2018-11-22 01:00 |

In a bizarrely self-congratulatory article about Bitcoin and its recent price plunge, a Bloomberg journalist has attempted to discredit practically every aspect of the planet’s number one digital currency based on its 2018 price performance alone.

Bitcoin Might Be Down But It’s Certainly Not OutIf there’s one thing you can rely on, it’s a bit of sensationalism from the mainstream media and Bloomberg’s latest piece on the world of Bitcoin and cryptocurrency is absolutely loaded with it.

For a start, the title, “Jamie Dimon and Warren Buffett Have the Last Laugh on Bitcoin,” seems likely to have been worded to harvest clicks for advertising revenue. It obviously refers to two of the digital currency’s most vocal naysayers from the traditional finance sector and suggests that they have been proved categorically right. Therefore, this should be the last we’ll be hearing about Bitcoin.

The market has dropped. There is, of course, no denying that.

However, as I remember, Jamie Dimon and Warren Buffett had called for much more than an 80% decline from the dizzying, speculation-driven all-time highs of last year. How a short-term market movement can be said to have proved all that Buffett and Dimon have said about the space is correct simply boggles the mind.

In the article, journalist Lionel Laurent attacks those who still believe in the societal transformation that decentralised finance could hold for the planet. He states:

“This is a long-term unravelling of all of the lies, exaggeration and populist fantasies that drove last year’s market mania.”

Later, Laurent turns his attention to those who bought in during the last months of 2017 and how they have lost money. For the Bloomberg writer, this is irrefutable evidence that everything positive ever uttered about blockchain-based, decentralised currencies must be entirely fabricated.

The narrative reads as though a set of sneaky insiders managed to whip up the speculative frenzy of the latter part of 2017 and were able to profit off the gullibility of others:

“Nothing on the Bitcoin label turned out to be in the bottle. As a means of payment, it is cumbersome, volatile and expensive. It has destroyed value rather than storing it. Its decentralized technology was sold to investors as being unique. It has been anything but.”

The writer also states that the mainstream media spent 2017 warning about the risks of investing in the cryptocurrency asset class. However, as a reporter who worked through the period in question, I saw first hand that the planet’s largest news publications did not solely advise against investing in the space. Instead, they would pedal absolutely anything to do with the technology to their readers and were themselves hugely responsible for the retail bubble we saw.

The fact is that markets never travel in one direction indefinitely. They experience boom and bust cycles. That is consistent with literally every market that has ever been. Therefore, to pronounce the entire space dead for repeating a price pattern that has happened several times before is jumping the gun at best, and click-bait sensationalism at worst.

Related Reading: Jamie Dimon Breaks Promise, Says He Doesn’t Give a S**t About Bitcoin

If Lionel Laurent was a health worker and Bitcoin a patient, its body would still be warm as it was wheeled out of the operating theatre and into the mortuary to the sound of emotional pleas from bedside relatives. This would be followed by a thorough inquest into the integrity of the “professional” who pronounced its life over.

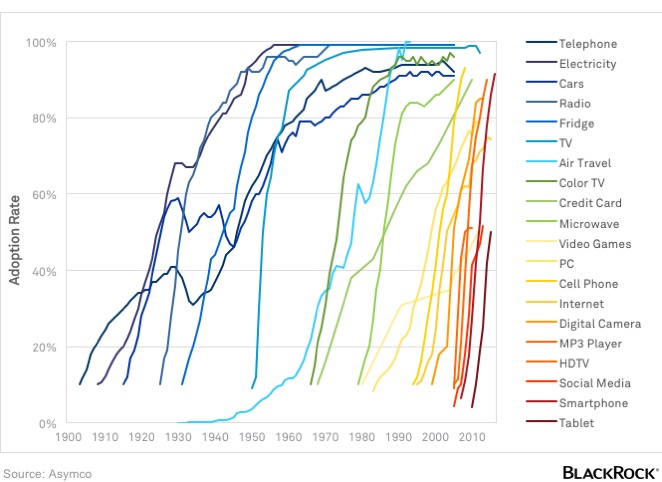

BTC remains the single best performing asset on the planet over the last five years. Whilst it is impossible to say whether Dimon and Warren Buffett will be proved correct in the coming years, a look at the BTC’s historical performance seems to mirror that of an entirely new technology experiencing rapid growth followed by a period of cooling off as it becomes better understood and the surrounding infrastructure slowly improves.

This is how markets move and none of this is new.

Let's hope people can learn from history and not make the mistake to panic sell right now. pic.twitter.com/Fz6IiYSlHi

— Tommy Mustache (@tommyp408) November 21, 2018

Featured image from Shutterstock.The post No, Jamie Dimon and Warren Buffett Won’t Have the Last Laugh on Bitcoin appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|