Rallies - Свежие новости [ Фото в новостях ] | |

The Altcoin Exodus: Trading Volumes Halve As Capital Flees To Bitcoin $65,000 Fortress

The altcoin market has faced persistent difficulties since 2024, with many assets still struggling to recover from the euphoric highs reached during the 2021 bull cycle. Despite intermittent rallies, broader momentum has remained weak, reflecting reduced speculative appetite, tighter liquidity conditions, and a gradual shift in investor preference toward more established crypto assets. дальше »

2026-2-19 10:00 | |

|

|

Alex Gurevich: Interest rates may return to zero, the long-term bond market trend is breaking down, and parabolic rallies follow slow upward trends | Forward Guidance

Interest rates may return to zero due to current economic conditions. The long-term bond market trend is breaking down, signaling a shift in economic conditions. Asset prices often experience parabolic rallies after a slow upward trend. дальше »

2026-2-15 22:15 | |

|

|

Solana Repeating Rare Cycle Pattern That Once Sent SOL Price Pumping

Solana price has entered a quiet phase that often appears after major market declines. Large rallies in previous cycles did not begin during excitement. They started when attention faded and structure slowly rebuilt. дальше »

2026-2-14 15:00 | |

|

|

The Cycle Without A Ceiling: Why Bitcoin’s Missing Peak Rewrites The Rules For The 2026 Bottom

Bitcoin continues to struggle below the $70,000 level, with repeated attempts to regain upward momentum meeting persistent selling pressure. The inability to sustain rallies has kept market sentiment cautious, and several analysts are increasingly warning that a deeper correction below $60,000 remains possible if current conditions persist. дальше »

2026-2-14 05:00 | |

|

|

U.Today Crypto Digest: Ripple CEO Calls XRP 'Heartbeat' of Company, Shiba Inu Drops to Lowest Level Since 2023, Bitcoin Price Rallies After US Jobs Report

Crypto news digest: Ripple CEO reaffirmed XRP's role; SHIB slides to 2023 lows; BTC sees brief spike after US jobs report. дальше »

2026-2-14 22:36 | |

|

|

Dogecoin Drops Below $0.09 as Market Weakness Outweighs Musk Hype

The latest slide in Dogecoin (DOGE) is a reminder of how quickly sentiment can shift in a fragile crypto market. Once known for sharp rallies driven by social media buzz, the meme coin is now struggling to find a footing amid broader selling pressure that overshadows brief bursts of optimism. дальше »

2026-2-7 06:00 | |

|

|

XRP Velocity Rallies Back To Yearly Highs After Months Of Cooling – What This Means

The XRP Ledger is currently operating at a rapid level as transactions and usage continue to climb, pointing to growing demand for block space and network utility beneath the surface. With this significant usage, the Ledger’s transaction velocity has spiked to record levels. дальше »

2026-2-6 23:00 | |

|

|

Hyperliquid Unveils Event Trading With HIP-4 as HYPE Token Rallies

Hyperliquid's HIP-4 update will support "outcomes" that are "useful for applications such as prediction markets and bounded options-like instruments." The post Hyperliquid Unveils Event Trading With HIP-4 as HYPE Token Rallies appeared first on DeFi Rate. дальше »

2026-2-5 21:46 | |

|

|

Crypto Market News Today: SUI Bounces From Oversold Depths, Jupiter Rallies, and DeepSnitch AI Presale Readies for Moonshot Launch in February

In crypto market news today, BitMine faces $7B losse, SUI recovers, Jupiter jumps, and DeepSnitch AI approaches moonshot launch. дальше »

2026-2-4 23:50 | |

|

|

ZIL rallies 71% ahead of Cancun EVM upgrade: can it go higher?

Zilliqa (ZIL) is one of the best performers among the top 200 cryptocurrencies by market cap after adding 71% to its value in the last 24 hours. The rally comes ahead of its upcoming Cancun upgrade this week, with investors optimistic about ZIL despite the broader weakness in the crypto market. The strong buying interest […] дальше »

2026-2-4 15:23 | |

|

|

Analyst Highlights What People Are Missing In The XRP Price Chart

An XRP analyst is pushing back against the growing sense of boredom surrounding XRP’s price action, with the outlook that people are misreading what is actually happening on the higher timeframes. Taking to the social media platform X, an analyst known as XRP QUEEN said traders are overlooking a typical setup that has always preceded some of XRP’s most notable rallies. дальше »

2026-2-3 23:00 | |

|

|

Dogecoin Crash Sends It To Key Demand Zone, Here’s The Level To Watch

Tracking the broader crypto market decline, Dogecoin (DOGE) has crashed to new lows, sending it back to a key demand zone. Market analyst Eric Crypto has shared a detailed analysis, highlighting the significance of this level and predicting that a hold above it could trigger a major rebound and subsequent price rallies for Dogecoin. дальше »

2026-2-3 18:30 | |

|

|

Dogecoin (DOGE) Price Prediction: Analyst Points to a Possible Move above $1.25

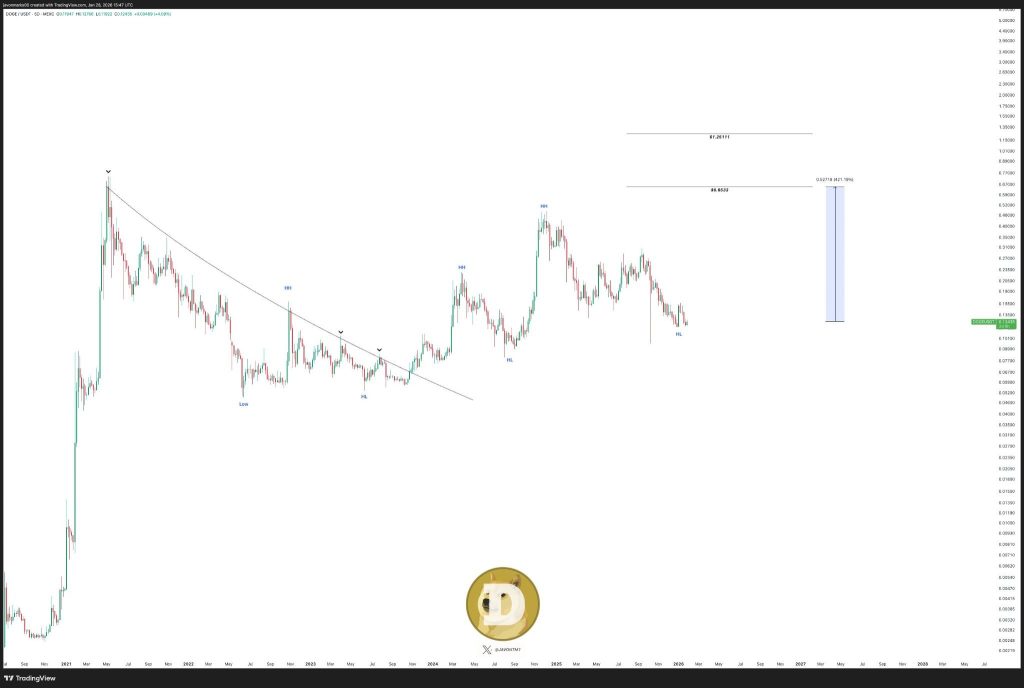

The idea behind Javon Marks’ take is pretty simple, and the chart makes it easy to follow. After spending a long time stuck under a curved downtrend that capped rallies through 2021, 2022, and much of 2023, the DOGE price finally broke above that resistance. дальше »

2026-1-29 18:45 | |

|

|

Avalanche price forecast as C-Chain transactions surpass $1B, daily users jump 20x

Avalanche’s price is down 5% in the past 24 hours, trading lower as most cryptocurrencies shed gains. With analysts pointing to continued pressure on Bitcoin as gold rallies, it appears AVAX could fall sharply below $11. дальше »

2026-1-30 18:12 | |

|

|

Why Bitcoin is down while gold rallies on a weaker dollar

Gold and other traditional safe-haven assets are surging amid a softening US dollar, yet Bitcoin continues to falter. This week, gold pushed past the $5,000 mark, setting fresh all-time highs and building on its strong momentum. дальше »

2026-1-30 16:42 | |

|

|

Worldcoin price rallies as OpenAI considers its biometric-based identity for new social app

Worldcoin price has jumped to $0.5275 at press time, up 14% over the past 24 hours, after reports speculated OpenAI may use its biometric identity verification system for a new social app. At its peak, the WLD token climbed more… дальше »

2026-1-29 09:10 | |

|

|

DeLorean DMC rallies over 200% after Binance perpetuals removal as community reasserts control

DeLorean DMC rebounds over 200% after Binance removes DMC perpetuals, revealing renewed organic market demand surge. After weeks of turbulence tied to derivatives-driven trading, DeLorean DMC, the official on-chain token of DeLorean Motor Company, has seen a sharp comeback even… дальше »

2026-1-29 20:07 | |

|

|

BlackRock is cannibalizing Bitcoin gains for “income” in a move that could leave retail investors behind during rallies

BlackRock is moving deeper into the “Bitcoin as a portfolio sleeve” trade, this time by packaging the flagship digital asset's inherent volatility into distributable income. On Jan. 23, the $14 trillion asset management firm filed a registration statement for the iShares Bitcoin Premium Income ETF. дальше »

2026-1-29 18:35 | |

|

|

PUMP rallies as Pump.fun usage doubles: Can Solana ride the memecoin wave?

It appears the memecoin risk appetite is back. According to blockchain analytics firm Artemis, the number of returning users on the memecoin creator platform Pump. fun has hit a record high of neaThe post PUMP rallies as Pump. дальше »

2026-1-28 12:00 | |

|

|

ASTER price rallies amid buybacks and CZ backing: key levels to watch

Aster (ASTER) has seen renewed momentum in recent days. The cryptocurrency is currently trading at around $0. 653, marking a 5. 8% gain over the past 24 hours, adding to its 8. 6% weekly gain, though it remains down 9. дальше »

2026-1-27 15:43 | |

|

|

Akash Network rallies 15% as demand grows for decentralized AI infrastructure

Akash Network price rose sharply to hit highs of $0. 53 on Tuesday. The token rallies as the decentralized AI sector attracts attention. Buyers may target $1 next, although bearish pressure persists. дальше »

2026-1-27 14:42 | |

|

|

Eric Trump highlights USD1, WLFI rallies 5% - Coincidence or strategic play?

We’re not even a month into 2026, and the market’s already feeling stablecoin-led. Macro volatility is spooking markets, pushing cash into stables, as everyone looks for a safe spot while high-capThe post Eric Trump highlights USD1, WLFI rallies 5% - Coincidence or strategic play? appeared first on AMBCrypto. дальше »

2026-1-25 02:00 | |

|

|

Silver Hits All-Time High, But What Does It Signal For Bitcoin’s Next Move?

Silver’s all-time high signals deepening macro fear and real-rate compression — conditions that historically precede Bitcoin rallies, but only after gold and silver absorb the first wave of defensive capital. дальше »

2026-1-24 22:48 | |

|

|

Solana Price Prediction: SOL Holds Up, PAAL Pops, and DeepSnitch AI Pulls the Market Into a 100x Thesis Pre-Launch

F/m Investments seeks tokenized ETF approval. We analyze the Solana price prediction. SOL dips, PAAL rallies, but DeepSnitch AI is the inevitable 100x launch. дальше »

2026-1-24 22:20 | |

|

|

Tron’s TRX rallies 3% despite bearish market conditions

The cryptocurrency market has been underperforming since the start of the week, with Bitcoin still trading around $89k. However, TRX, the native coin of the Tron ecosystem, has tapped the $0. 30 level after rising 3% over the last 24 hours. дальше »

2026-1-24 13:26 | |

|

|

Bitcoin Supply Overhang Likely To Cap Rallies Above $98,400, Glassnode Says

On-chain analytics firm Glassnode has pointed out in a new report how Bitcoin is facing supply overhang beyond the $98,000 region. Bitcoin Could Find Resistance Beyond $98,000 In its latest weekly report, Glassnode has discussed about how the recent Bitcoin rally stalled near the Realized Price of the short-term holders (STHs). дальше »

2026-1-23 11:00 | |

|

|

Shiba Inu faces critical support amid modest rally prospects

Shiba Inu (SHIB) currently hovers near critical support; breaking it may trigger deeper losses. Momentum is weak, and future rallies are expected to be modest. Investors are shifting to utility and DeFi tokens for higher ROI. дальше »

2026-1-22 19:10 | |

|

|

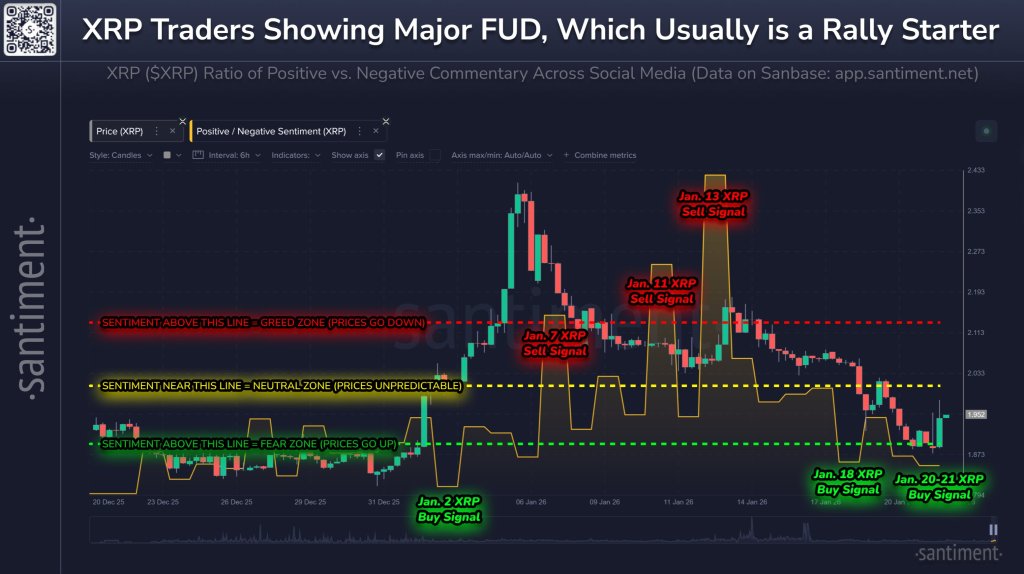

Santiment Says XRP Social Sentiment Hits ‘Extreme Fear’: Buy Signal?

XRP is back in a familiar spot: social chatter has turned sharply bearish even as the market probes support after an early-January surge. Analytics firm Santiment said its social data shows XRP slipping into “Extreme Fear” after a roughly 19% pullback from its early-month high, a setup it argues has historically preceded rallies. дальше »

2026-1-22 12:30 | |

|

|

“Millionaire Maker” Pattern Returns: How ETH, XRP, BNB and SOL Are Quietly Mirroring 2021’s Explosive Altcoin Rally

Recent market analysis points to an approaching altcoin season. However, the transition is unfolding quietly rather than through explosive price action. History shows that the start of altcoin rallies is rarely dramatic, but when usage, capital flows, and investor patience align beneath the surface. дальше »

2026-1-22 19:05 | |

|

|

Kaspa (KAS) Price Mirrors Bitcoin’s Early Path As Chart Points To New All Time High

Kaspa price is back in focus after a chart surfaced showing a striking resemblance between KAS price action and Bitcoin price behavior before one of its most powerful historical rallies. The visual comparison is hard to ignore, showing a long consolidation phase, gradual upward pressure, and then a sharp expansion that changed Bitcoin’s trajectory completely. дальше »

2026-1-21 17:30 | |

|

|

Gold rallies to new highs as Bitcoin slides, highlighting divergent asset flows

Gold prices extended their rally to a new all-time high, breaking above $4,700 per ounce, even as Bitcoin continued to lose ground in recent sessions. The contrasting performance between the tradThe post Gold rallies to new highs as Bitcoin slides, highlighting divergent asset flows appeared first on AMBCrypto. дальше »

2026-1-21 21:04 | |

|

|

While 71% are in profit XRP just triggered a rare signal last seen in 2022 that could paralyze rallies for months

XRP's on-chain structure now mirrors a precarious moment from early 2022, when short-term accumulation beneath longer-term cost bases set the stage for prolonged sideways chop. Glassnode flagged the pattern on Jan. дальше »

2026-1-21 19:15 | |

|

|

Investors Rotate Into DUSK After Missing XMR and DASH Rallies, but Data Raises Warnings

Capital from investors interested in privacy coins shows signs of rotating toward lower-market-cap altcoins. This shift occurs as many believe billion-dollar projects such as XMR and DASH have become saturated. дальше »

2026-1-19 08:42 | |

|

|

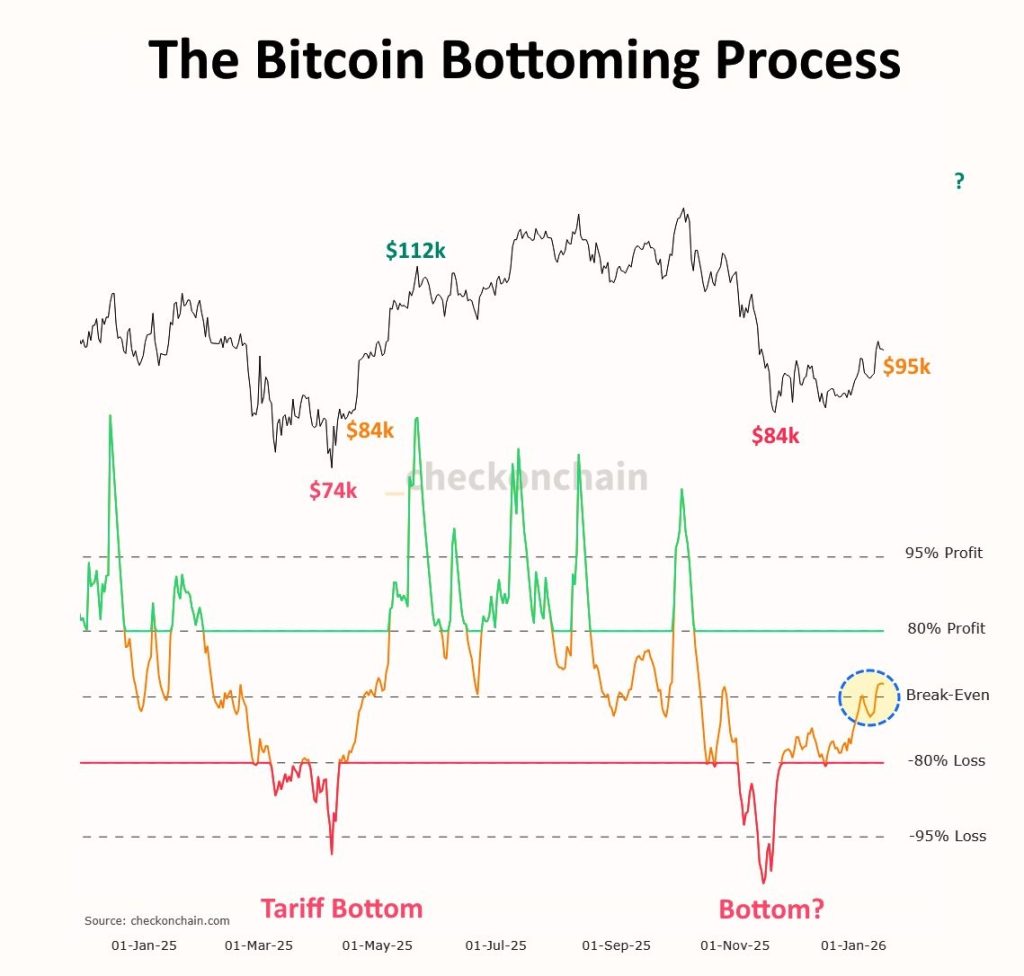

Bitcoin Bottom Signal? This On-Chain Flip Has Preceded Every Major Rally

Bitcoin might be quietly doing something important right now. While price action still looks messy on the surface, on-chain data is starting to tell a calmer story. A signal shared by Crypto Patel shows the Short-Term Holder Supply Ratio flipping back above break-even, a move that has historically appeared before some of Bitcoin’s strongest rallies. дальше »

2026-1-19 00:00 | |

|

|

Wall Street rallies, Ethereum slips - But ETH/BTC tells another story

As the second-largest cryptocurrency, Ethereum [ETH] often serves as a barometer for altcoin market conditions. Recent signals suggest diverging outcomes, reflecting uncertainty across both crypto anThe post Wall Street rallies, Ethereum slips - But ETH/BTC tells another story appeared first on AMBCrypto. дальше »

2026-1-18 09:00 | |

|

|

Bitcoin Flashes Near-Identical Fractal Before The 2021 Bull Run Started

Bitcoin may be replaying a market structure that historically preceded one of its most powerful rallies. A high-timeframe trader has identified a fractal that closely mirrored Bitcoin’s behavior ahead of the 2021 bull run. дальше »

2026-1-17 08:00 | |

|

|

The Ethereum MACD Crossover That Could Lead To A Massive Bull Wave

Ethereum is showing bullish technical strength, with momentum indicators beginning to tilt back in favor of buyers. After weeks of uneven price action, the ETH/USD chart on the 3-day timeframe is now printing a MACD bullish crossover, a signal that has preceded some of Ethereum’s rallies in the past. дальше »

2026-1-17 02:00 | |

|

|

3 Altcoins To Watch This Weekend | January 17 – 18

With the market seemingly shifting its stance from bullish to bearish, the question of whether altcoins’ recent rallies will survive or not is arising. While some altcoins might depend on external developments, others are still following BTC’s cues. дальше »

2026-1-16 20:00 | |

|

|