Risk - Свежие новости [ Фото в новостях ] | |

The Bitcoin CME gap will now close forever in May leaving a return to $84k hanging

CME Group has spent most of its life as the financial plumbing moving the gears behind wheat hedges, rate bets, equity futures, the quiet machinery that keeps risk moving. Now it is taking a very public step into crypto’s always-on world. дальше »

2026-2-20 13:11 | |

|

|

XRP price outlook: Thinning order books raise risk of breakdown below $1.30 support

XRP price is hovering near $1.42 as thinning liquidity and repeated tests of the $1.30 support level raise the risk of a breakdown. XRP traded at $1.42 at press time, down 0.7% in the last 24 hours. Over the past… дальше »

2026-2-20 10:29 | |

|

|

Ethereum Breaks Fhe Final Whale Floor In A 2018-Style Capitulation: What To Expect

Ethereum is struggling to reclaim the $2,000 level, with persistent selling pressure continuing to weigh on sentiment across the broader crypto market. Despite intermittent recovery attempts, price action remains fragile as liquidity conditions tighten and investors reassess risk exposure following the sharp correction from the 2025 highs. дальше »

2026-2-20 10:00 | |

|

|

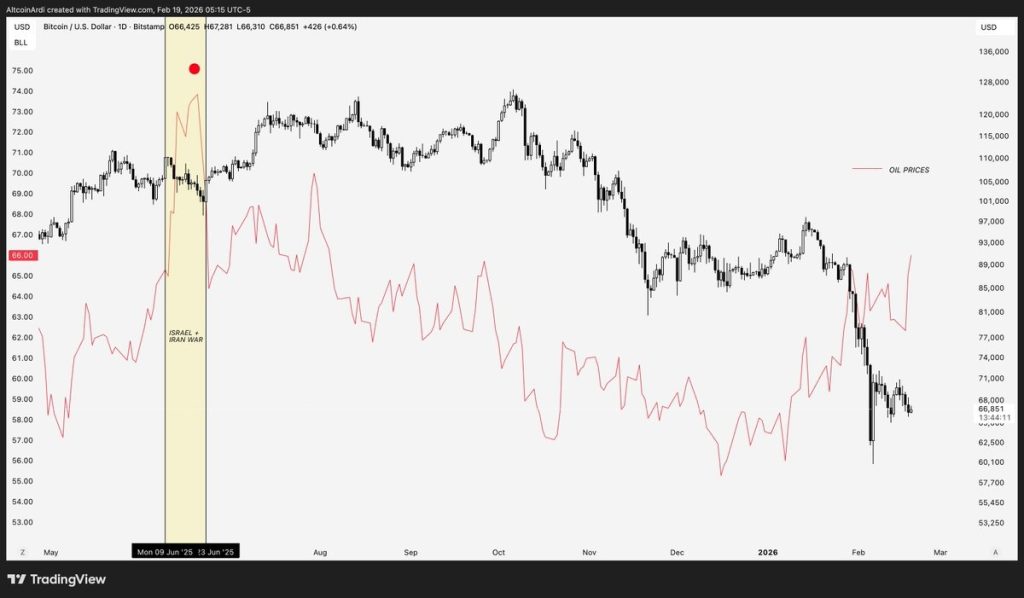

Iran-US Conflict Could Trigger a Bitcoin Crash – Watch Crude Oil, Not Crypto Twitter

The BTC price doesn’t move in a bubble. And when geopolitical tension starts heating up, Bitcoin usually acts a lot less like “digital gold” and a lot more like what it really is in today’s market: a risk asset. дальше »

2026-2-20 03:30 | |

|

|

Caroline Pham: CFTC’s focus on foundational principles will enhance market integrity, why collaboration with SEC is essential, and the importance of a positive regulatory posture for crypto innovation | Empire

The CFTC is focusing on returning to foundational principles to enhance market oversight. Emphasis is placed on ensuring financial markets serve the economy through price discovery and risk mitigation. дальше »

2026-2-20 01:10 | |

|

|

Andrea Miotti: The risk of human extinction from uncontrolled AI is imminent, why superintelligence must be banned, and the urgent need for regulation | The Peter McCormack Show

The risk of human extinction due to uncontrolled AI development is significant, emphasizing the need for immediate action. Superintelligent AI systems could eventually surpass human dominance if proactive measures aren't taken. дальше »

2026-2-20 16:50 | |

|

|

Crypto price prediction as hawkish FOMC minutes sparks market sell-off

The latest Federal Open Market Committee minutes struck a hawkish tone, pressuring risk assets including cryptocurrencies. Policymakers acknowledged that while inflation has cooled from its highs, progress toward the Fed’s 2% target “might be slower and more uneven than generally… дальше »

2026-2-20 14:32 | |

|

|

Solana weakens as liquidations rise and sentiment cools

Solana (SOL) has fallen below $82 as selling pressure and risk aversion increased. Rising liquidations show leveraged traders are exiting positions. $80 support remains critical, with $75 and $90 as key levels to watch. дальше »

2026-2-20 14:18 | |

|

|

Crypto fear index falls to 10 as Strait of Hormuz tensions rise

Crypto fear index fell from 12 to 10 this week as Iran’s Hormuz drills raised oil and energy risk for BTC miners. Cryptocurrency market sentiment declined this week as geopolitical tensions escalated in the Middle East, with Iran conducting military… дальше »

2026-2-19 12:58 | |

|

|

AIW3 Integrates Snowball’s MNS, CIP, and ORS to Enhance On-Chain Strategy Execution

Today, AIW3 has made a strategic alliance with Snowball Labs to enhance the decentralized trading infrastructure, account, and settlement and risk layers. дальше »

2026-2-19 11:00 | |

|

|

From sell-offs to staking rewards - Inside Grayscale’s strategic SUI move!

Wall Street is moving from watching crypto to actively joining it. Even with market volatility, institutions are finding ways to get into risk assets. Among these, ETF launches remain the go-to rThe post From sell-offs to staking rewards - Inside Grayscale’s strategic SUI move! appeared first on AMBCrypto. дальше »

2026-2-19 08:00 | |

|

|

Bitcoin Doesn’t Get A Macro ‘Bailout’ This Time: Alden Warns Of Gradual QE

Bitcoin investors hoping for a familiar macro rescue may be reading the room wrong. In an interview with Coin Stories host Nathalie Brunell, macro analyst Lyn Alden argued that the next policy turn is more likely to resemble a slow balance-sheet creep than the kind of “nuclear print” that has historically juiced risk assets, leaving bitcoin to compete largely on its own fundamentals and narrative pull. дальше »

2026-2-19 08:00 | |

|

|

Tyler Muir: Financial crises amplify asset price drops, why recovery dynamics differ from economic activity, and the rise of populism post-crisis | Macro Musings

Financial crises have a more profound impact on asset markets than ordinary recessions. Asset prices drop more during financial crises due to an extra risk premium channel. Asset markets typically recover faster than economic activity post-crisis. дальше »

2026-2-18 22:15 | |

|

|

Solana price risks a drop below $80 as bearish engulfing candles indicate weakness

Solana price is showing renewed downside risk after bearish engulfing candles rejected key resistance, with weakening market structure opening the probability of testing sub-$80 support levels. дальше »

2026-2-18 20:46 | |

|

|

Joe Lubin: Banks must adopt blockchain to survive the DeFi revolution | Epicenter

Banks are increasingly adopting blockchain technology to improve efficiency and adapt to the rise of decentralized banking. The shift to Web3 presents a risk of being undermined by legacy financial institutions maintaining control. дальше »

2026-2-18 18:30 | |

|

|

Bitcoin price at risk of hitting $50k, Coinbase premium sinks

Bitcoin price remained in a tight range this week, and the waning Coinbase Premium Index points to more downside as institutional demand wanes. дальше »

2026-2-18 17:19 | |

|

|

Ethereum’s Bounce Still Lacks Conviction — Downside Risk Remains

Ethereum is attempting to rebound after recent selling pressure, but the recovery so far lacks the strength needed to confirm a lasting bottom. With momentum appearing corrective rather than impulsive and key resistance levels still intact, downside risk remains on the table unless buyers can deliver a decisive structural shift. дальше »

2026-2-18 02:30 | |

|

|

Top Crypto Presale: Whales Bump Up Their DeepSnitch AI Allocations for 300% Bonuses, OPZ and PEPETO Gain New Ground

DeepSnitch AI remains the top crypto presale as it hits $1.60M raised with five AI agents for real-time risk detection. Whales continue chasing 300% bonuses while Aave proposes a DAO-funded model. дальше »

2026-2-17 16:20 | |

|

|

Investors reassess risk as global uncertainty reshapes capital flows

Global uncertainty and AI disruption are forcing investors and operators to shift from growth at all costs to resilience and optionality. Business leaders and investors are increasingly reporting a sense of economic and geopolitical uncertainty that is reshaping decision-making across… дальше »

2026-2-18 13:55 | |

|

|

Kevin O’Leary points to quantum risk in Bitcoin price outlook

Kevin O’Leary says quantum risks are capping institutional Bitcoin exposure near 3% as BIP-360 proposes a new P2MR output to harden the network’s security. Billionaire entrepreneur and investor Kevin O’Leary said security risks posed by quantum computers are preventing institutional… дальше »

2026-2-18 13:42 | |

|

|

Binance stablecoin reserves drop $9B, signal fading risk appetite

Binance logs three straight months of heavy stablecoin outflows, erasing $9B in reserves and signaling a sustained liquidity squeeze across crypto markets. Binance has recorded three consecutive months of negative stablecoin netflows, marking a sustained contraction in crypto market liquidity,… дальше »

2026-2-18 13:22 | |

|

|

Bitcoin crash risk? Kevin O’Leary flags growing quantum fears

Bitcoin has plunged nearly 50% from its all-time highs, but investor and entrepreneur Kevin O’Leary says the real story goes far beyond price action. In a recent post, O’Leary argued that while sharp drawdowns are nothing new for Bitcoin (BTC),… дальше »

2026-2-18 13:18 | |

|

|

Bitcoin Bears Dominate: Failure to Break $71,800 Keeps Downside Risk Alive

Bitcoin Magazine Bitcoin Bears Dominate: Failure to Break $71,800 Keeps Downside Risk Alive Key levels in focus: $65,650 support holds for now, but break below opens $63,000 then Fibonacci $57,800; resistance caps upside at $71,800–$74,500. дальше »

2026-2-17 21:21 | |

|

|

Аналитик Bloomberg подтвердил прогноз в $10 000 за биткоин

В 2026 году цена первой криптовалюты может обвалиться до $10 000, предвещая рецессию в экономике США. Об этом заявил старший стратег по сырьевым товарам Майк Макглоун. Collapsing Bitcoin/Cryptos May Guide the Next Recession - "Healthy Correction" is what we should hear soon from stock market analysts (who risk unemployment if not onboard), following collapsing cryptos. дальше »

2026-2-17 21:19 | |

|

|

Vitalik Buterin Warns Prediction Markets’ Focus on Sports and Crypto Comes at a Cost

Vitalik Buterin warns prediction markets risk becoming speculative "corposlop," urging a shift toward hedging and long-term financial utility. The post Vitalik Buterin Warns Prediction Markets’ Focus on Sports and Crypto Comes at a Cost appeared first on DeFi Rate. дальше »

2026-2-17 17:17 | |

|

|

CryptoQuant flags $863M Nexo loans as confidence holds in pullback

CryptoQuant data shows Nexo users borrowed nearly 1 billion dollars in a year and over 30% returned, suggesting managed deleveraging as Bitcoin, Ethereum, and Solana retreat. Crypto lending platform Nexo has quietly become a barometer of risk appetite in digital… дальше »

2026-2-17 15:06 | |

|

|

Bitcoin volatility spikes as key support cracks below $68k–$70k range

Bitcoin wavers below key support as liquidations rise and CVDD highlights deeper downside risk. Bitcoin’s (BTC) price has entered a period of volatility as the cryptocurrency struggles to maintain recent highs amid macroeconomic concerns and market liquidations, according to market… дальше »

2026-2-17 15:03 | |

|

|

I’d rather go broke than contribute to KYC’s encroaching grip on society | Opinion

Know your customer, or KYC, is often justified in the name of safety, but centralized safety is still a centralized risk дальше »

2026-2-17 14:17 | |

|

|

Bitcoin faces quantum scrutiny as leveraged shorts eye liquidation risk zone

Bitcoin faces quantum computing scrutiny and heavy leveraged short positioning, with SOPR stabilization, ETF inflows and CME gap levels shaping whether a 10% move triggers a cascade of liquidations. Bitcoin’s potential vulnerability to quantum computing threats has drawn attention from… дальше »

2026-2-17 12:40 | |

|

|

Ethereum Price Reverses Under $2,000, Bulls On The Back Foot

Ethereum price started a fresh decline and traded below $2,000. ETH is now consolidating and remains at risk of another decline below $1,940. Ethereum struggled to extend gains above $2,050 and corrected lower. дальше »

2026-2-16 06:18 | |

|

|

Web3 Investing Made Simple: How IPO Genie Unlocks Early Crypto Opportunities

What if the next big Web3 winner is being priced today, while most buyers still scroll past it? Many crypto investors don’t miss because they lack skill. They miss because they arrive after the early window closes, when the upside is diluted, and the risk is higher. дальше »

2026-2-15 16:00 | |

|

|

PEPE volume erupts 283% in 24 hours! Is memecoin mania back?

The market has regained its appetite for risk, with memecoins once again taking the lead. At the time of writing, Pepe [PEPE] was trading at $0.00000493, posting a 29.3% price surge. Momentum strengtThe post PEPE volume erupts 283% in 24 hours! Is memecoin mania back? appeared first on AMBCrypto. дальше »

2026-2-15 15:00 | |

|

|

Vitalik Buterin Sounds Alarm On Prediction Market Direction

Ethereum co-founder Vitalik Buterin is raising fresh concerns about the trajectory of modern prediction markets, warning that the sector is drifting toward short-term speculation rather than fulfilling its original promise as a tool for information discovery and risk management. дальше »

2026-2-15 19:47 | |

|

|

Bitcoin price prediction as U.S. Government Shutdown risk shakes markets

Bitcoin price held steady on Saturday, reaching a high of $70,000 for the first time in days, even as a partial government shutdown started in the United States. Bitcoin (BTC) rose to $70,000, up substantially from the year-to-date low of… дальше »

2026-2-15 19:18 | |

|

|

Bitcoin is at risk of a talent drain because AI just created 1.3 million jobs

Within a span of weeks in early 2026, a cluster of senior crypto operators announced they were stepping back or switching domains. Akshay BD, who spent five years building Solana's ecosystem, posted a “life update” saying he was “grateful to pass the torch. дальше »

2026-2-15 19:05 | |

|

|

Gold and Silver Risk Multi-Year Decline as Russia Signals Return to Dollar System

Gold and silver prices have delivered remarkable strength in recent months as demand continued to climb across global markets. At the time of writing, gold trades near $5,000 and silver near $77 after both metals reached record highs close to $5,600 and $121. дальше »

2026-2-14 09:58 | |

|

|

Perpetual futures changed how retail traders perceived risk in 2025

Perpetual futures allow positions to stay open indefinitely, letting risk build over time. Losses increasingly stem from prolonged exposure, not sudden price moves. Contract design now plays a bigger role in risk than traditional entry and exit timing. дальше »

2026-2-14 15:34 | |

|

|

Will $2.3B options expiry jolt Ethereum price from key strike levels?

Ethereum price continues to lag its 2021 peak as institutions rotate cautiously into ETH exposure while weighing ETF flows, on-chain activity, and broader macro risk. BlackRock is leaning into the pain on Ethereum (ETH) price, quietly ramping up its exposure… дальше »

2026-2-14 14:56 | |

|

|

Solana price breaks below $80 as RSI sinks to 25 — is capitulation underway?

Solana price has slipped beneath a critical support level, with momentum indicators flashing deep oversold conditions as traders re-assess risk. Solana was trading at $78.33 at press time, down 2.7% over the past 24 hours. The token has dropped 45%… дальше »

2026-2-13 10:24 | |

|

|

Dogecoin Is Now In The ‘Maximum Opportunity / Minimum Risk’ Zone: Crypto Analyst

Dogecoin is flashing what crypto analyst Cryptollica (@Cryptollica) calls on X a rare “maximum opportunity / minimum risk” setup, as long-horizon indicators on a DOGE-versus-dollar proxy chart push into levels that previously coincided with cycle lows. дальше »

2026-2-12 18:30 | |

|

|