Lths - Свежие новости [ Фото в новостях ] | |

Bitcoin HODLer Selloff Ending? LTH Outflows Decline

On-chain data shows the Bitcoin long-term holder outflows have been declining recently, a potential sign that selling pressure may be fading. Bitcoin Long-Term Holder Netflow Is Getting Less Negative In a new post on X, on-chain analytics firm Glassnode has talked about the latest trend in the netflow associated with the Bitcoin long-term holders (LTHs). дальше »

2026-1-13 10:00 | |

|

|

Bitcoin - Assessing why BTC LTH selling fears may be overblown

At first glance, the data looked worrying. The numbers showed long-term holders (LTHs) selling Bitcoin [BTC] heavily, with worries about whether BTC was starting to crack. But a closer look tells yThe post Bitcoin - Assessing why BTC LTH selling fears may be overblown appeared first on AMBCrypto. дальше »

2025-12-21 20:00 | |

|

|

Bitcoin crashes below $90K - Extreme fear grips traders

Key Takeaways How did BTC drop below $90K? Extreme fear, thin bids, and weakening support levels made it happen. Are LTHs helping stabilize the market? Somewhat. LTHs are buying, but short-term The post Bitcoin crashes below $90K - Extreme fear grips traders appeared first on AMBCrypto. дальше »

2025-11-18 10:00 | |

|

|

Bitcoin: STHs forced to sell 65K BTC in a day, but all's not lost

Key Takeaways What is driving Bitcoin’s recent decline? Heavy selling from long-term and short-term holders, with LTHs offloading 350,000 BTC in 30 days. Does Bitcoin still have rebound potentiThe post Bitcoin: STHs forced to sell 65K BTC in a day, but all's not lost appeared first on AMBCrypto. дальше »

2025-11-17 19:00 | |

|

|

Why Bitcoin LTHs hold steady while new BTC whales face $1B in losses

Key takeaways Why is Bitcoin’s risk-return profile weakening? Metrics like the Sharpe Ratio and NRM have fallen as institutional demand cools. What are Bitcoin whales doing during this phase? The post Why Bitcoin LTHs hold steady while new BTC whales face $1B in losses appeared first on AMBCrypto. дальше »

2025-11-12 01:00 | |

|

|

Bitcoin: Smart money holds, while STHs test the waters - What's next?

Key Takeaways Is BTC strong right now? Yes. LTHs remain in profit, and Bitcoin is holding near $110K. Will trader confidence return to the market? Slowly. Leverage is creeping back on Binance, bThe post Bitcoin: Smart money holds, while STHs test the waters - What's next? appeared first on AMBCrypto. дальше »

2025-10-21 05:00 | |

|

|

Dogecoin dips, conviction holds – Are LTHs about to be rewarded?

Key Takeaways Are Dogecoin holders losing confidence after the memecoin crash? No. Short-term holders are buying the dip! Is Dogecoin currently undervalued? Yes, data points to DOGThe post Dogecoin dips, conviction holds – Are LTHs about to be rewarded? appeared first on AMBCrypto. дальше »

2025-10-15 02:00 | |

|

|

Bitcoin's $110K flash crash sends retail running: Who's still holding?

Key Takeaways Bitcoin's sharp pullback has flushed out newer investors, but LTHs remain strong as the market tests key support. Holding above $110.8K could confirm this as a healthy reset and not a fThe post Bitcoin's $110K flash crash sends retail running: Who's still holding? appeared first on AMBCrypto. дальше »

2025-8-27 07:00 | |

|

|

Bitcoin: $114 mln in old coins move, but bulls look unbothered

Key takeaways Despite a recent dip, Bitcoin demand remains strong, with LTHs and accumulators continuing to buy. A rare move of 1,000 dormant BTC raised caution, but overall market conviction still lThe post Bitcoin: $114 mln in old coins move, but bulls look unbothered appeared first on AMBCrypto. дальше »

2025-8-5 03:00 | |

|

|

$117M in BTC sold! - Will Bitcoin bulls defend $118K, if not, what next?

Key Takeaways Bitcoin hit $118.9K as a whale sold 1,000 BTC. On-chain data showed rising profit-taking from STHs and LTHs amid growing sell-side risk. Will BTC’s $120K target survive rising selThe post $117M in BTC sold! - Will Bitcoin bulls defend $118K, if not, what next? appeared first on AMBCrypto. дальше »

2025-7-13 00:00 | |

|

|

Bitcoin easily absorbs LTH exits - Is MicroStrategy’s 3% BTC share the reason?

Bitcoin absorbs LTH selling as Strategy tightens supply. July’s bullish track record and institutional demand hint at a potential breakout. Bitcoin [BTC] LTHs are steadily distributing theThe post Bitcoin easily absorbs LTH exits - Is MicroStrategy’s 3% BTC share the reason? appeared first on AMBCrypto. дальше »

2025-7-1 12:00 | |

|

|

Decoding XRP's rise: LTHs hold tight, all eyes on THIS price level!

Long-term XRP holders were accumulating, as on-chain liveliness drops and selling pressure declines. Positive Funding Rates and bullish technicals showed growing momentum, but short-term resistThe post Decoding XRP's rise: LTHs hold tight, all eyes on THIS price level! appeared first on AMBCrypto. дальше »

2025-6-10 12:00 | |

|

|

Bitcoin’s HODL level hits 2-year high: Are LTHs the key to BTC's next surge?

BTC's HODL level hits a 2-year high. Bitcoin accumulation score for 10-100 BTC and <1 BTC hits 1.0. Over the past two weeks, Bitcoin [BTC] has struggled to keep up its uptrend. The king cThe post Bitcoin’s HODL level hits 2-year high: Are LTHs the key to BTC's next surge? appeared first on AMBCrypto. дальше »

2025-6-6 04:00 | |

|

|

Bitcoin rallies, but STHs are dumping BTC! - THIS could be the reason

STH distribution spiked as Bitcoin rallies, signaling a potential market top and an upcoming correction post-October 2025. STH Realized Price hits $94.5K, diverging from LTHs, suggestinThe post Bitcoin rallies, but STHs are dumping BTC! - THIS could be the reason appeared first on AMBCrypto. дальше »

2025-5-26 21:00 | |

|

|

Bitcoin: 8,511 BTC moved on-chain: What LTHs are trying to show us

8.511 BTC, held for 3-5 years, was on the move. Bitcoin was experiencing a strong bullish momentum, setting the crypto up for more gains. Amid Bitcoin’s [BTC] price surge, long-terThe post Bitcoin: 8,511 BTC moved on-chain: What LTHs are trying to show us appeared first on AMBCrypto. дальше »

2025-5-22 03:00 | |

|

|

All about Bitcoin's LTHs, Metaplanet's purchase, and if you should be worried or not

Bitcoin LTHs are realizing approximately 85% profits right now Metaplanet bought 330 BTC, with their Bitcoin holdings climbing to 4855 BTC While Bitcoin [BTC] has struggled to maintain any uThe post All about Bitcoin's LTHs, Metaplanet's purchase, and if you should be worried or not appeared first on AMBCrypto. дальше »

2025-4-22 22:00 | |

|

|

Shiba Inu: 787T SHIB held by LTHs despite recent losses - Here's why

Shiba has declined by 8.4% over the past month. Shiba Inu's long-term holders remain optimistic with hodlers' balances and addresses hitting a new ATH. Despite increased downward preThe post Shiba Inu: 787T SHIB held by LTHs despite recent losses - Here's why appeared first on AMBCrypto. дальше »

2025-4-6 16:00 | |

|

|

Why Bitcoin’s $65k-$71k zone matters: Insights for long-term investors

Bitcoin’s support zone between $65,000 and $71,000 is key for LTHs, signaling strong demand An active realized price of $71,000 and true market mean at $65,000 reinforce Bitcoin's support zonThe post Why Bitcoin’s $65k-$71k zone matters: Insights for long-term investors appeared first on AMBCrypto. дальше »

2025-4-3 20:00 | |

|

|

SOPR ratio shows long term holders sold en masse last week

Bitcoin’s spent output profit ratio (SOPR) is calculated by dividing the SOPR of long-term holders (LTH-SOPR) by the SOPR of short-term holders (STH-SOPR). When elevated, it shows whether LTHs are realizing more profits than STHs, which can signal potential market tops. дальше »

2025-3-24 14:27 | |

|

|

'Fearful' Solana LTHs should count on THESE factors in the short term!

Long-term Solana holders are showing signs of fear, but these are the moments when smart money steps in SOL hit a new ATH in network adoption, with 11.09 million addresses now holding the tokenThe post 'Fearful' Solana LTHs should count on THESE factors in the short term! appeared first on AMBCrypto. дальше »

2025-3-23 23:00 | |

|

|

Ethereum's next steps - Long-term holder strength vs fall in network activity

Despite recent market turbulence, ETH LTHs have maintained their grip on the market ETH fees dropped by over 60% this week - A sign of falling on-chain activity Ethereum (ETH), at press timeThe post Ethereum's next steps - Long-term holder strength vs fall in network activity appeared first on AMBCrypto. дальше »

2025-2-2 05:00 | |

|

|

Bitcoin: LTHs ease sell pressure - What this means for BTC

Bitcoin’s Binary CDD and HODL Waves indicated that long-term holders were accumulating, easing market sell-side pressure. New triggers could drive its next major price movement. Bitcoin’The post Bitcoin: LTHs ease sell pressure - What this means for BTC appeared first on AMBCrypto. дальше »

2025-1-23 17:00 | |

|

|

Bitcoin holders clamp down on selling - Assessing its impact

Bitcoin’s LTHs are distributing slower, signaling a potential shift in market sentiment Historical trends suggest reduced LTH selling pressure often leads to upward price momentum Bitcoin'The post Bitcoin holders clamp down on selling - Assessing its impact appeared first on AMBCrypto. дальше »

2025-1-12 22:00 | |

|

|

Bitcoin LTHs start selling to STHs: Warning sign for BTC?

Long-term holders have started selling Bitcoin to short-term holders. Social media sentiment and crypto market news remained quite positive. Bitcoin's [BTC] historical data revealed significThe post Bitcoin LTHs start selling to STHs: Warning sign for BTC? appeared first on AMBCrypto. дальше »

2025-1-2 17:00 | |

|

|

Bitcoin LTHs cash out at 326% gains: Can new demand keep BTC stable?

Long-term Bitcoin holders cash out, locking in profits amid rising uncertainty. New investors, particularly via Bitcoin ETFs, play a crucial role in absorbing the increased supply. As BitcoiThe post Bitcoin LTHs cash out at 326% gains: Can new demand keep BTC stable? appeared first on AMBCrypto. дальше »

2024-12-11 07:00 | |

|

|

Litecoin Adds $1 Billion to Its Market Cap, LTHs Begin to Liquidate

Litecoin’s market cap has risen by $1 billion as LTHs liquidate their positions, yet bullish momentum suggests further price gains. The post Litecoin Adds $1 Billion to Its Market Cap, LTHs Begin to Liquidate appeared first on BeInCrypto. дальше »

2024-12-3 16:30 | |

|

|

Bitcoin LTHs Hit 5-Month High in Selling, but BTC’s Rally Stays Strong

Bitcoin is on the verge of breaking the $100,000 mark, but concerns about long-term holders taking profits could create short-term volatility. Despite this, the overall trend remains positive, with room for growth before any significant pullbacks. дальше »

2024-12-1 23:30 | |

|

|

What Bitcoin's future holds as THESE groups make opposite moves

Bitcoin LTHs sold 366k BTC, the highest level since April. BTC declined by 4.47% over the past 24 hours. Since hitting an ATH of $99800, Bitcoin [BTC] has experienced a decline to hit a locaThe post What Bitcoin's future holds as THESE groups make opposite moves appeared first on AMBCrypto. дальше »

2024-11-26 19:00 | |

|

|

ETH’s $3,200 test: Will Ethereum whales drive the rally or cause a setback?

Ethereum’s price surge to $3,200 draws attention to Ethereum whales and long-term holders. Increased whale activity could fuel further growth, but profit-taking by LTHs may limit upside. AThe post ETH’s $3,200 test: Will Ethereum whales drive the rally or cause a setback? appeared first on AMBCrypto. дальше »

2024-11-12 03:00 | |

|

|

Bitcoin exchange reserves drop below 2.6 million BTC in a volatile market

BTC LTHs are torn between selling and holding amidst price volatility. Bitcoin remained below $60,000 at press time. The recent increase in Bitcoin's [BTC] volatility is evident, as its pricThe post Bitcoin exchange reserves drop below 2. дальше »

2024-8-31 23:00 | |

|

|

Long-term holders currently possess more than 14 million BTC

Quick Take Recent data from Glassnode reveals significant insights into the behavior of Bitcoin holders, particularly those classified as long-term holders (LTHs) and short-term holders (STHs). LTHs, defined as investors who have held Bitcoin for more than 155 days, now control over 14 million BTC, which accounts for 71% of the circulating supply. дальше »

2024-8-30 13:40 | |

|

|

Is Dogecoin a Buy? Examining why LTHs are still betting on it

Dogecoin's market sentiment seemed far from bullish Memecoin's indicators hinted at a bearish takeover soon Dogecoin [DOGE] has been on some sort of rollercoaster ride with its volatile pricThe post Is Dogecoin a Buy? Examining why LTHs are still betting on it appeared first on AMBCrypto. дальше »

2024-7-21 01:00 | |

|

|

Long-Term Bitcoin Holders Resist Selling Amid Recent Highs — What This Signals

As Bitcoin flirts with its previous all-time highs, the celebrated ‘diamond hands’—a term in crypto parlance denoting long-term holders (LTHs)—are demonstrating notable restraint, selling their holdings at a rate notably lower than in previous bull markets. дальше »

2024-5-30 04:00 | |

|

|

Bitcoin market absorbs 1 million BTC in 5 months

Quick Take While Bitcoin currently trades approximately 20% below its all-time high, the more compelling narrative unfolds within the dynamic flow of coins between short-term holders (STHs) and long-term holders (LTHs) LTHs, holding Bitcoin for over 155 days, typically accumulate during bear markets and distribute during bulls. дальше »

2024-4-30 22:15 | |

|

|

Bitcoin’s long-term holders shift to accumulation

Quick Take Long-term holders (LTHs) are defined by Glassnode as investors holding Bitcoin (BTC) for 155 days or more. Renowned for their astute investment strategies, LTHs typically accumulate BTC during bear markets and sell during bull runs to generate profits. дальше »

2024-4-15 19:40 | |

|

|

How Bitcoin's hike above $72K changed investors like you

BTC’s recent price surge has led to a notable change in market sentiment. LTHs have started distributing their holdings for profit. Bitcoin’s [BTC] recent rally above the $72,000 price rThe post How Bitcoin's hike above $72K changed investors like you appeared first on AMBCrypto. дальше »

2024-3-14 12:30 | |

|

|

STHs transfer $2.6 billion at loss to exchanges, marking third highest since May 2022

Quick Take The market’s response to Bitcoin’s approximate 15% decline from just over $69,000 to roughly $59,500 showcases a clear distinction between long-term holders (LTHs), who have retained Bitcoin for more than 155 days, and short-term holders (STHs), whose holding period is less than 155 days. дальше »

2024-3-6 14:00 | |

|

|

Bullish signal for Bitcoin as realized price outpaces long-term holder cost

Quick Take Bitcoin is experiencing a bullish breakout, indicated by the realized price, the average cost at which all existing Bitcoins were last moved, surpassing the realized price for long-term holders (LTHs). дальше »

2023-11-10 14:00 | |

|

|

Bitcoin Long-Term Holders Stay Strong, Show Little Reaction To Crash

On-chain data shows that Bitcoin long-term holders have continued to hold strong recently as their exchange inflows have remained low. Bitcoin Long-Term Holder Supply Has Set A New All-Time High The “long-term holders” (LTHs) refer to all those investors who have been holding onto their coins since more than 155 days ago. Generally, the longer […] дальше »

2023-8-23 00:00 | |

|

|

Bitcoin bear market sees 4 million coins at a loss

Quick Take In the dynamic world of cryptocurrency, long-term holders (LTHs) of Bitcoin currently possess approximately 4 million coins that are held at a loss. This figure becomes notably significant when viewed through the prism of cyclical market movements. дальше »

2023-8-14 14:00 | |

|

|

Bitcoin decouples from risky assets: Good news for LTHs?

Bitcoin's 30-day correlation coefficient with TradFi bellwethers continued to be negative. Bitcoin's volatility relative to gold has been declining steadily over the past few years. SentimenThe post Bitcoin decouples from risky assets: Good news for LTHs? appeared first on AMBCrypto. дальше »

2023-8-6 00:30 | |

|

|

Bitcoin: LTHs and STHs may want to know this about their BTC holdings

CryptoQuant's latest analysis stated that short-term holders could make a profit upon selling their BTC. Despite a bearish front put forth by indicators, retail demand for BTC did witness a smaThe post Bitcoin: LTHs and STHs may want to know this about their BTC holdings appeared first on AMBCrypto. дальше »

2023-8-4 09:30 | |

|

|

Heavy accumulation puts 75% of Bitcoin’s circulating supply in profit

Despite the volatility Bitcoin experienced in 2023, the extended sideways movement between February and July has proved to be fertile ground for accumulation. Onchain analysis showed that short-term holders (STHs) and long-term holders (LTHs) had steadily accumulated throughout the past quarter, indicating a strong belief in the asset’s long-term value. дальше »

2023-7-12 20:00 | |

|

|

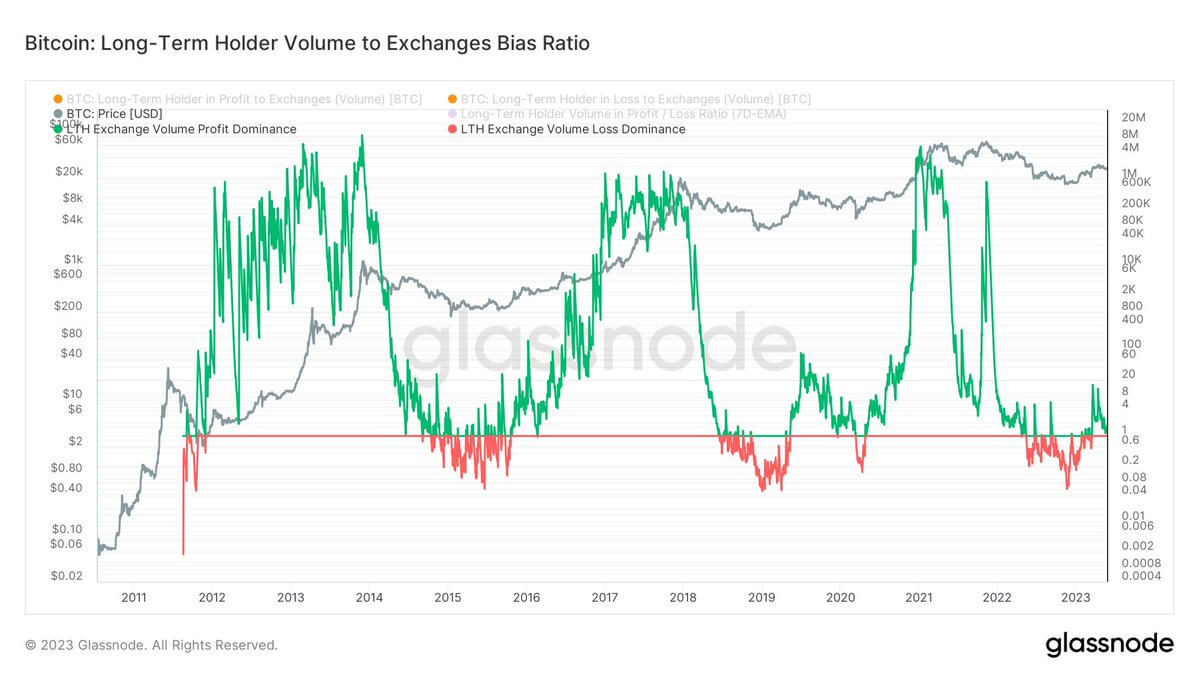

Long-term holders’ bias ratio hints at Bitcoin’s potential return to bull market

The Bitcoin Long-Term Holder (LTH) volume-to-exchanges bias ratio has been showing an interesting trend, with LTHs sending more coins in profit to exchanges compared to coins in loss. Currently, at a ratio of 1. дальше »

2023-5-25 20:32 | |

|

|

Bitcoin's total supply held by LTHs go up high, but here's the issue

Bitcoin's Total Supply held by Long-Term Holders continued to push toward new all-time highs. A significant number of HODLers remained confident in the BTC's long-term potential. Earlier thiThe post Bitcoin's total supply held by LTHs go up high, but here's the issue appeared first on AMBCrypto. дальше »

2023-5-1 17:30 | |

|

|

Long-term holders hit all-time high – roughly 5 months after FTX collapse

In this exclusive Alpha article, we reveal the impressive growth of Bitcoin's long-term holders (LTHs) and their impact on the market. Our analysis uncovers the record-breaking LTH supply and their recent accumulation activities. дальше »

2023-4-28 14:20 | |

|

|

A neutral BTC could mean a hold sign for LTHs, but will STHs see eye to eye?

BTC's NVT golden cross stood above the 2. 2 mark which wasn't a good sign for the king of cryptocurrencies. BTC's fear and greed index also stood in a neutral position at the time of writing. дальше »

2023-4-26 04:30 | |

|

|

Bitcoin long-term holders capitulate at levels seen during FTX collapse

Quick Take Bitcoin long-term holders (LTHs) are defined as investors who have held Bitcoin for longer than six months and are considered the smart money of the ecosystem. The post Bitcoin long-term holders capitulate at levels seen during FTX collapse appeared first on CryptoSlate. дальше »

2023-3-11 21:20 | |

|

|