2020-9-16 23:00 |

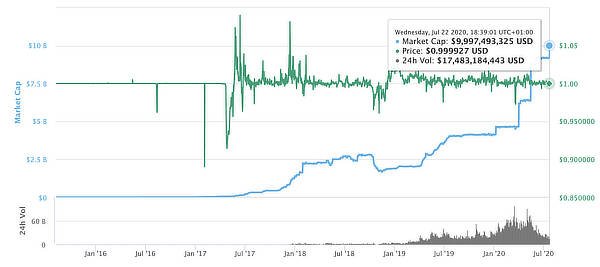

This week, over $5 billion in Tether (USDT) was minted and added to the stablecoin’s circulating supply and market cap. A correlation with newly minted USDT and Bitcoin pumping has sent the crypto community into a tailspin.

Today, an automated Twitter account that alerts investors as to when new Tether is minted claimed another $1 billion was added, but that’s not quite the case. Before Bitcoin investors expect another major pump, here’s what really happened and what this actually means for crypto.

Tether Supply and Stablecoins Rapidly Rise Out Of Crypto Bear Market AshesTether, the controversial stablecoin is now the third most dominant cryptocurrency in the entire industry, rising out of the bear market as the one clear winner. No coin has benefitted from the crypto winter as much as the stable flight to crypto safety has.

USDT as a token has several uses. It offers a stable store of wealth, a means of exchange, and a hedge against crypto market volatility and downturns. It grew in popularity chiefly due to crypto traders moving into USDT instead of actual dollars to keep capital in the crypto market, but away from Bitcoin, Ethereum, and others that are more susceptible to violent price swings.

Related Reading | Financial Advisory Group: Bitcoin Would Be 40% More Valuable Without Manipulation

Today, however, its the base currency on most cryptocurrency trading platforms, and an ideal choice for sending funds around the internet thanks to its peg to the dollar.

Stablecoins, not just Tether, have grown immensely recently, showing the demand for digital dollars with more integrity than what Tether offers. Although nothing has ever been proven, a dark cloud has ominously hung over the stablecoin and its parent company by association.

Tether has been accused of being central to everything from Bitcoin price manipulation to being insolvent. Its also been embroiled in several high profile court cases, but its supply keeps on climbing.

BTCUSDT Versus Tether USDT Market Cap | Source: TradingView $1 Billion In USDT Is A Reprint, Not New Money To Pump BitcoinEach time the supply increases, Bitcoin pumps. Or so it seems. The one time a massive amount of USDT was pulled from the crypto market, Bitcoin plummeted to its bear market bottom at $3,200.

Since then, every time more supply is injected into the crypto market, the top crypto asset soars. The ongoing correlation appears to indicate that Bitcoin is about to rise more than it ever has in the past.

And its got crypto investors watching the USDT supply like a hawk for the next major printing and pump in Bitcoin. Today, an alert got the community up in arms when another $1 billion in Tether was said to be printed. However, that was not the case.

Related Reading | How Does The Next Chapter In The Tether Printing Story Unfold For Bitcoin

What actually took place, was a coordinated effort with a third-party to swap out $1 billion of the USDT supply off of the Tron blockchain and onto Ethereum as an ERC-20 token.

Tomorrow Tether will coordinate with a 3rd party to perform two chain swaps (conversion from Tron to ERC20 protocol) for 1B USDt.

Tether total supply will not change during this process.

Read more here: https://t.co/abfgnELSvi

— Tether (@Tether_to) September 14, 2020

Ethereum-based Tether has exploded as the most dominant chain of the stablecoin, however, rising gas fees recently has made USDT and other stablecoins expensive to send.

It is not clear what the motivation was behind the swap, but there is no reason to expect what is effectively $1 billion removed and re-added will cause Bitcoin or any crypto assets to pump.

Featured image from DepositPhotos, Charts from TradingView origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|