2021-10-20 00:08 |

Key takeaways

The recent stellar bitcoin bull run has been tracking PlanB’s S2F model.There is some bearish metric though as data from Glassnode indicates that Bitcoin whales are declining. However, smaller whales are increasing even as data indicates that sell pressure is low.Bitcoin has been on an immense bull run this month. The pioneer cryptocurrency is up 38.9% in October. It has surpassed the $60,000 level last reached in April and seems to be targeting its previous all-time high. The price of Bitcoin is currently around $64,079.

BTCUSD Chart By TradingViewThe market seems to be playing out just the way pseudonymous analyst PlanB, the creator of Bitcoin’s stock-to-flow (S2F) valuation model, predicted it would. PlanB’s prediction in June, when Bitcoin was trading around $43,000, was that Bitcoin would trade at $63,000 as a worst-case scenario price and ultimately cross 6 figures by December. Notably, the quants prediction for August and September also played out.

“My worst-case scenario for 2021 (price/on-chain based): Aug>47K, Sep>43K, Oct>63K, Nov>98K, Dec>135K,” PlanB said in June.

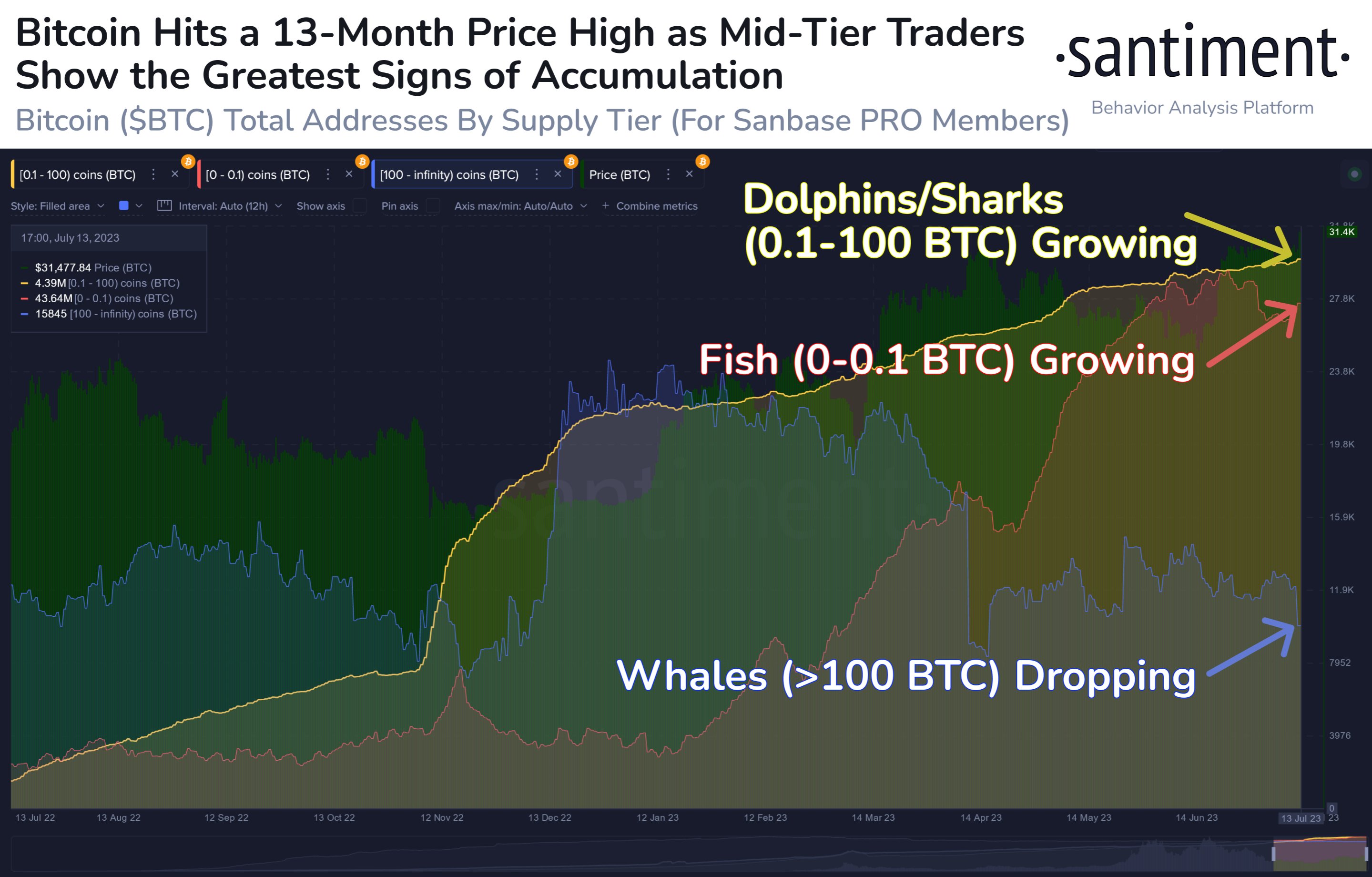

Despite the highly bullish market sentiment, one metric shows that large Bitcoin whales are on the decline. As first pointed out by crypto-journalist Colin Wu, data from Glassnode showed that the number of “Bitcoin whales” (a term used to describe entities or individuals with large Bitcoin holdings) that held more than 10,000 Bitcoins was at an all-time low of 82.

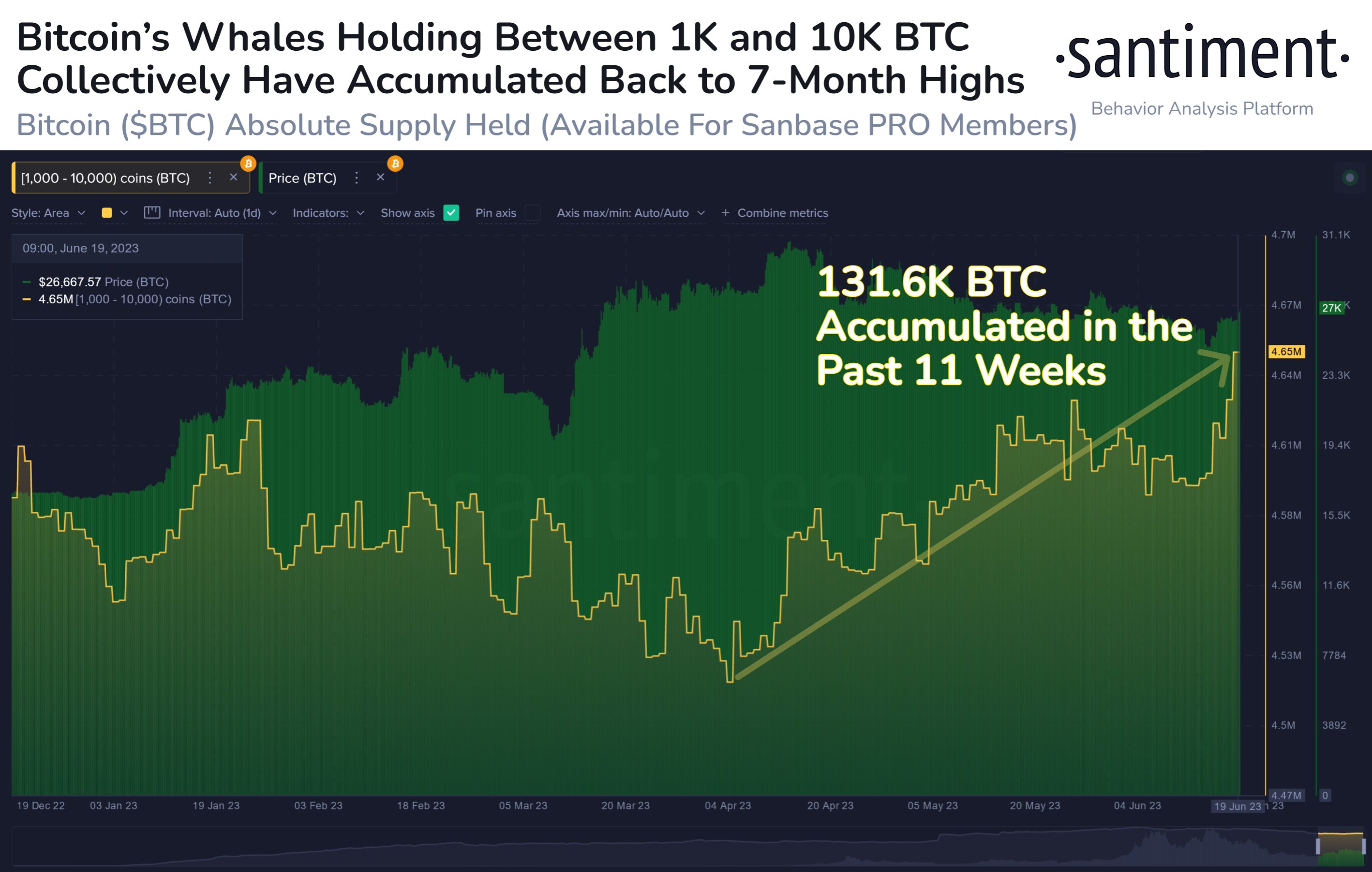

Wu however notes that smaller whales (wallets that held between 100 to 1,000 BTC) had increased significantly in the past five weeks according to Santiment – a cryptocurrency behavior analytics platform. While the decline of mega whales is quite bearish for the market, observers are taking comfort from the fact that smaller whales are on the increase.

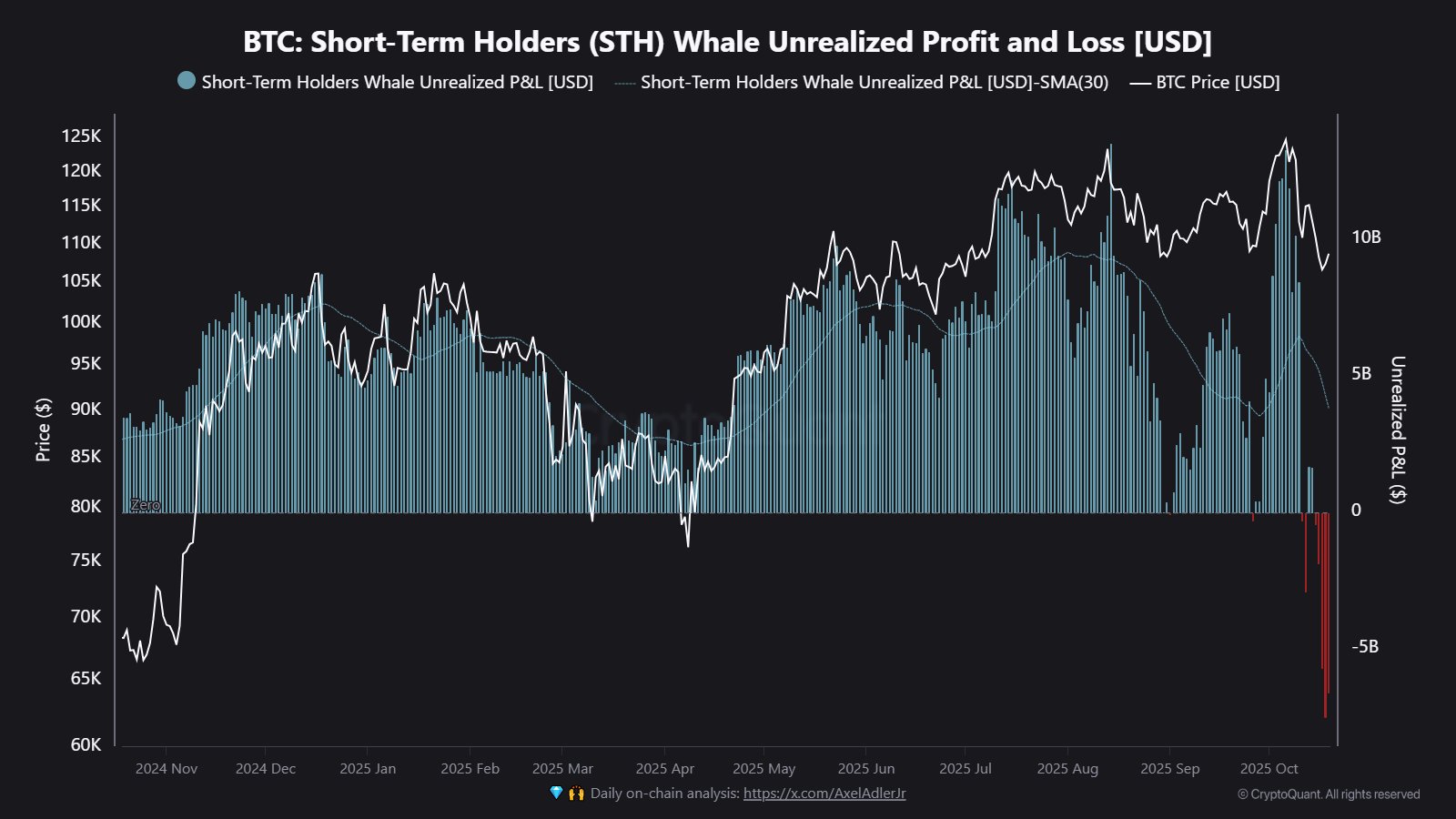

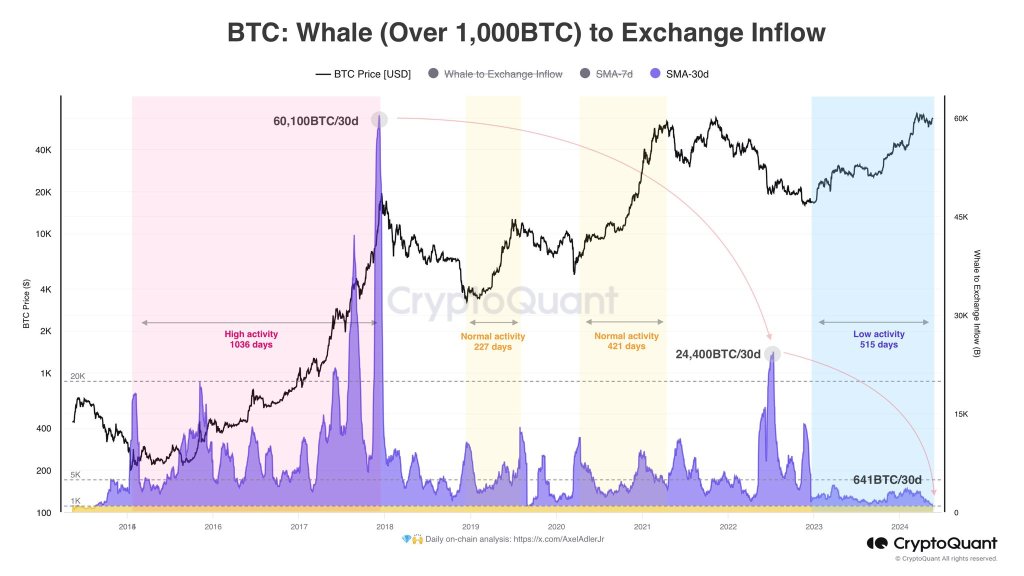

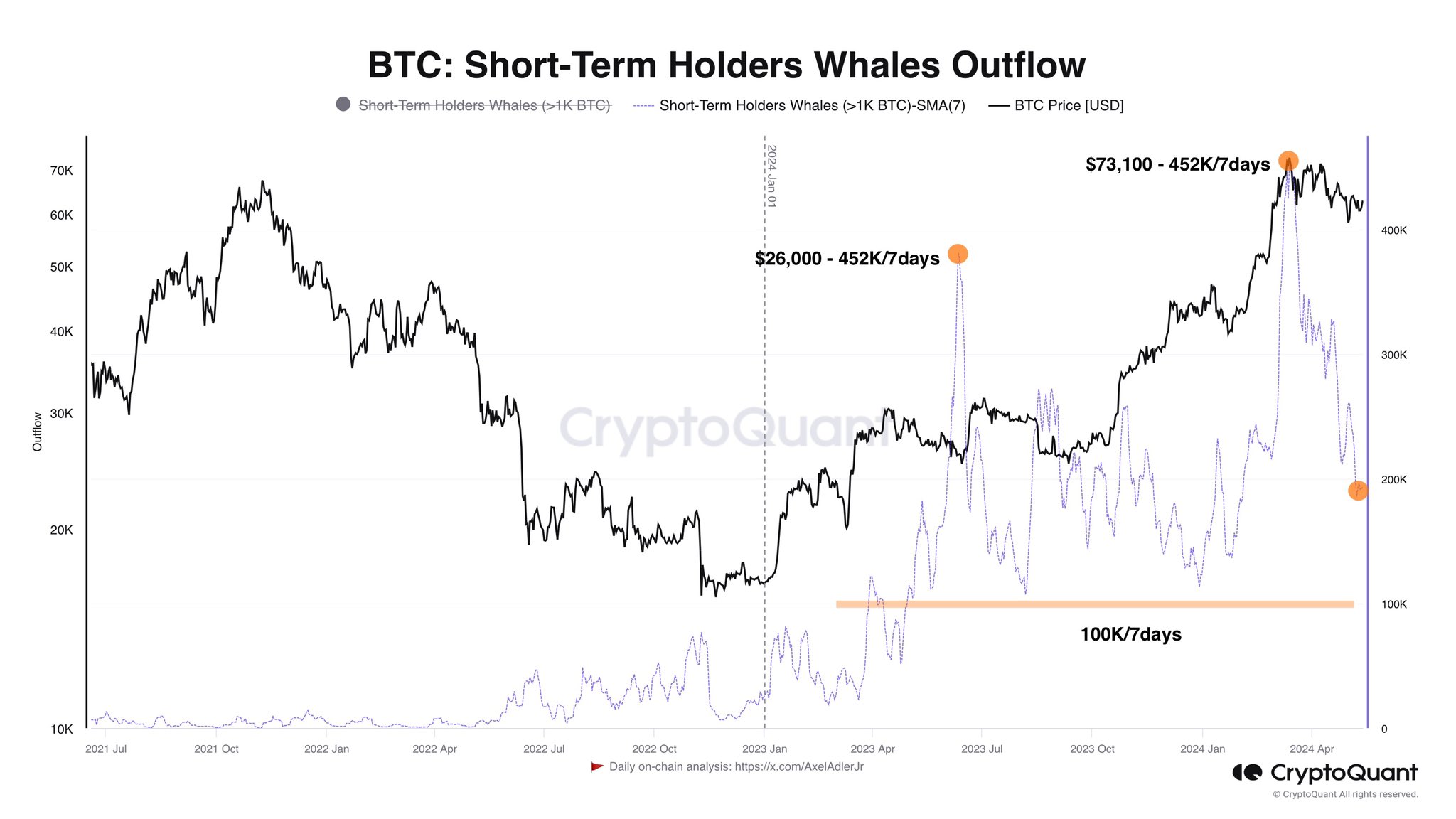

An additionally bullish metric is the reducing selling pressure in the market pointed out by Ki-Young Ju, CEO of Bitcoin on-chain analysis website Cryptoquant. In a recent tweet, Ju points out that potential selling pressure was relatively weak, just like the bull-run starting points last year. He supports his claim by pointing to the large number of stablecoins sitting on cryptocurrency exchanges, adding that his hope was that they would push prices up.

Meanwhile, Bitcoin’s run-up has majorly been attributed to the anticipated SEC approval of a Bitcoin ETF. While the regulators have been previously denying all applications, the fact they have approved ProShares Bitcoin Strategy ETF is expected to accelerate Bitcoin’s price through the roof.

Compared to the pioneer cryptocurrency, the market performance of top altcoins including Ethereum, Cardano, XRP, and Solana has been quite tame recently. The exception though has been Binance coin (BNB) which has surged 12.7% in the last 7 days following Binance’s announcement of a $1 billion ecosystem support fund.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|