2020-10-21 04:00 |

Santiment, a blockchain analytics firm, recently shared that Ethereum’s NVT is still “bullish” The NVT is the network value to transaction ratio, which is seen as a price-to-earnings ratio for blockchain networks. Data also shows that investors are accumulating ETH en-masse, with coins leaving exchanges at a rapid clip. Ethereum On-Chain Trends Still Favoring Bulls

Ethereum has undergone a strong drop from its weekly highs around $385. The coin fell under $370 on Tuesday morning as capital flooded from the altcoin market back towards Bitcoin, which has underperformed altcoins over the past six months.

Despite the local, short-term drop, analysts remain bullish on ETH.

One key reason why this is the case is that Ethereum’s on-chain trends are still bullish.

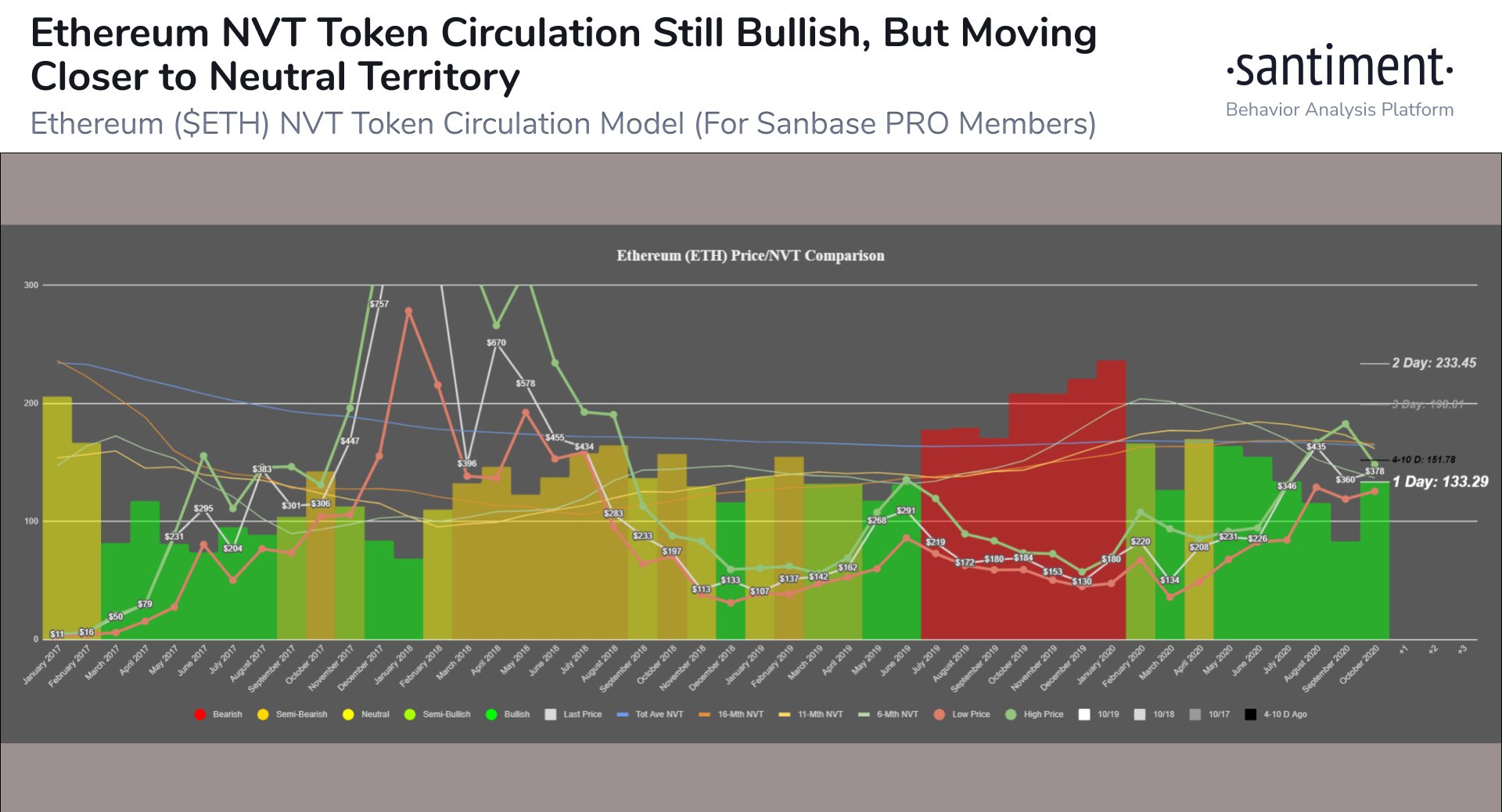

Santiment, a blockchain analytics firm, recently shared the chart seen below. it shows ETH’s price action relative to the network value to transactions metric, which is seen as a price-to-earnings ratio for blockchain networks.

On the current state of the ratio, Santiment wrote that Ethereum is still “bullish” but the trend is moving into “neutral territory.”

Chart of ETH's price action over the past few years with an overlay of the NVT model. Chart from Santiment, a blockchain analytics firm.This post comes shortly after the firm noted that a spirit of accumulation has appeared amongst Ethereum holders and investors. Santiment recently reported that the number of ETH held on exchanges has dropped rather dramatically in the past two months, suggesting accumulation:

“$ETH’s top 10 whale exchange addresses have continued swapping their funds to non-exchange wallets, & moving holdings at an impressive rate. The 20.5% decrease in tokens on exchanges the past 2 months indicates price confidence by top #Ethereum holders.”

Chart of ETH's price action over the past few months with an overlay of the number of top 10 exchange holdings vs. non-exchange holdings. Chart from Santiment, a blockchain analytics firm. Not Everyone Is Convinced of AltcoinsNot all investors and analysts in the space are convinced of altcoins such as Ethereum in the current phase of the Bitcoin market cycle, though.

Kyle Davies, a co-founder of crypto fund Three Arrows Capital, recently suggested that Bitcoin is likely to dramatically outpace altcoins. This came shortly after his business partner Su Zhu made a similar comment, suggesting that this is a time for BTC to rally while altcoins sink.

“You’re about to find out why all of the rich OG’s hold mostly $BTC.”

You’re about to find out why all of the rich OG’s hold mostly $BTC

— Kyle Davies (@kyled116) October 19, 2020

Just today, BTC rallied 2% as Ethereum sunk 2%.

Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com On-Chain Ethereum Trends Favor Bulls Despite 5% Drop From Local Highs origin »Bitcoin price in Telegram @btc_price_every_hour

High Performance Blockchain (HPB) на Currencies.ru

|

|