2018-11-20 22:35 |

The Problem Of Using ‘Market Cap’ In The Crypto Ecosystem

According to Investopedia: Market capitalization refers to the total dollar market value of a company's outstanding shares. Commonly referred to as “market cap,” it is calculated by multiplying a company's shares outstanding by the current market price of one share. The investment community uses this figure to determine a company's size, as opposed to using sales or total asset figures. Using market capitalization to show the size of a company is important because company size is a basic determinant of various characteristics in which investors are interested, including risk.”

Market cap has been an essential tool in traditional finance but has crept into the analysis of the crypto market too because of sites like Coinmarketcap.

A report by nomics in collaboration with Nathaniel Whittemore critiques the use of market cap in the crypto space and breaks it down into four points.

Critique #1: Tokens Are Not StocksStocks represent ownership of an economically-generative entity. Specifically, possessing stock gives the owner two things; A claim on future cash flows/profits and a claim to participate in the upside of a liquidity event such as a sale or public listing. Tokens, on the other hand, represent participation in a voluntary value network. They do not come with any claim to future cash flows or liquidity event participation – in part because the issuing entities are often not structured as centralized, economically-generative entities but as decentralized networks or nonprofits. They do not, at least in general or so far, come with rights.

Critique #2: IssuanceIn the realm of equity, the total supply of stocked issued is fixed, and can only be changed through a stock split, where new shares are issued in proportion to the owner’s previous holdings. While tokens are designed with built-in emissions schedules. In other words, the supply of a crypto’s tokens is continuously inflating, based on some set of pre-defined and programmatic rules.

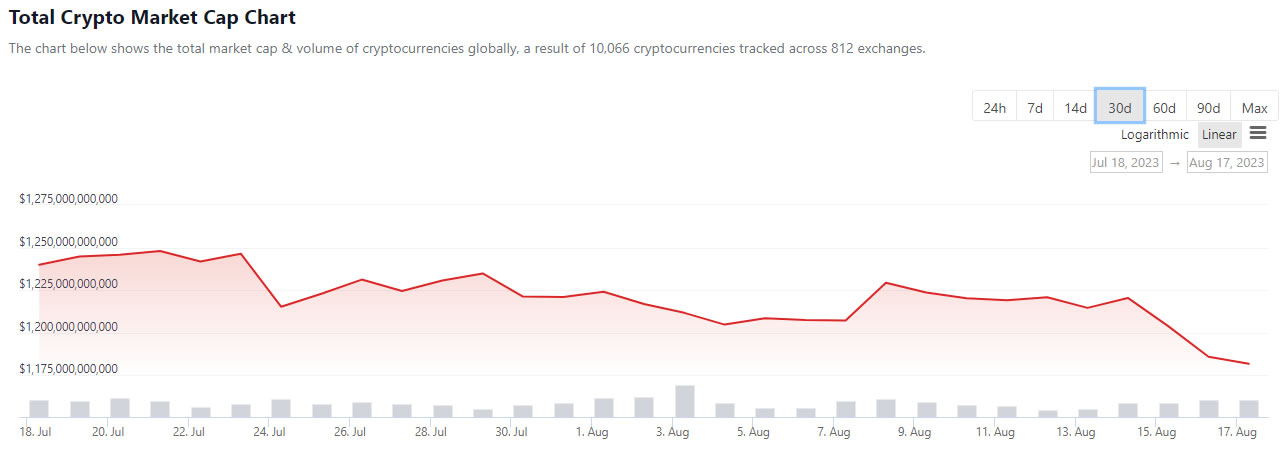

Critique #3: Circulating SupplyOne of the biggest areas of critique with regard to the market cap as a metric for crypto asset networks has to do with the challenges of determining what number to use for supply. Originally, circulating Supply was meant to put an end to that to that particular type of market manipulation by only counting liquid supply. The challenge is that there are a number of problems with determining just what is liquid.

Critique #4: Redemption ImpactRedemption Impact Score is a measure of how likely significant buy and sell activity around a token is to change that token’s price. It is a measure of liquidity and the “realness” of a price. The more liquid an asset is, and the more distributed supply of that asset is, the better able to absorb meaningful exchange volume without seeing a price shock. Even more than inflation, even more than overestimated supply; the biggest challenge to the market cap metric is that, for the vast, vast majority of cryptocurrencies, buy or sell orders of any significant volume at the market cap price would have a dramatic impact on the price.

origin »Bitcoin price in Telegram @btc_price_every_hour

KuCoin Shares (KCS) на Currencies.ru

|

|