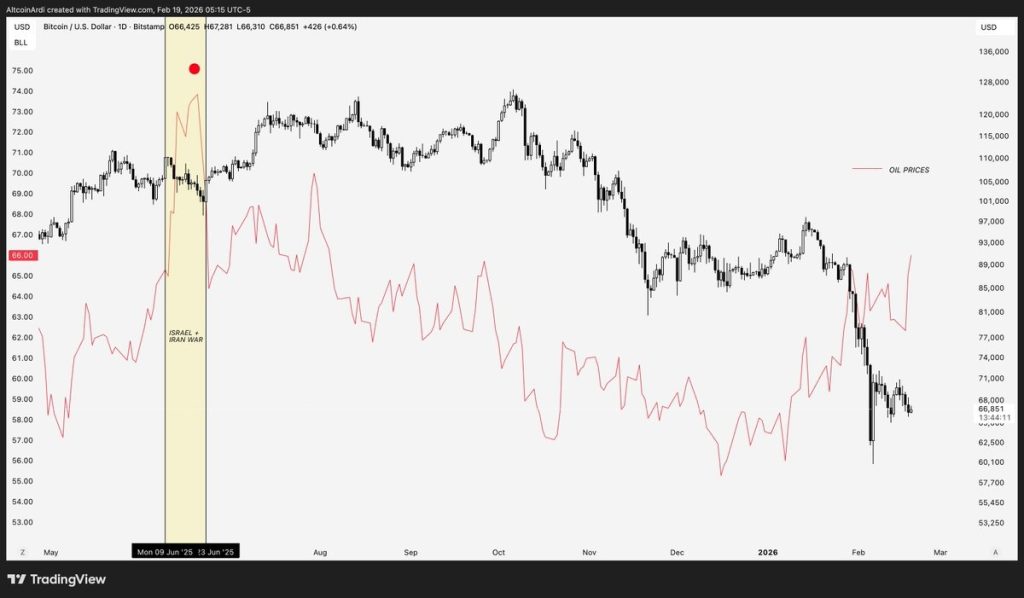

Read Also: Analyst Warns Against Being Bullish on Crude Oil, Points to Potential Dangers Ahead

Ondo Price Targets: Where Could ONDO Go Next?ONDO is still sitting at $0.2578, but if tokenized equities continue growing at this pace, the upside targets become clearer.

The first major level to watch is a move back toward $0.35, which would mark a recovery into the previous resistance zone. If momentum builds and tokenized stock demand keeps rising, the ONDO price could push toward $0.50 next.

A full breakout cycle, especially with more institutional adoption, could open the door for a larger run toward $0.75 to $1.00 over time. That would still be early compared to the size of the market Ondo is trying to dominate.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post ONDO Just Took Over Tokenized Equities – Here’s Where the Ondo Price Could Go Next appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

The Tokenized Bitcoin (imBTC) на Currencies.ru

|

|