Depeg - Свежие новости [ Фото в новостях ] | |

Solana’s USX Depeg Sparks Fresh Stablecoin Liquidity Fears

Solana-based stablecoin USX briefly lost its dollar peg due to a secondary market liquidity drain, dropping as low as $0.10. The post Solana’s USX Depeg Sparks Fresh Stablecoin Liquidity Fears appeared first on Coinspeaker. дальше »

2025-12-26 15:34 | |

|

|

Liquidity drain causes Solana-based USX stablecoin to depeg to $0.1

The Solana ecosystem is facing fresh turbulence after USX stablecoin, a synthetic stablecoin issued by Solstice, suffered a sharp but temporary depeg on secondary markets. The incident has reignited concerns around liquidity management, even as the issuer and independent analysts stress that USX’s collateral backing remained intact. дальше »

2025-12-26 15:09 | |

|

|

Yala’s Bitcoin-Backed Stablecoin Plunges Again as Old Exploit Resurfaces

Yala’s Bitcoin-backed stablecoin, $YU, has fallen to $0. 42, marking its second sharp depeg in a single night. The drop follows warnings of bridge vulnerabilities, abnormal borrowing stress, and renewed doubts about the asset’s real backing. дальше »

2025-11-18 13:18 | |

|

|

Tether at $500 billion would outsize Bank of America — but one depeg can jolt crypto 39x faster

Would Tether’s push toward half a trillion, bigger than Bank of America, survive when one slip shakes crypto 39 times harder? Tether reportedly aims for a $500 billion valuation On Sep. 24, Bloomberg reported that Tether Holdings, the issuer of… дальше »

2025-9-24 20:26 | |

|

|

Synthetix founder urges stakers to act as sUSD depeg persists

As sUSD continues to trade below its intended $1 peg, Synthetix founder Kain Warwick has urged stakers to step up and help restore stability before more stringent measures are implemented. The depeg has stretched on for weeks, triggered by recent… дальше »

2025-4-22 11:15 | |

|

|

Tether Denies Reports Of U.S. Investigation Amid Minor USDT Depeg

The Wall Street Journal recently reported that U. S. authorities are investigating Tether, the issuer of the stablecoin USDT. However, Tether’s CEO swiftly denied these claims on the platform X (formerly Twitter). дальше »

2024-10-29 13:13 | |

|

|

Crypto whale loses $36M in major phishing scam causing DETH depeg

Blockchain security firm Scam Sniffer reported that a crypto whale’s address was drained of 15,079 fwDETH, worth approximately $36 million, in a phishing scam. Data from Arkham Intelligence suggest that the phished address might be linked to the venture firm Continue Capital. дальше »

2024-10-11 12:25 | |

|

|

ezETH depeg puts ETH restaking volatility into the limelight

Renzo's ezETH suffers a severe price drop and high trading volume as the liquid restaking market faces volatility and liquidations. The post ezETH depeg puts ETH restaking volatility into the limelight appeared first on Crypto Briefing. дальше »

2024-4-27 20:28 | |

|

|

Renzo Protocol rethinks strategy after $60M in liquidations

Renzo’s ezETH depeg led to massive liquidations following backlash on its tokenomics. The protocol has amended the tokenomics following massive backlash. On Tuesday, 24th April, Renzo The post Renzo Protocol rethinks strategy after $60M in liquidations appeared first on AMBCrypto. дальше »

2024-4-25 16:45 | |

|

|

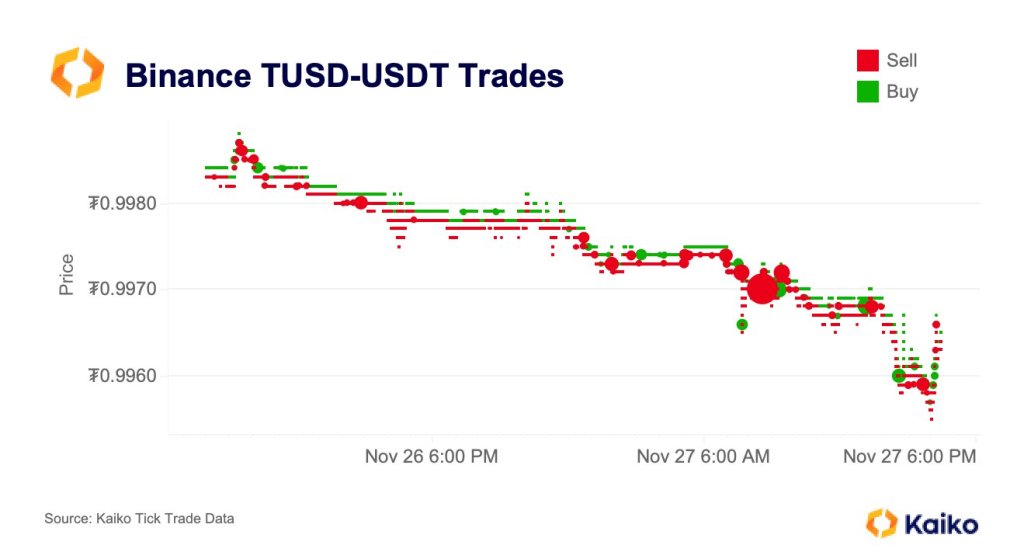

$3.1 Billion TUSD Stablecoin Shaky, Briefly Depegs—What’s Happening?

TrueUSD (TUSD), a stablecoin with a market cap exceeding $3. 1 billion, appears “shaky” and briefly depegged on November 22, dropping to as low as $0. 9976 before restoring its peg. The temporary depeg was attributed to a deluge of selling orders, according to Kaiko, a blockchain analytics firm. дальше »

2023-11-28 06:00 | |

|

|

Citadel Securities accused by Terraform of acting in ‘bad faith’ over UST depeg incident

The legal fight between Terraform Labs and Citadel Securities over the 2022 UST stablecoin issue presents a complicated situation filled with accusations, calling for a careful and unbiased review to find out what really happened. дальше »

2023-10-27 00:01 | |

|

|

Terraform Labs’ New Filing Reveals Who Was Responsible For The May 2022 UST Stablecoin Depeg Catastrophe

In an intriguing disclosure, Do Kwon-co-created Terraform Labs has held trading firm Citadel Securities responsible for causing its so-called algorithmic TerraUSD (UST) stablecoin to lose its peg to the U.S. dollar in 2022. дальше »

2023-10-16 01:49 | |

|

|

Terraform Labs Asks Court To Compel Citadel To Provide Data Relating To UST Depeg

In a bid to defend itself against the “complex cryptocurrency action” brought against it by the US Securities and Exchange Commission (SEC), Terraform Labs has once again filed a motion against Citadel Securities, asking the court to compel the market maker to provide certain documents. дальше »

2023-10-14 16:00 | |

|

|

Depeg crisis of real estate-backed USDR stablecoin deemed terminal as protecting users ‘impossible’

TangibleDAO will discontinue its real estate-backed USDR stablecoin stablecoin project after it depegged on Oct. 11. In an Oct. 12 post on X (formerly Twitter), the project said the stablecoin has too many attack vectors in its design, and measures designed to protect its users were easily manipulated. дальше »

2023-10-12 15:30 | |

|

|

USDT: Deciphering the depegging mystery amid declining volatility

USDT depeg sheds light on the other side of the coin as low volatility reveals impact. USDT remains in good spirits in terms of utility despite depegging concerns. Stablecoin depegs are a coThe post USDT: Deciphering the depegging mystery amid declining volatility appeared first on AMBCrypto. дальше »

2023-9-2 08:30 | |

|

|

Despite USDT’s recent depeg, Tether’s market share is larger than it’s ever been

Tether (USDT) recently lost its peg to the U.S. dollar. Although USDT is the most valuable stablecoin by market cap, the market turbulence did not spare the asset. Last week, USDT depegged below $1 and stayed below the $1 peg for the longest time since the collapse of FTX, before making a recovery at the […] дальше »

2023-8-15 22:30 | |

|

|

USDT holds firm despite latest depeg

USDT has been depegging since 4 August. The stablecoin has maintained its market cap despite the depeg. Since 4 August, Tether [USDT] has been in the throes of a depegging event. According tThe post USDT holds firm despite latest depeg appeared first on AMBCrypto. дальше »

2023-8-8 14:30 | |

|

|

Multichain Failure Hits Fantom DeFi: Assets Depeg Amid TVL Decline

The cross-chain protocol Multichain's issues have disrupted Fantom's decentralized finance (DeFi) operations, causing asset depegging and project closures. Fantom's total value locked (TVL) has dropped by over 80%. дальше »

2023-7-17 19:23 | |

|

|

Tether addresses depeg fears as Binance.US faces 8% Bitcoin discount

Bitcoin (BTC) and other digital assets, including Tether (USDT), are currently trading at an 8% discount on Binance. US, a situation attributed to liquidity issues on the platform following a lawsuit filed by the U. дальше »

2023-7-10 12:40 | |

|

|

Lido maintains its top spot in DeFi as MakerDAO dawdles

Within six months, Lido's TVL has doubled that of MakerDao. DAI's supply has trended downwards since the temporary depeg in March. According to data from DefiLlama, Lido [LDO] currently holdThe post Lido maintains its top spot in DeFi as MakerDAO dawdles appeared first on AMBCrypto. дальше »

2023-7-2 12:30 | |

|

|

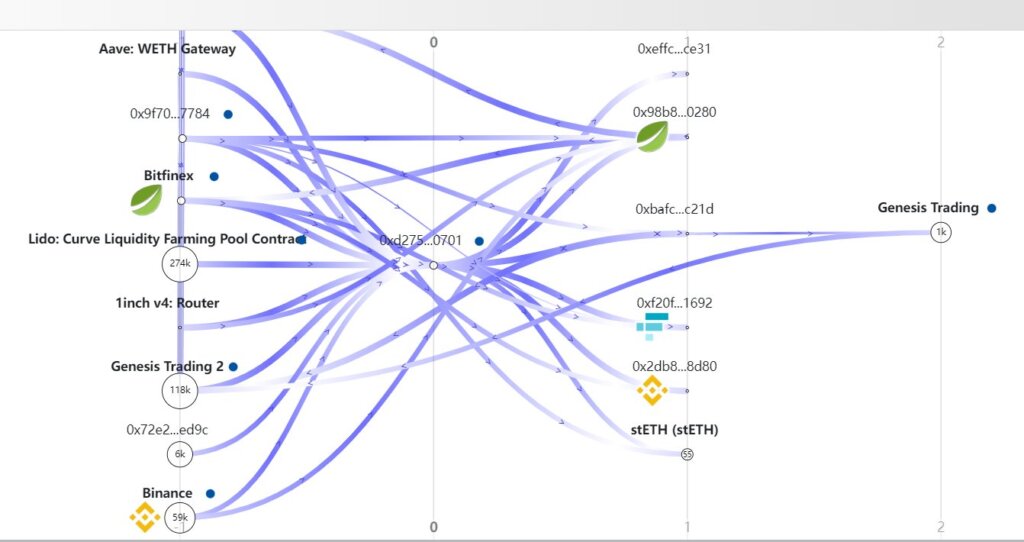

Mysterious whale ‘0xd275e’ linked to FTX collapse, Tether depeg, and recent $75M token transfers

Recent on-chain activity involving the Ethereum address ‘0xd275e‘ has caught the attention of the crypto community. Through CryptoSlate‘s on-chain analysis, no concrete evidence pointing to the owner of the account has been discovered. дальше »

2023-6-21 20:33 | |

|

|

USDT depeg sends shivers through traders, but its dominance sustains

USDT's depegging incident rattles traders with significant market impact and increased activity. Despite the depegging, USDT maintains dominance with the largest market cap. As per reports aThe post USDT depeg sends shivers through traders, but its dominance sustains appeared first on AMBCrypto. дальше »

2023-6-17 05:30 | |

|

|

Here Are The Facts On-Chain Data Reveals About Tether’s Depeg

The largest stablecoin in the cryptocurrency, Tether (USDT), recently lost its $1 peg. Here are some facts that on-chain data reveals about this event. Several On-Chain Indicators Spiked While Tether Suffered A Depeg In the past couple of days, USDT became decoupled from its $1 peg as the stablecoin’s value plunged to $0.996. Since then, […] дальше »

2023-6-17 19:00 | |

|

|

Tether CTO calls USDT depeg ‘good stress test’ for company

Paulo Ardoino said the Tether “attack” was a good stress test but is now “dying off. ” Tether (USDT) moved from a low of $0. 99579 on June 15, reaching a local top of $0. 99976 later in the day – recovering its de-pegged position. дальше »

2023-6-16 13:30 | |

|

|

USDT Depeg Was a Planned Attack on Tether, Says CTO Paolo Ardoino

In response to USDT's deviation from its dollar peg, Tether's CTO Paolo Ardoino has categorically labeled the incident as a planned attack, while underscoring Tether's commitment to protect its community and uphold transparency. дальше »

2023-6-16 01:56 | |

|

|

Stablecoins are shaky as USDT shows signs of depeg

As the crypto market’s volatility continues, the total stablecoin market capitalization declined by 0.25% over the past 24 hours, with an average price change of 0.71%. The downward movement comes after the largest stablecoin by market cap, USDT, shows signs… дальше »

2023-6-15 10:58 | |

|

|

Stablecoin TrueUSD Struggles: Depeg Causes Turmoil in Crypto Market

In a surprising development, TrueUSD (TUSD) has deviated from its US Dollar peg, creating ripples in the crypto market and raising questions about the stability of stablecoins. The post Stablecoin TrueUSD Struggles: Depeg Causes Turmoil in Crypto Market appeared first on BeInCrypto. дальше »

2023-6-10 09:24 | |

|

|

What happened to Terra Luna: one year after collapse

In May 2022, the crypto community was shattered by the crash of the Terra ecosystem. One year after, we are reconstructing the events, from luna’s depeg to Terraform CEO Do Kwon becoming a criminal. Terra and its sibling token LUNA… дальше »

2023-6-5 10:12 | |

|

|

Uniswap V3 liquidity grew 208% in Q1 as Coinbase and Binance saw declines: CCData report

Uniswap V3 recorded a 208% jump in liquidity in Q1. Coinbase and Binance saw declines of – 6. 35% and -13. 4% respectively amid regulatory pressures. The depeg of USDC and collapse of Silicon Valley Bank also highlighted the pressure events in the quarter. дальше »

2023-4-15 20:54 | |

|

|

Though USDC regains market confidence, this area still concerns investors

USDC's market cap dropped to 18-month lows as depeg impact extended. The demand for the stablecoin saw some recovery fueled by demand in smart contracts. Circle [USDC] experienced robust outThe post Though USDC regains market confidence, this area still concerns investors appeared first on AMBCrypto. дальше »

2023-4-3 01:30 | |

|

|

MakerDAO Maintains Trust In USDC Despite Depeg Debacle

MakerDAO, the governance community of the popular DeFi lending platform Maker, has decided to keep using USD coin (USDC) as the primary reserve asset for the DAI stablecoin. Although USDC experienced a temporary depeg earlier this month, an overwhelming majority of the MakerDAO have chosen to retain their faith in the world’s second-largest stablecoin, dismissing any other viable options. дальше »

2023-3-26 07:15 | |

|

|

How The USDC Depeg Will Impact DeFi, Expert Explains

Following the closure of Silicon Valley Bank (SVB), the value of the world’s fifth-largest cryptocurrency, USD Coin (USDC), plummeted to an all-time low on Saturday. The U. S. -based company behind the coin, Circle, revealed that $3. дальше »

2023-3-16 02:00 | |

|

|

House Financial Chair Puts Skids on Stablecoin Regulation After USDC Depeg

Rep. Maxine Waters said in a recent interview that she would prioritize the passage of a stablecoin bill after the depegging of USDC last week. The post House Financial Chair Puts Skids on Stablecoin Regulation After USDC Depeg appeared first on BeInCrypto. дальше »

2023-3-16 23:20 | |

|

|

Tether: How Its $2 Billion USDT Minting Impacts Ethereum’s Success In The Bull Market

Despite recent negative developments in the crypto market, the sentiment seemed to be somehow bullish as Tether, its stablecoin and some major cryptos show resilience in the past couple of days. The collapse of major banks has significantly impacted the stablecoin market, with Circle’s USDC suffering a depeg causing smart money to flee USDC in favor of other stablecoins. дальше »

2023-3-16 22:28 | |

|

|