Ratio - Свежие новости [ Фото в новостях ] | |

XRP Binance reserves drop 200m as holders move off exchange

XRP slips ~0.5% in 24h as 200m tokens exit Binance over ten days. XRP (XRP) exchange reserves on Binance have declined over the past ten days, with approximately 200 million tokens withdrawn from the platform. The token supply ratio on… дальше »

2026-2-20 14:48 | |

|

|

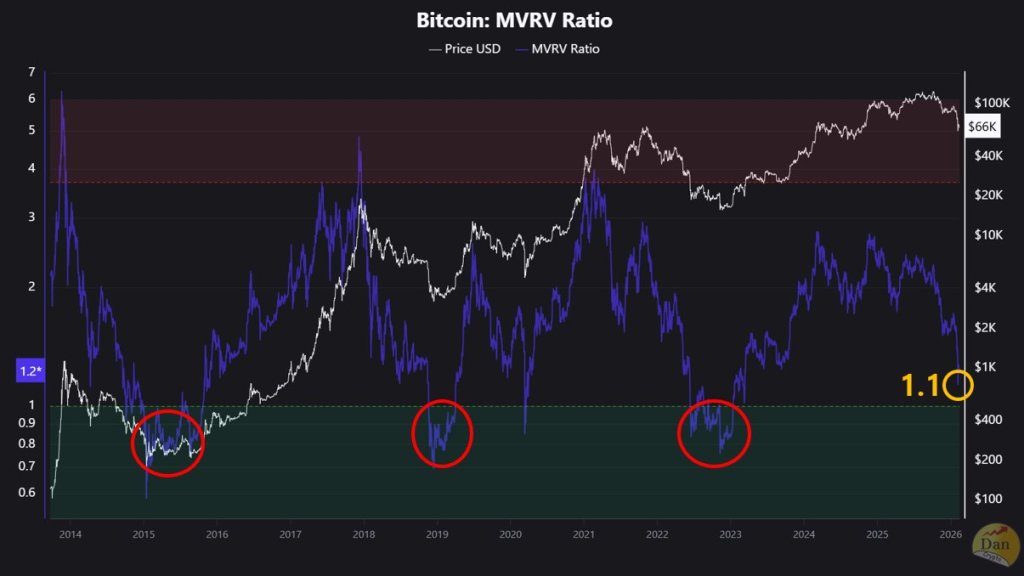

Bitcoin Flirts With ‘Undervalued’ As MVRV Slides Toward 1

Bitcoin is nearing a level on the MVRV ratio that historically lines up with market “undervaluation,” according to CryptoQuant contributor Crypto Dan, as traders look for signs that a four-month drawdown from October 2025’s all-time high is shifting from distribution into accumulation. дальше »

2026-2-14 03:00 | |

|

|

Bitcoin Taker Buy Ratio Signals Peak Bearish Sentiment — Relief Soon?

The price of Bitcoin experienced one of the most bearish periods in its history over the past week, losing one crucial technical level after the other. According to data, the cryptocurrency market has seen $1 trillion worth of capital flow out since mid-January. дальше »

2026-2-8 00:30 | |

|

|

While Bitcoin And Ether Falter, XRP Optimism Stands Out: Analysts

XRP’s online mood is holding up even as prices slide, creating a split between what traders say and what markets are doing. Related Reading: Coinbase Escalates Fight With Australian Banks Over Crypto Bans XRP Social Mood Outpaces Peers According to Santiment, social chatter around XRP has a far higher positive-to-negative ratio than the big two […] дальше »

2026-2-6 00:00 | |

|

|

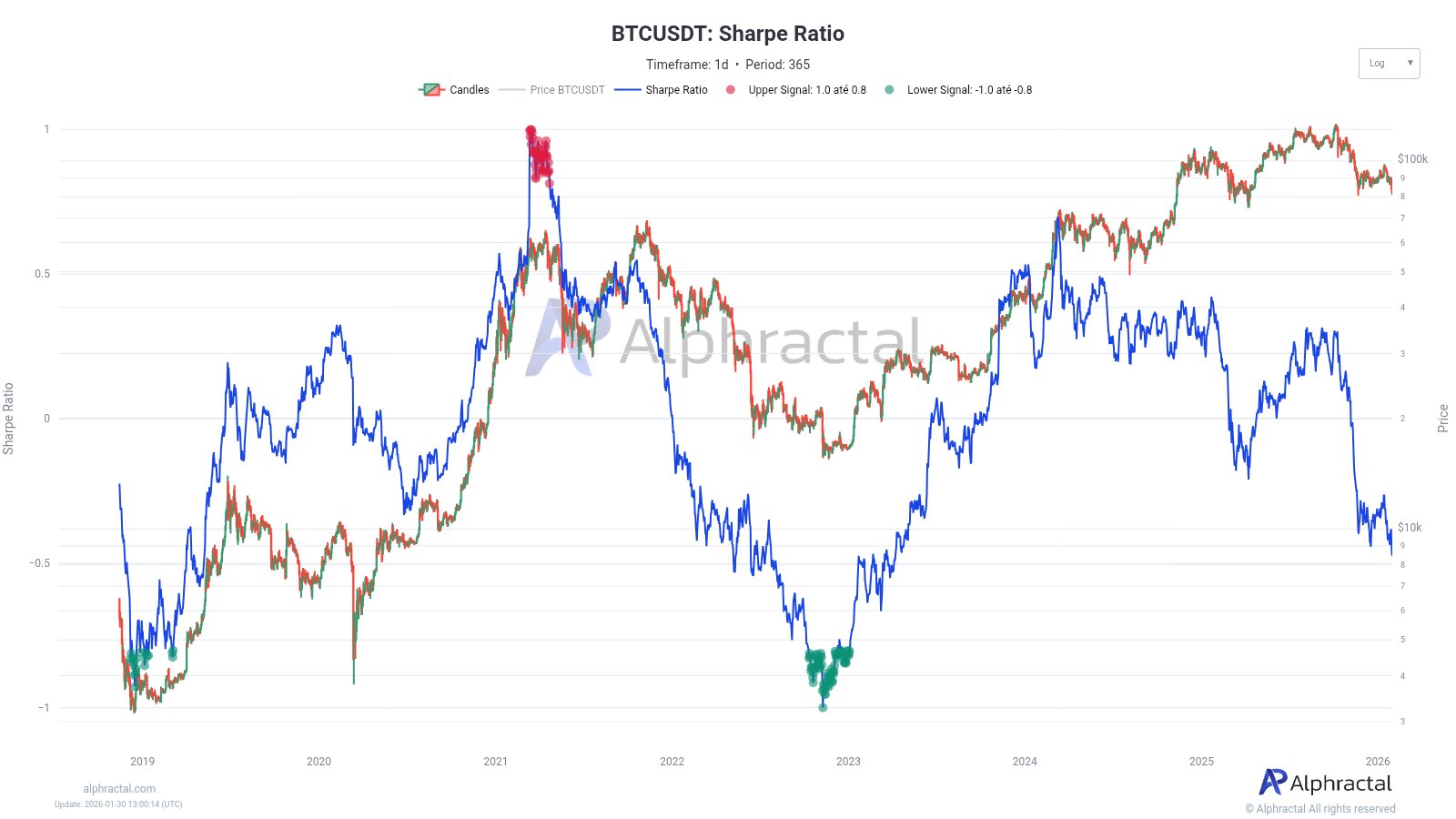

Bitcoin Sharpe Ratio Currently Falling Faster Than Price — What’s Happening?

If there has been any doubt about the arrival of the bear market, the latest drop in the Bitcoin price to around $81,000 somewhat made it more believable. While different triggers, including geopolitical tensions, Microsoft’s earnings miss, and liquidation cascades, have been credited for this drop, the premier cryptocurrency seems to be struggling catch any […] дальше »

2026-1-31 14:00 | |

|

|

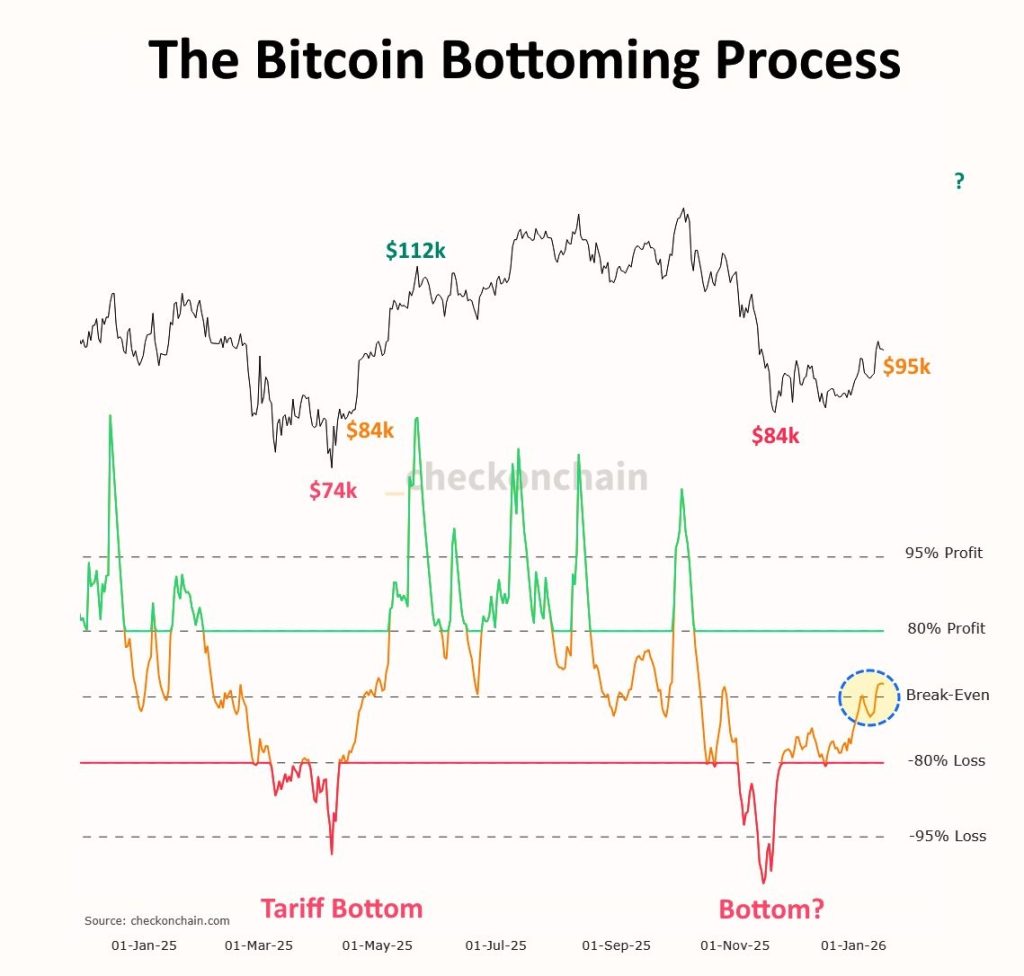

Bitcoin short-term holders need liquidity reset as 22% of BTC supply sits in loss

Bitcoin’s next uptrend hinges on fresh liquidity, with Glassnode saying BTC’s profit/loss ratio must rise well above 5 as 22% of supply sits in loss and selling risk lingers. On-chain analytics firm Glassnode has identified key metrics that will determine… дальше »

2026-1-29 12:20 | |

|

|

XRP, Ethereum Now ‘Undervalued’ On MVRV, Says Santiment

On-chain analytics firm Santiment has pointed out how XRP and Ethereum are among coins sitting in the MVRV Ratio’s “undervalued” zone. 30-Day MVRV Is Negative For XRP & Ethereum In a new post on X, on-chain analytics firm Santiment has talked about where some notable cryptocurrencies like XRP and Bitcoin currently sit from the perspective of the 30-day Market Value to Realized Value (MVRV) Ratio. дальше »

2026-1-27 09:00 | |

|

|

Binance Bitcoin Leverage Hits 2 Months High, Here’s the Implication

Binance Bitcoin Leverage Ratio hit 0.182, marking the highest level since November 2025, in what may shift the price outlook. The post Binance Bitcoin Leverage Hits 2 Months High, Here’s the Implication appeared first on Coinspeaker. дальше »

2026-1-22 16:00 | |

|

|

Bitcoin Bottom Signal? This On-Chain Flip Has Preceded Every Major Rally

Bitcoin might be quietly doing something important right now. While price action still looks messy on the surface, on-chain data is starting to tell a calmer story. A signal shared by Crypto Patel shows the Short-Term Holder Supply Ratio flipping back above break-even, a move that has historically appeared before some of Bitcoin’s strongest rallies. дальше »

2026-1-19 00:00 | |

|

|

Altseason 2026: Why One Analyst Sees a Bigger Cycle Than 2017 and 2021

Crypto Patel is keeping things simple with his take. The OTHERS/BTC ratio is sitting right on a long-term support zone that has marked major turning points in the past. He points back to 2017 and 2021, when similar setups led to strong periods of altcoin outperformance, and frames 2026 as the next potential expansion phase. дальше »

2026-1-17 23:30 | |

|

|

XRP/Gold Ratio Just Reached A Historical Support Zone, What This Means For Price

Despite its slow momentum over the past few weeks, XRP is still on analysts’ radar as they look beyond its dollar price action and into its performance against gold. One analyst has said that the long-term XRP/Gold ratio has just reached a historical support zone, signaling a familiar technical setup that could determine its next move. дальше »

2026-1-15 02:00 | |

|

|

Bitcoin Sell-Side Risk Ratio Falls To Lowest Since Oct ’23: What It Means

On-chain data shows the Bitcoin Sell-Side Risk Ratio has plummeted recently. Here’s what this could suggest for the cryptocurrency. Bitcoin Sell-Side Risk Ratio Has Fallen To Multi-Year Lows In a new post on X, Glassnode analyst Chris Beamish has talked about the latest trend in the Bitcoin Sell-Side Risk Ratio, an on-chain indicator that keeps […] дальше »

2026-1-14 11:00 | |

|

|

ETH/BTC looks promising - Is Ethereum set to surge?

The ETH/BTC ratio appeared to have bottomed in April, similar to what played out in 2019. Development activity on Ethereum is still strong, and more value is flowing into tokenized assets on the netwoThe post ETH/BTC looks promising - Is Ethereum set to surge? appeared first on AMBCrypto. дальше »

2026-1-13 01:00 | |

|

|

Why Has ALTSEASON Not Started Yet?

When you look at this chart, it’s hard to argue that altcoins are in any kind of breakout phase. The ratio of the total crypto market cap excluding the top 10 compared to Bitcoin has been trending lower for a long time. дальше »

2026-1-13 23:00 | |

|

|

Gate Releases Latest Proof of Reserves Report: Total Reserve Ratio Hits 125%, BTC Reserve Ratio Soars to 140.69%

According to the official announcement, Gate has released a new reserve report. The data shows that the platform’s reserve framework remains highly stable. As of January 6, 2026, the overall reserve coverage ratio increased from 124% to 125%, with total reserves reaching $9. дальше »

2026-1-12 16:00 | |

|

|

Bitcoin bulls face key on-chain test at six–twelve month cost basis

Bitcoin tests a key on-chain cost basis after its longest winning streak in months, with rising stablecoin reserves but weakening Sharpe ratio tempering the rebound. Bitcoin (BTC) is testing a critical resistance level this week that analysts say will determine… дальше »

2026-1-7 15:00 | |

|

|

Bitcoin price rises toward $95K resistance — is this crucial ratio flashing a warning?

Bitcoin price climbed toward the $95,000 even as risk-adjusted returns continued to weaken. Bitcoin traded at $93,810 at press time, up 1.4% over the past 24 hours, as the price continued to move toward the $95,000 resistance area. The leading cryptocurrency… дальше »

2026-1-6 08:44 | |

|

|

Are memecoins back? One specific wallet metric suggests the $50 billion rally is a dangerous trap

After a year of steady decline, the “memecoin dominance” ratio, a key metric tracking the sector's share of the total altcoin market, has abruptly reversed course from historic lows. This came as the total capitalization of meme assets reclaimed the $50 billion mark and tokens such as PEPE, BONK, and FLOKI posted outsized double-digit gains […] The post Are memecoins back? One specific wallet metric suggests the $50 billion rally is a dangerous trap appeared first on CryptoSlate. дальше »

2026-1-7 02:55 | |

|

|

Memecoins are back, but one specific wallet metric suggests the $50 billion rally is a dangerous trap

After a year of steady decline, the “memecoin dominance” ratio, a key metric tracking the sector's share of the total altcoin market, has abruptly reversed course from historic lows. This came as the total capitalization of meme assets reclaimed the $50 billion mark and tokens such as PEPE, BONK, and FLOKI posted outsized double-digit gains […] The post Memecoins are back, but one specific wallet metric suggests the $50 billion rally is a dangerous trap appeared first on CryptoSlate. дальше »

2026-1-6 02:55 | |

|

|

Meme Market Dominance Ratio Rebounds from Lows, Rally Ahead?

The meme coin market has added $11 billion in value as 2026 starts as trading volume jumped to $8.8 billion in the past day. The post Meme Market Dominance Ratio Rebounds from Lows, Rally Ahead? appeared first on Coinspeaker. дальше »

2026-1-5 14:35 | |

|

|

Optimism Returns With US Institutions as Bitcoin Reclaims $91K

Bitcoin bulls have reason for optimism as the new year begins. Three key on-chain metrics are flashing pre-bullish signals simultaneously: the Coinbase Premium Gap is bouncing back as institutional inflow recovers, the Fear & Greed Index has jumped, and the long/short ratio remains above 1. дальше »

2026-1-5 03:31 | |

|

|

Bitcoin Sharpe Ratio Flips Into Negative Territory— Is The Recovery Back On?

The price of Bitcoin seems to be positioning for a renewed bullish phase following its positive start to the new year. The premier cryptocurrency closed 2025 with a range-bound price performance, recording no significant movement in the past month of December. дальше »

2026-1-4 17:30 | |

|

|

Bitcoin eyes copper-gold signal as whales ease selling into 2026 uncertainty

Bitcoin’s 2025 slide has analysts tracking a copper-gold ratio RSI signal, waning whale selling, and potential gold-silver rotation as crypto winter fears linger into 2026. A cryptocurrency analyst has identified a potential correlation between the copper-gold ratio and Bitcoin price… дальше »

2026-1-1 18:10 | |

|

|

How can Bitcoin avoid a year-long bear market? Trader conviction isn't the answer

Bitcoin [BTC] saw an increasing long/short ratio once again, noted analytics platform Alphractal in a post on X. This signaled increased interest from traders to go long. While this is a common occThe post How can Bitcoin avoid a year-long bear market? Trader conviction isn't the answer appeared first on AMBCrypto. дальше »

2025-12-31 16:00 | |

|

|

Bitcoin, silver price ratio signals shifting market risk appetite

The Bitcoin-silver price ratio highlights the ongoing tug-of-war between digital scarcity and traditional hard assets. While it should not be used in isolation, it provides critical insight into how capital is rotating beneath the surface. дальше »

2025-12-27 23:00 | |

|

|

Inside South Korea’s crypto shock: Upbit announces 99% cold-storage security overhaul

South Korea’s biggest exchange Upbit raised its cold-storage ratio to 99% in response to its recent multimillion-dollar Solana breach. This move comes days after news that regulators are weighingThe post Inside South Korea’s crypto shock: Upbit announces 99% cold-storage security overhaul appeared first on AMBCrypto. дальше »

2025-12-11 20:00 | |

|

|

Upbit to Raise Cold Wallet Ratio to 99% Amid Liquidity Concerns

South Korea’s largest cryptocurrency exchange, Upbit, announced plans to increase its cold wallet storage ratio to 99%, following a major security breach last month. The announcement comes as part of a comprehensive security overhaul following hackers’ theft of approximately 44. дальше »

2025-12-10 08:02 | |

|

|

IOTA price soars as network staking ratio hits 50% milestone

Cryptocurrencies saw remarkable rallies on Thursday as Bitcoin reclaimed $91,000. Most altcoins display substantial intraday gains, with the value of all digital currencies up 4. 50% from the previous day to $3. дальше »

2025-11-27 16:53 | |

|

|

Chinese DEX Sun Wukong reveals $64.14M in reserves

Chinese decentralized contract exchange, Sun Wukong, launches its proof-of-reserves page which contains the platform’s current stablecoin reserves standing at $64.14 million. According to the Chinese platform’s main website, its stablecoin reserve ratio currently stands at 100%. The page allows traders… дальше »

2025-11-12 15:04 | |

|

|

Most Reliable Bitcoin Boom Indicator Just Went Off-Script: Expert

Chartered Market Technician (CMT) Tony “The Bull” Severino argues that Bitcoin’s most dependable macro tell—the copper-to-gold ratio—has broken character at the very moment the market typically enters a parabolic phase, leaving the post-halving script in disarray and altcoins without their usual rotation. дальше »

2025-11-12 04:00 | |

|

|

Why Bitcoin LTHs hold steady while new BTC whales face $1B in losses

Key takeaways Why is Bitcoin’s risk-return profile weakening? Metrics like the Sharpe Ratio and NRM have fallen as institutional demand cools. What are Bitcoin whales doing during this phase? The post Why Bitcoin LTHs hold steady while new BTC whales face $1B in losses appeared first on AMBCrypto. дальше »

2025-11-12 01:00 | |

|

|