Urpd - Свежие новости [ Фото в новостях ] | |

Bitcoin Price Analysis: Expert Highlights 3 Key Price Zones That Could Decide Its Fate

The Bitcoin price has been on edge, and recent analysis has identified key areas every holder should note. Specifically, prominent market watcher Ali Martinez highlighted these crucial support zones in his recent X analysis using the BTC URPD. дальше »

2026-1-23 01:45 | |

|

|

Solana Air Gap: Analyst Says No Major Support Level Until $24

An analyst has pointed out how a sort of supply “air gap” exists for Solana below $144, with no major on-chain support levels until much lower. Solana URPD Reveals Supply Chasm Below $144 In a new post on X, analyst Ali Martinez has talked about how Solana support is looking from an on-chain lens. дальше »

2025-11-15 03:00 | |

|

|

Dogecoin (DOGE) Chart Reveals a Dangerous Gap, And It Might Be About to Fill Fast

Dogecoin price might be getting ready for a big move, and according to analyst Ali, the chart is flashing something major. He pointed out a massive price gap between $0. 07 and $0. 19 on Dogecoin’s UTXO Realized Price Distribution (URPD) chart from Glassnode. дальше »

2025-10-16 01:30 | |

|

|

Bitcoin Price Analysis Reveals Market-Bottom Cues, but $113,500 Remains the Key Test

Bitcoin price is holding above critical support as SOPR and URPD metrics flash potential market bottom signs. A test of $113,500 resistance now looks pivotal. The post Bitcoin Price Analysis Reveals Market-Bottom Cues, but $113,500 Remains the Key Test appeared first on BeInCrypto. дальше »

2025-9-1 11:35 | |

|

|

Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

The analytics firm Glassnode has revealed the Solana price levels that could be important to watch, based on on-chain accumulation data. Solana Cost Basis Distribution Reveals Where Supply Is Most Concentrated In a new post on X, Glassnode has discussed about the UTXO Realized Price Distribution (URPD) of Solana. дальше »

2025-3-20 13:00 | |

|

|

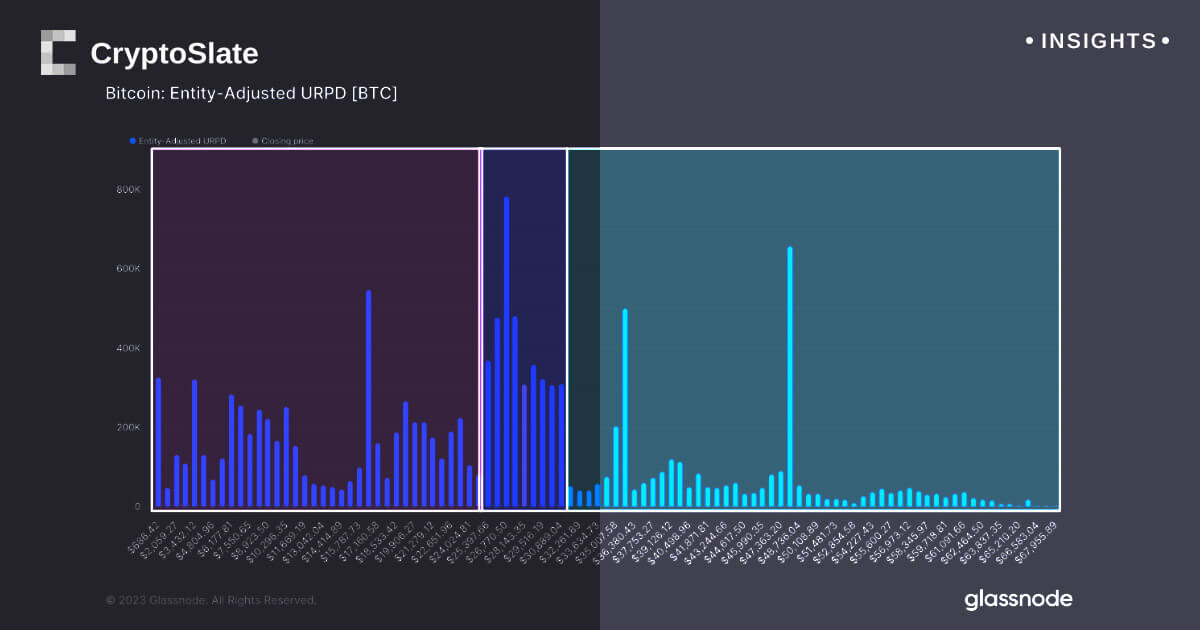

URPD analysis: 7% of Bitcoin’s supply locked in $60,000 to $65,000 price range

Quick Take The URPD metric by Glassnode provides insights into the distribution of Bitcoin unspent transaction outputs (UTXOs) based on their creation prices. Each bar in the chart represents the quantity of existing Bitcoins that were last moved within a specified price range. дальше »

2024-4-26 21:57 | |

|

|

Bitcoin holder sentiment split as UTXO data reveals both substantial profits and losses

Quick Take The most recent UTXO Realized Price Distribution (URPD) data provides a clear indication of the price points at which the existing Bitcoin UTXOs were created. The current set of Bitcoin UTXOs, created at varying price points, is effectively demonstrated with each bar representing the quantity of bitcoins last transacted within a specified price […] The post Bitcoin holder sentiment split as UTXO data reveals both substantial profits and losses appeared first on CryptoSlate. дальше »

2023-10-18 15:05 | |

|

|

Bitcoin trading analysis shows major holding pattern, UTXO data reveals

Quick Take Latest data from the UTXO Realized Price Distribution (URPD) reveals an interesting pattern of Bitcoin’s trading behavior. The URPD, which illustrates the prices at which the current set of Bitcoin UTXOs were generated, indicates a particular concentration between the $28. дальше »

2023-8-13 02:02 | |

|

|

Over 50% of the Bitcoin UTXOs that have been created now sit in profit

Definition UTXO Realized Price Distribution (URPD) shows at which prices the current set of Bitcoin UTXOs were created, i.e. The post Over 50% of the Bitcoin UTXOs that have been created now sit in profit appeared first on CryptoSlate. дальше »

2023-3-21 21:01 | |

|

|

As Bitcoin rallies after FTX collapse, 25% of supply is held between $15.5k and $23k

Definition UTXO Realized Price Distribution (URPD) shows at which prices the current set of Bitcoin UTXOs were created, i. e. , each bar shows the number of existing bitcoins that last moved within that specified price bucket. дальше »

2023-2-1 22:27 | |

|

|

Over 8% Bitcoin supply was bought between $15.5K and $17K

The UTXO Realized Price Distribution (URPD), a metric for indicating the percentage of BTC supply across a specified market price, indicated 8% of the Bitcoin supply was bought between $15,500 and $17,000, according to data analyzed by CryptoSlate. дальше »

2022-12-3 20:28 | |

|

|

Ноябрьский отчет о рынке биткойна — bigger, longer & uncut

Итоговый обзор за октябрь 2021 – о состоянии и перспективах рынка биткойна и определяющих макроэкономических факторах. Содержание Тенденции ончейн накопления Пик в объеме предложения в руках долгосрочных держателей, Supply Shock, SOPR Сокращение биржевых балансов BTC, количество активных адресов Предложение в прибыли, Coin Days Destroyed, распределение реализованной цены UTXO (URPD) Деривативы Фьючерсный биткойн-ETF и CME Фьючерсы […] дальше »

2021-11-5 12:40 | |

|

|