Institutional - Свежие новости [ Фото в новостях ] | |

Bitcoin-backed loans with sub-prime-style incentives, but with liquidation triggers hit Wall Street

Ledn's $188 million securitization marks the moment Bitcoin-backed consumer credit started looking like mainstream asset-backed debt. Ledn Issuer Trust 2026-1 packages 5,441 fixed-rate balloon loans into rated, tradable notes with investment-grade and subordinated tranches, custody arrangements, liquidity reserves, and all the structural scaffolding that allows institutional investors to buy Bitcoin-linked yield without ever touching spot […] The post Bitcoin-backed loans with sub-prime-style incentives, but with liquidation triggers hit Wall Street appeared first on CryptoSlate. дальше »

2026-2-20 17:15 | |

|

|

Kalshi–Tradeweb Deal Signals Prediction Markets’ Push Into Institutional Macro Hedging

Embedding Kalshi data in Tradeweb first gives institutional desks a new signal layer for hedging and positioning, but direct trading integration would be structurally disruptive by letting fixed-income players hedge binary political and policy risks without synthetic workarounds. дальше »

2026-2-20 13:12 | |

|

|

Sharplink refreshes brand as ETH staking reaches $1.7 billion

Sharplink, a leading advocate for Ethereum-focused digital asset treasuries, announced a series of major milestones on Thursday that signify its rapid ascent in the institutional finance space. The company revealed that institutional ownership has surged to 46%, a record level… дальше »

2026-2-20 10:47 | |

|

|

Will Bitcoin price crash to $60k as bearish double top coincides with 5-week ETF outflows streak?

Bitcoin price has formed a highly bearish pattern that hints at a potential crash to $60K as both institutional and retail confidence continued to erode in the legacy crypto asset. According to data from crypto.news, Bitcoin (BTC) price fell to… дальше »

2026-2-20 10:46 | |

|

|

AAVE price defends $120 demand zone as RWA deposits cross $1B

AAVE is holding the $120 demand zone as real-world asset deposits on Aave cross $1 billion, indicating rising institutional demand. Aave (AAVE) was trading at $123 at press time, up 0.6% in the past 24 hours. The token sits near… дальше »

2026-2-20 09:33 | |

|

|

Cardano (ADA) Attracts Fresh Institutional Capital As Grayscale Expands Holdings

Cardano’s price may be in a downward action due to a weakening crypto environment, but there has been a resurgence in buying activity from both retail and institutional investors across the sector. This resurgence in buying activity is indicated by the steady purchase by Grayscale, one of the leading treasury companies in the world. Grayscale […] дальше »

2026-2-20 05:00 | |

|

|

Canton (CC) Price Outlook: The Burn Mechanism Is Getting Violent in 2026

The CC price is starting to pop up on more radars lately, and it’s not because of hype or memes. It’s because Canton is showing something rare in crypto right now: real deflation tied directly to institutional activity. дальше »

2026-2-20 01:30 | |

|

|

XRP sentiment hits a 5-week high as money rotates away from Bitcoin and Ethereum

XRP is attracting institutional money and a burst of bullish positioning, even as much of the crypto industry remains stuck in a risk-off tape. According to a CoinShares report, XRP is the best-performing crypto token this year, attracting around $150 million in fresh capital, while Bitcoin and Ethereum have registered cumulative outflows of around $1. дальше »

2026-2-20 22:35 | |

|

|

CME Group to launch 24/7 trading for crypto futures and options on May 29

CME crypto futures move to 24 7 trading on May 29 after record $3T in 2025 volume and rising institutional demand. The post CME Group to launch 24/7 trading for crypto futures and options on May 29 appeared first on Crypto Briefing. дальше »

2026-2-20 18:11 | |

|

|

Crypto companies being funded again sound great, until you trace where the money actually lands

Dragonfly Capital closed its fourth fund at $650 million this week, the same size as its 2022 vehicle, raised into a venture market Fortune calls a “mass extinction event. ” The headline reads like a vote of confidence: institutional capital returning, crypto winter thawing, alt season loading. дальше »

2026-2-20 15:30 | |

|

|

Crypto VC funding surging again sounds like a rally, until you trace where the money actually lands

Dragonfly Capital closed its fourth fund at $650 million this week, the same size as its 2022 vehicle, raised into a venture market Fortune calls a “mass extinction event. ” The headline reads like a vote of confidence: institutional capital returning, crypto winter thawing, alt season loading. дальше »

2026-2-20 15:30 | |

|

|

Polymarket Opens the Pipes: Public APIs and Permissionless Liquidity Mark Structural Shift

Polymarket US is rolling out public APIs and permissionless liquidity rewards to encourage deeper liquidity, tighter spreads, and more institutional participation. But there are tradeoffs. The post Polymarket Opens the Pipes: Public APIs and Permissionless Liquidity Mark Structural Shift appeared first on DeFi Rate. дальше »

2026-2-20 11:20 | |

|

|

World Liberty Financial to launch institutional RWA product

World Liberty Financial has unveiled plans to roll out an institutional-grade real-world asset product, starting with a tokenized investment linked to Trump International Hotel & Resort, Maldives. дальше »

2026-2-19 08:40 | |

|

|

Goldman Sachs CEO David Solomon says he holds Bitcoin

Goldman Sachs' CEO owning Bitcoin signals growing institutional acceptance, potentially influencing future regulatory and market dynamics. The post Goldman Sachs CEO David Solomon says he holds Bitcoin appeared first on Crypto Briefing. дальше »

2026-2-18 19:59 | |

|

|

Matt Hogan: Institutional adoption is ending the four-year cycle, Bitcoin halving is losing significance, and covered call strategies are reshaping investment | Empire

The traditional four-year cycle in crypto is becoming obsolete due to the influence of institutional adoption. Institutional investments in crypto have reached a staggering $15 trillion, indicating a major shift in market dynamics. дальше »

2026-2-18 19:20 | |

|

|

XRP Ledger activates permissioned DEX for regulated institutions on mainnet

The activation of a permissioned DEX on XRPL may enhance institutional blockchain adoption, bridging traditional finance with decentralized markets. The post XRP Ledger activates permissioned DEX for regulated institutions on mainnet appeared first on Crypto Briefing. дальше »

2026-2-18 18:31 | |

|

|

Bitcoin price at risk of hitting $50k, Coinbase premium sinks

Bitcoin price remained in a tight range this week, and the waning Coinbase Premium Index points to more downside as institutional demand wanes. дальше »

2026-2-18 17:19 | |

|

|

Grayscale debuts SUI Staking ETF on NYSE

The launch of GSUI may accelerate institutional adoption of digital assets, highlighting the growing importance of scalable blockchain solutions. The post Grayscale debuts SUI Staking ETF on NYSE appeared first on Crypto Briefing. дальше »

2026-2-18 16:00 | |

|

|

Crypto income is being sold on Wall Street but a discreet switch decides who gets in

Bitwise's February announcement arrived as two moves packaged as one. The crypto asset manager announced a partnership with Morpho to launch curated yield vaults and simultaneously acquired Chorus One's institutional staking business. дальше »

2026-2-19 15:30 | |

|

|

TradFi is selling crypto income on Wall Street but a hidden switch decides who gets in

Bitwise's February announcement arrived as two moves packaged as one. The crypto asset manager announced a partnership with Morpho to launch curated yield vaults and simultaneously acquired Chorus One's institutional staking business. дальше »

2026-2-18 15:30 | |

|

|

SUI token price prediction as Grayscale Sui Staking ETF begins trading today

The launch of the new Sui-focused exchange-traded product marks another step in institutional crypto expansion. Asset manager Grayscale Investments will begin trading its Sui Staking ETF today, offering investors regulated exposure to SUI along with staking rewards. Grayscale’s Sui staking… дальше »

2026-2-18 14:14 | |

|

|

Thai SEC clears BTC, crypto, carbon credits for derivatives

Thai SEC adds BTC and other digital assets plus carbon credits as eligible underlying assets for regulated derivatives, with TFEX to design crypto-linked contracts to attract institutional traders and support ETF-like products. дальше »

2026-2-18 13:02 | |

|

|

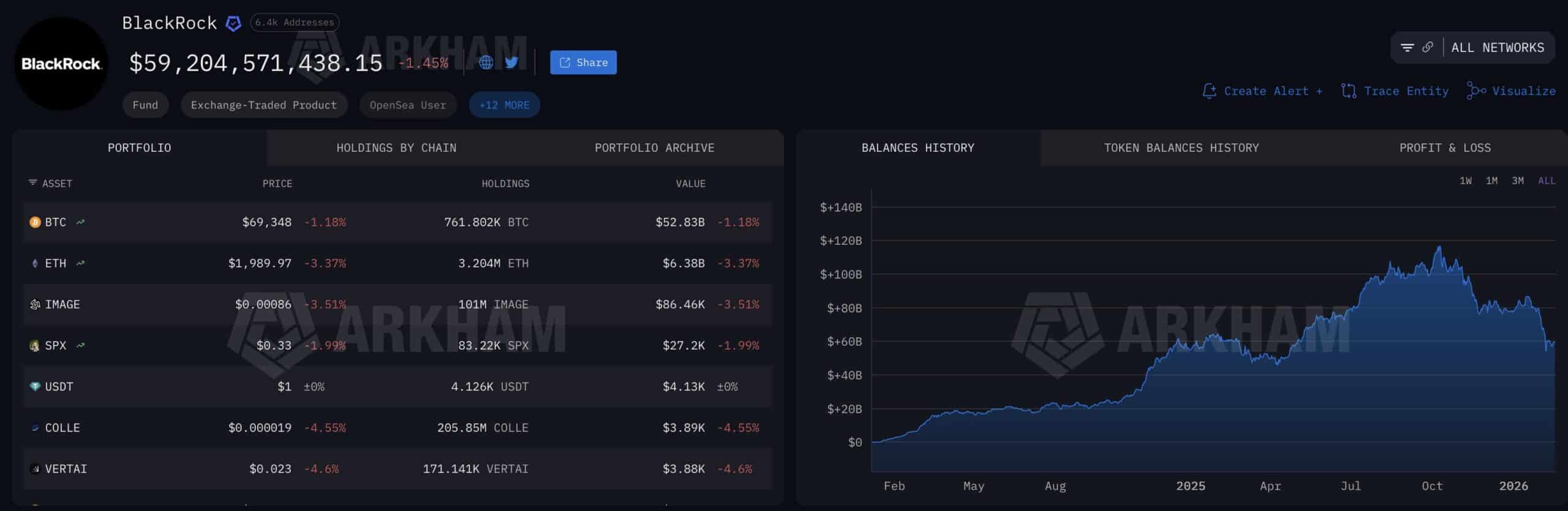

Bitcoin: Corporations rush to secure BTC - So why is price still falling?

Bitcoin entered 2026 under clear pressure. Institutional balance sheets expanded, but price momentum faded. By February 2026, Bitcoin was already down more than 20% for the quarter. That put Q1 on The post Bitcoin: Corporations rush to secure BTC - So why is price still falling? appeared first on AMBCrypto. дальше »

2026-2-18 00:30 | |

|

|

Fireplace Raises $1.5M to Build Institutional Trading Infrastructure for Prediction Markets

PRNewswire, PRNewswire, 17th February 2026, Chainwire The post Fireplace Raises $1.5M to Build Institutional Trading Infrastructure for Prediction Markets appeared first on CaptainAltcoin. дальше »

2026-2-18 22:37 | |

|

|

Centrifuge and Pharos partner to expand onchain distribution infrastructure for institutional assets

Centrifuge and Pharos team up to enable tokenized U.S. Treasuries and AAA-rated credit products via shared onchain infrastructure. Centrifuge and Pharos have announced a partnership focused on enabling institutional assets to be distributed and operated onchain through a shared infrastructure… дальше »

2026-2-18 20:50 | |

|

|

Kevin O’Leary points to quantum risk in Bitcoin price outlook

Kevin O’Leary says quantum risks are capping institutional Bitcoin exposure near 3% as BIP-360 proposes a new P2MR output to harden the network’s security. Billionaire entrepreneur and investor Kevin O’Leary said security risks posed by quantum computers are preventing institutional… дальше »

2026-2-18 13:42 | |

|

|

Standard Chartered slashes XRP price target by 65% as whales send millions of tokens to Binance

XRP is sliding even as the XRP Ledger (XRPL) rolls out features that supporters have long framed as a bridge to institutional adoption. According to CryptoSlate's data, the token has been trading around $1. дальше »

2026-2-18 13:24 | |

|

|

Wintermute adds tokenized gold to institutional OTC desk

Wintermute has rolled out institutional over-the-counter trading for tokenized gold, marking its entry into digital commodities amid rising interest in asset-backed tokens. The firm said on Feb. 16 that its OTC desk now supports trading in Pax Gold and Tether… дальше »

2026-2-18 07:32 | |

|

|

XRP Ledger Positioned At The Heart Of Japan’s Next Financial Transformation

With a strong regulatory environment, proactive institutional participation, and a growing appetite for blockchain-powered financial solutions, Japan is positioning itself at the forefront of next-generation finance, and XRPL is increasingly becoming central to that vision. дальше »

2026-2-17 02:30 | |

|

|

Harvard Management Company Rebalances Crypto Portfolio

Institutional capital rotation is once again reshaping the digital asset landscape, and the latest move from Harvard Management Company underscores how rapidly strategies are evolving. In its latest quarterly disclosure, the endowment trimmed its exposure to Bitcoin exchange-traded funds while simultaneously opening a significant position in an Ethereum-focused vehicle. дальше »

2026-2-18 19:20 | |

|

|

XRP Outpaces Top Assets With $33.4 Million Inflow as Investors Rotate out of Bitcoin

XRP outpaces Bitcoin with $33.4 million in institutional inflows despite crypto ETP market outflows. Discover how regional demand in Europe is driving XRP's price resilience at the $1.40s. дальше »

2026-2-17 18:04 | |

|

|

Morning Crypto Report: Europe Leads Ripple USD Activity on XRP Ledger, Dormant Ethereum Wallet With 6,335x Profit Fails 1 ETH Deposit, Solana Records $31 Million Weekly ETF Inflows Amid 'Buoyant' Sentiment

Monday Morning Crypto Report: Europe leads Ripple USD on XRPL, while a dormant Ethereum ICO whale nets 6,335x profit. Plus, Solana ETFs see $31 million inflows as institutional demand stays "buoyant.". дальше »

2026-2-17 15:56 | |

|

|

Shining in Hong Kong: HTX Ventures and HTX DAO Attend Consensus 2026, Advancing a Sustainable Web3 Ecosystem

PANAMA CITY, Feb. 14, 2026 /PRNewswire/ — Consensus Hong Kong 2026 was successfully held from February 11-12, bringing together global blockchain leaders, developers, and institutional investors. дальше »

2026-2-15 19:07 | |

|

|