Management - Свежие новости [ Фото в новостях ] | |

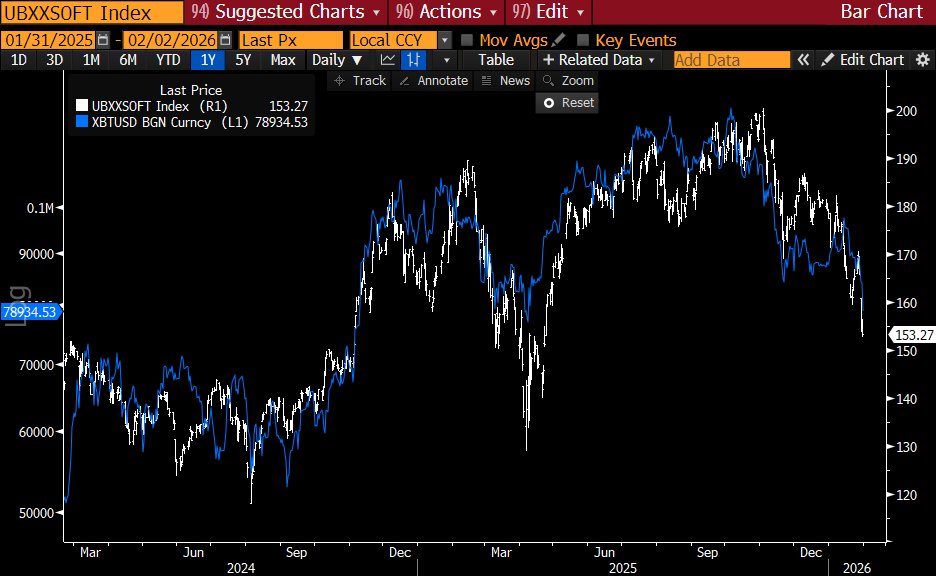

BTC volatility spikes as price slides from $85k to $60k

Crypto asset management company Matrixport stated in its latest research note that cryptocurrency markets are approaching a critical turning point, according to a report released by the firm. The report indicated that a sharp decline in Bitcoin (BTC) led to… дальше »

2026-2-20 14:26 | |

|

|

Crypto.com adds ISO 42001 to its AI, security certifications

Crypto.com gains ISO 42001 AI certification in 2026, expanding its regulated security and AI governance stack. Crypto.com has become the first digital asset platform to secure ISO/IEC 42001:2023 certification, the international standard for Artificial Intelligence Management Systems, the company announced.… дальше »

2026-2-19 13:03 | |

|

|

PINDex and Cache Wallet Form Strategic Alliance to Revolutionize AI-Driven On-Chain Trading

PINDex and Cache Wallet partner to merge AI-native perpetual trading with secure UX, streamlining on-chain asset management for the next generation of Web3. дальше »

2026-2-19 08:00 | |

|

|

David Bailey’s Nakamoto strikes $107M deal to buy BTC Inc and UTXO

Bitcoin-focused public company Nakamoto Inc. , led by chairman and CEO David Bailey, has signed definitive agreements to acquire BTC Inc. and UTXO Management GP, LLC in an all-stock transaction valued at approximately $107. дальше »

2026-2-18 10:23 | |

|

|

Bitwise files for prediction market-backed ETFs under “PredictionShares” brand name

Bitwise Asset Management has filed with regulators to launch a new line of exchange-traded funds tied to political prediction markets, marking its latest push into alternative investment products. The filing was disclosed by Bloomberg ETF analyst James Seyffart, who shared… дальше »

2026-2-18 07:48 | |

|

|

Harvard rotates from Bitcoin to Ethereum ETFs in late-2025 rebalance

Harvard Management Company trimmed its Bitcoin ETF exposure while increasing its allocation to Ethereum in the fourth quarter of 2025. This is according to its latest Form 13F filing, signaling aThe post Harvard rotates from Bitcoin to Ethereum ETFs in late-2025 rebalance appeared first on AMBCrypto. дальше »

2026-2-17 20:28 | |

|

|

Harvard Management Company Rebalances Crypto Portfolio

Institutional capital rotation is once again reshaping the digital asset landscape, and the latest move from Harvard Management Company underscores how rapidly strategies are evolving. In its latest quarterly disclosure, the endowment trimmed its exposure to Bitcoin exchange-traded funds while simultaneously opening a significant position in an Ethereum-focused vehicle. дальше »

2026-2-18 19:20 | |

|

|

Harvard rebalances crypto exposure: Trims Bitcoin, buys into Ether ETF

Harvard Management Company (HMC), the investment arm of Harvard University’s endowment, reduced its stake in a major Bitcoin exchange-traded fund (ETF) by roughly 21 %. Harvard rotates into ETH as Bitcoin ETF holdings shrink 21% Simultaneously, HMC established a new… дальше »

2026-2-17 13:56 | |

|

|

Wall Street giant Apollo to acquire up to 90M MORPHO tokens in new strategic deal

Apollo Global Management is moving to deepen its involvement in decentralized finance through a long-term collaboration with the Morpho Association. The partnership was announced on Feb. 13, with the Morpho Association confirming that it had signed an agreement with Apollo… дальше »

2026-2-16 08:16 | |

|

|

Pavel Durov: Freedom is threatened by fear and greed, confronting mortality enhances life quality, and alcohol consumption harms cognitive abilities | Lex Fridman Podcast

Freedom is often threatened by fear and greed, which require active management. Confronting the fear of death can lead to a more fulfilling life. Alcohol consumption can lead to brain cell paralysis and death, impacting cognitive abilities. дальше »

2026-2-15 21:25 | |

|

|

Vitalik Buterin Sounds Alarm On Prediction Market Direction

Ethereum co-founder Vitalik Buterin is raising fresh concerns about the trajectory of modern prediction markets, warning that the sector is drifting toward short-term speculation rather than fulfilling its original promise as a tool for information discovery and risk management. дальше »

2026-2-15 19:47 | |

|

|

Richard Clarida: Fed and Treasury collaboration is crucial for economic stability, the chair’s power lies in persuasion, and inflation management faces unique challenges | Odd Lots

Collaboration between the Federal Reserve and the Treasury is crucial for effective economic policy. The Fed has a responsibility to ensure liquidity in the treasury market. Criticism of the Fed's inflation management should consider the challenges of the financial crisis. дальше »

2026-2-15 18:05 | |

|

|

Bitwise client invests $11M in Bitcoin during market correction dip

Bitwise CEO reveals wealth management client invested $11M in Bitcoin during recent market correction, marking their first crypto purchase after two years. Bitwise CEO Hunter Horsley disclosed that a wealth management client invested $11 million in Bitcoin during the recent… дальше »

2026-2-12 12:30 | |

|

|

Ripple and Aviva Investors Announce Tokenized Funds on XRP Ledger

Key Takeaways: Ripple has collaborated with Aviva investors to launch conventional fund designs on the XRP Ledger. The venture is the inaugural European investment management firm to enter into a The post Ripple and Aviva Investors Announce Tokenized Funds on XRP Ledger appeared first on CryptoNinjas. дальше »

2026-2-12 18:46 | |

|

|

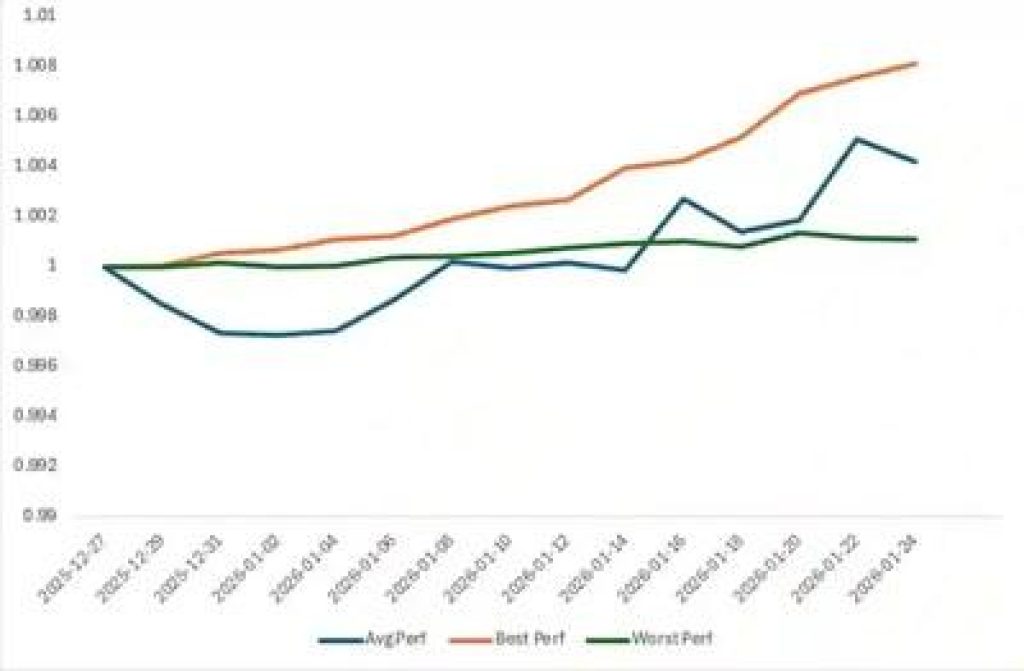

Bybit Private Wealth Management Sustains Positive Momentum in January 2026

PRNewswire, PRNewswire, 11th February 2026, Chainwire

The post Bybit Private Wealth Management Sustains Positive Momentum in January 2026 appeared first on CaptainAltcoin.

дальше »2026-2-11 14:27 | |

|

|

Why Bitcoin ETFs bleed billions while Gold makes 53 new all-time highs with $559B in demand

Gold demand reached a record $555 billion in 2025, driven by an 84% surge in investment flows and $89 billion in inflows into physically backed ETFs. The World Gold Council reports ETF holdings climbed 801 tons to an all-time high of 4,025 tons, with assets under management doubling to $559 billion. дальше »

2026-2-11 22:45 | |

|

|

Bitcoin far from a bottom? Analysts flag 50% drop amid China’s treasury moves

Risk management is taking center stage amid rising market FUD. From a technical perspective, the crypto market has wiped out more than $1 trillion in under a month, forcing investors to repositioThe post Bitcoin far from a bottom? Analysts flag 50% drop amid China’s treasury moves appeared first on AMBCrypto. дальше »

2026-2-10 14:00 | |

|

|

Bitcoin Sell-Off May Be Done, Analyst Flags Recovery Signs

According to Matt Hougan, chief investment officer at Bitwise Asset Management, much of the crypto complex already went through a down cycle last year even though headline coins looked steadier. Related Reading: Russia’s Biggest Exchange To Launch XRP Indices And Futures He points to heavy buying from ETFs and companies that kept Bitcoin, Ether, and XRP from showing the full brunt of those losses. дальше »

2026-2-7 07:00 | |

|

|

BitMEX Unveils Hyperliquid Copy Trading, $100K USDT Rewards and $5,050 Credits for Users

Key Takeaways: BitMEX introduced Hyperliquid Copy Trading, allowing users to copy or invert orders of leading traders, along with risk management tools. New entrants can receive up to $5,050 transaction The post BitMEX Unveils Hyperliquid Copy Trading, $100K USDT Rewards and $5,050 Credits for Users appeared first on CryptoNinjas. дальше »

2026-2-7 19:10 | |

|

|

Bitwise files spot Uniswap ETF with SEC as altcoin caution lingers

Bitwise Asset Management has taken a fresh step in the push to bring decentralised finance tokens into regulated investment products, filing for a spot exchange-traded fund linked to Uniswap. The proposal adds to a growing list of altcoin ETF applications in the US, even as market prices remain subdued. While bitcoin and ether products have […] дальше »

2026-2-6 10:14 | |

|

|

Bitwise files for first spot Uniswap ETF with SEC

Bitwise Asset Management has filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a spot Uniswap ETF, marking a major step toward a regulated exchange-traded product tied directly to the UNI token. Uniswap ETF… дальше »

2026-2-6 09:07 | |

|

|

Gate Releases January Transparency Report: TradFi Trading Volume Surpasses $20 Billion as a Multi-Asset Framework Takes Shape

In January 2026, digital asset trading platform Gate released its latest Transparency Report. The report shows that Gate continues to advance across key areas, including multi-asset trading, on-chain derivatives, and asset management, with its trading structure and user use cases steadily expanding. дальше »

2026-2-6 17:00 | |

|

|

Bitwise CIO Claims Crypto Winter Began in 2025—Now the Question Is When It Ends

Matt Hougan, Chief Investment Officer (CIO) at Bitwise Asset Management, said the market is experiencing a crypto winter. According to his analysis, the crypto winter began in January 2025, but heavy institutional inflows “papered over that truth,” masking the depth of the downturn. дальше »

2026-2-4 14:05 | |

|

|

BTC ETFs sees over $270M in outflows as prices remain under pressure

Assets under management in US spot Bitcoin exchange-traded funds slipped below $100 billion on Tuesday, following renewed investor withdrawals and a sharp downturn across the broader cryptocurrency market. дальше »

2026-2-5 13:48 | |

|

|

Corn: DeFi faces critical customer support challenges, Yearn’s foresight on UST highlights governance risks, and the market is set for recovery in late 2023 | On The Brink with Castle Island

Yearn Finance highlights the urgent need for better risk management as DeFi faces growing challenges. The post Corn: DeFi faces critical customer support challenges, Yearn’s foresight on UST highlights governance risks, and the market is set for recovery in late 2023 | On The Brink with Castle Island appeared first on Crypto Briefing. дальше »

2026-2-4 01:40 | |

|

|

Why Brazil and XDC Network Are Winning the RWA Race

For years, RWA tokenization was a tomorrow story. In 2026, it has officially become a today reality. While the retail market often fixates on the price action of speculative tokens, a far more profound transformation is occurring in the boring sectors of the industry, trade finance, regulated credit, and treasury management. дальше »

2026-2-3 13:17 | |

|

|

Crypto Isn’t Broken, It’s A US Liquidity Squeeze, Says Raoul Pal

Raoul Pal is pushing back on the idea that crypto’s current drawdown signals a broken market cycle, arguing instead that bitcoin and high-beta risk are being hit by a temporary US liquidity air pocket tied to Treasury cash management and government shutdown dynamics. дальше »

2026-2-3 00:30 | |

|

|

Hyperliquid introduces outcome trading via HIP-4 as HYPE jumps over 10%

HyperCore's new trading feature could significantly enhance market dynamics by offering innovative risk management and prediction tools. The post Hyperliquid introduces outcome trading via HIP-4 as HYPE jumps over 10% appeared first on Crypto Briefing. дальше »

2026-2-3 20:30 | |

|

|

OKX CEO blames irresponsible USDe yield campaigns for October flash crash

The October crash highlights the urgent need for stricter risk management and transparency in crypto markets to prevent systemic failures. The post OKX CEO blames irresponsible USDe yield campaigns for October flash crash appeared first on Crypto Briefing. дальше »

2026-1-31 14:04 | |

|

|

Ripple launches Ripple Treasury to help Arc Miner modernize its enterprise cash and digital asset management

Ripple launches Ripple Treasury to boost XRP payment infrastructure as Arc Miner expands XRP-based revenue tools. Ripple launched Ripple Treasury, an enterprise-grade innovative solution designed to improve the efficiency of global corporate finance operations. дальше »

2026-1-30 22:00 | |

|

|

Sodot launches Exchange API Vault for secure, automated crypto trading

Tel Aviv-based crypto key management startup Sodot announced the general availability of its Exchange API Vault on Thursday, a new tool designed to let institutional traders secure their trading keys without sacrificing the speed needed for high-frequency operations. дальше »

2026-1-30 18:55 | |

|

|

Banks may lose up to $500B after Fidelity’s official token launches on Ethereum with freeze powers

Fidelity announced the launch of a stablecoin on the Ethereum mainnet, positioning the token as a compliance-wrapped settlement dollar distributed through the firm's brokerage, custody, and wealth management channels. дальше »

2026-1-29 15:55 | |

|

|

Pundit Says XRP Price Is Not A ‘Crypto’ Question, But A Systemically Important Liquidity Asset

A crypto analyst has provided a new update on the XRP price, highlighting its role as a systemically important liquidity asset. According to the pundit, its price dynamics go beyond the typical crypto speculation, emphasizing its value as a foundational financial tool for global liquidity, settlement, and treasury management. дальше »

2026-1-29 14:00 | |

|

|

Ripple’s billion dollar masterstroke forces 13,000 banks to rethink corporate cash while raising tough questions for XRP

Ripple has pushed deeper into corporate finance with a new treasury platform that aims to let finance teams manage cash and digital assets in one system. The product, called Ripple Treasury, is built on treasury management software Ripple acquired in October 2025 when it bought GTreasury in a $1 billion deal. дальше »

2026-1-29 13:47 | |

|

|