Contracts - Свежие новости [ Фото в новостях ] | |

CME Group to launch 24/7 crypto futures and options trading

CME Group, the world’s largest regulated derivatives marketplace, announced plans to begin 24-hour, seven-day-a-week trading of its cryptocurrency futures and options contracts on May 29, 2026, pending regulatory review. дальше »

2026-2-20 08:37 | |

|

|

Ethereum Makes History With Majority Of Supply Staked – What It Means For Price And Network

While buying interest in Ethereum may be losing momentum, the staking ecosystem has been experiencing significant growth over the past few months. Following a period of steady rise, the quantity of ETH locked away in staking contracts has reached a critical landmark that could impact its market outlook. Over Half Of All Ethereum Now Staked […] дальше »

2026-2-20 03:00 | |

|

|

OpenAI and Paradigm launch smart contract security evaluation system

OpenAI has introduced a new system called EVMbench, designed to measure how well artificial intelligence agents can find and fix security flaws in crypto smart contracts. The company announced on Feb. дальше »

2026-2-19 08:15 | |

|

|

Jeffrey Quesnelle: Centralization in AI is stifling innovation, how decentralization can democratize access, and the critical role of smart contracts in AI training | Raoul Pal

Centralization in the AI industry is driven by the concentration of capital in large companies. Decentralization technologies can address both funding and operational challenges in AI. Crypto rails enable permissionless access to computing resources, enhancing decentralization. дальше »

2026-2-20 23:55 | |

|

|

OpenAI launches benchmarking system for securing crypto tokens and smart contracts

OpenAI launches EVMbench with Paradigm to test AI on smart contract vulnerabilities and commits $10M to cybersecurity research. The post OpenAI launches benchmarking system for securing crypto tokens and smart contracts appeared first on Crypto Briefing. дальше »

2026-2-18 22:52 | |

|

|

Bitwise Joins Roundhill in Race to Launch US Election Prediction ETFs

Bitwise filed with the SEC to launch 2028 US election ETFs under its new PredictionShares brand, joining Roundhill and GraniteShares in the race to bring political outcome contracts to NYSE Arca. The post Bitwise Joins Roundhill in Race to Launch US Election Prediction ETFs appeared first on DeFi Rate. дальше »

2026-2-18 17:30 | |

|

|

Thai SEC clears BTC, crypto, carbon credits for derivatives

Thai SEC adds BTC and other digital assets plus carbon credits as eligible underlying assets for regulated derivatives, with TFEX to design crypto-linked contracts to attract institutional traders and support ETF-like products. дальше »

2026-2-18 13:02 | |

|

|

Justin Huhn: Uranium market tightening signals long-term utility contracts, potential squeeze on prices, and the disconnect between fundamentals and spot prices | Macro Voices

The uranium market is experiencing a tightening trend, potentially shifting back to long-term utility contracting. Trimming positions is a strategic move after significant gains in uranium stocks. дальше »

2026-2-18 03:40 | |

|

|

Robinhood Q4 Earnings Show Prediction Markets Gaining Structural Importance

Robinhood ($HOOD) earnings report showed 12 billion event contracts traded in 2025 as the exchange continues its quest to build the "Financial SuperApp." The post Robinhood Q4 Earnings Show Prediction Markets Gaining Structural Importance appeared first on DeFi Rate. дальше »

2026-2-12 06:18 | |

|

|

Nevada Rep Targets Federal Prediction Market Ban Amid Democrat-Led Charge

Rep. Titus announced a bill to prohibit sports event contracts as Nevada battles Kalshi and others. The push is clearly partisan: Democrats are driving legislative efforts to restrict the industry. дальше »

2026-2-12 22:34 | |

|

|

SFC greenlights crypto margin lending and perpetual trading in Hong Kong

Hong Kong is widening the scope of regulated crypto activity as its market enters a new phase of development. The Securities and Futures Commission said on Wednesday it will allow licensed brokers to offer virtual asset margin financing and set out a framework for perpetual contracts on licensed trading platforms. дальше »

2026-2-12 15:20 | |

|

|

Cardano: Why CME’s ADA futures sparked 3% drop instead of a rally

Cardano [ADA] is back in the headlines. On the 9th of February 2026, CME Group launched futures contracts for ADA, Chainlink [LINK], and Stellar [XLM], expanding regulated access to altcoin derivativeThe post Cardano: Why CME’s ADA futures sparked 3% drop instead of a rally appeared first on AMBCrypto. дальше »

2026-2-11 01:00 | |

|

|

Interactive Brokers Adds Nano Bitcoin Futures Via Coinbase Derivatives

Bitcoin Magazine Interactive Brokers Adds Nano Bitcoin Futures Via Coinbase Derivatives Interactive Brokers now offers nano Bitcoin futures via Coinbase Derivatives, providing smaller, lower-risk, and perpetual-style contracts to broaden regulated crypto access for its clients. дальше »

2026-2-11 19:12 | |

|

|

Bitcoin ETFs Extend Inflow Streak as Institutional Capital Rotates Into $HYPER

What to Know: Spot Bitcoin ETFs continue to see consistent net inflows, creating a supply shock that historically precedes capital rotation into infrastructure altcoins. Bitcoin Hyper differentiates itself by integrating the Solana Virtual Machine (SVM) to bring high-speed, programmable smart contracts to the Bitcoin network. дальше »

2026-2-10 12:54 | |

|

|

Saylor Buys $90M-Worth of Bitcoin Amidst Full Market Crash, While $HYPER Breaks Records

What to Know: MicroStrategy purchased an additional $90M in Bitcoin during the market crash, signaling strong institutional conviction despite bearish retail sentiment. Bitcoin Hyper utilizes the Solana Virtual Machine (SVM) to bring high-speed smart contracts and sub-second finality to the Bitcoin network. дальше »

2026-2-9 16:50 | |

|

|

OpenClaw AI Faces Poisoned Plugins Crisis as SUBBD Token’s Presale Over-Performs

What to Know: The OpenClaw ‘poisoned plugin’ incident reveals critical security flaws in Web2 AI agent architectures. Investors are pivoting toward decentralized AI solutions that offer verifiable security and immutable smart contracts. дальше »

2026-2-9 16:08 | |

|

|

Strategy’s Stock Surges by 26% as Bitcoin Hyper Presale Accelerates

What to Know: Strategy’s recent 26% stock surge indicates a high-beta rotation, signaling increased market appetite for leveraged Bitcoin infrastructure plays. Bitcoin Hyper uses the Solana Virtual Machine (SVM) to bring sub-second transaction speeds and Rust-based smart contracts to the Bitcoin network. дальше »

2026-2-9 15:21 | |

|

|

What caused the Feb 5 crypto crash? Bitwise advisor explains

Bitwise advisor Jeff Park attributed the February 5 crypto selloff to multi-asset portfolio deleveraging rather than crypto-specific factors. IBIT recorded 10 billion in trading volume, doubling its previous high, while options activity hit historic levels led by put contracts rather… дальше »

2026-2-9 19:00 | |

|

|

Kalshi Super Bowl Promo Code DEFI – $10 Free on SEA vs. NE

Super Bowl LX kicks off tomorrow at 6:30 p. m. ET as the Seattle Seahawks take on the New England Patriots at Levi’s Stadium in Santa Clara. Super Bowl LX has more contracts and prop bets than any game in history. дальше »

2026-2-8 00:39 | |

|

|

Kalshi Super Bowl Promo Code DEFI for $10 on Seahawks vs. Patriots

Super Bowl LX kicks off tomorrow at 6:30 p. m. ET as the Seattle Seahawks take on the New England Patriots at Levi’s Stadium in Santa Clara. Super Bowl LX has more contracts and prop bets than any game in history. дальше »

2026-2-7 21:43 | |

|

|

Sleeper Adds Kalshi Prediction Markets Days Before Super Bowl

Fantasy sports platform begins rolling out federally regulated event contracts following NFA approval and CFTC lawsuit withdrawal The post Sleeper Adds Kalshi Prediction Markets Days Before Super Bowl appeared first on DeFi Rate. дальше »

2026-2-7 22:22 | |

|

|

Bitcoin options worth $2.1B set to expire today: Will BTC price fall back towards $60K?

Bitcoin price entered Friday under pressure as $2.1 billion in options contracts approach expiry. Bitcoin is facing another key test as a large batch of derivatives contracts reaches maturity. Bitcoin options worth about $2.1 billion are set to expire at… дальше »

2026-2-6 11:52 | |

|

|

Coinbase faces legal action in Nevada over prediction markets

Nevada’s Gaming Control Board has filed a civil enforcement action against Coinbase over wagers on sports event contracts. According to a Feb. 3 press release from the board, Coinbase, through its prediction market products, may be offering unlicensed wagers on… дальше »

2026-2-4 11:30 | |

|

|

Hyperliquid (HYPE) Jumps 76% in 2 Weeks as HIP-4 Launch Nears — Is More Upside Left?

Hyperliquid has recorded a sharp price surge as anticipation builds around the launch of HIP-4. HYPE has rallied strongly in recent sessions, driven by interest in fully collateralized outcome contracts. дальше »

2026-2-4 22:00 | |

|

|

Hyperliquid launches ‘Outcome Trading’ testnet for prediction markets

Hyperliquid has launched Outcome Trading testnet, introducing fully funded contracts for prediction markets and event-based trading. Hyperliquid announced on Feb. 2 that it has launched “Outcome Trading” on its testnet under Hyperliquid Improvement Proposal 4. The new feature allows users… дальше »

2026-2-3 06:46 | |

|

|

Hyperliquid Announces Support for ‘Outcomes’ Prediction Market Contracts

Hyperliquid introduces HIP-4 protocol supporting Outcomes prediction market contracts. The new feature is currently in testnet phase before mainnet deployment. The post Hyperliquid Announces Support for ‘Outcomes’ Prediction Market Contracts appeared first on Coinspeaker. дальше »

2026-2-3 21:50 | |

|

|

Coinbase Launches Prediction Markets in the U.S., Turning Sports, Politics, and Crypto into Trades

Key Takeaways: Coinbase officially introduced the managed prediction markets for U. S. users via Coinbase Financial Markets. Traders can buy “Yes” or “No” contracts in various fields such as sports, crypto, The post Coinbase Launches Prediction Markets in the U. дальше »

2026-2-3 21:49 | |

|

|

Bitcoin Slides As Dollar Liquidity Contracts Sharply

Global crypto markets are showing fresh signs of stress as Bitcoin (BTC) and Ethereum (ETH) prices tumble amid tightening U. S. dollar liquidity. Crypto asset prices are not moving in isolation, they are responding to macroeconomic shifts that are reshaping risk assets around the world. дальше »

2026-1-31 19:36 | |

|

|

CFTC chair signals clearer rules for prediction markets, lawful innovation

The Commodity Futures Trading Commission will draft clear standards for prediction markets and withdraw proposals that would prohibit political and sports-related event contracts, Chair Michael S. Selig said Thursday. дальше »

2026-1-31 10:59 | |

|

|

Bitcoin sell-off ripples through altcoins as market cap contracts

Bitcoin’s slide below $85,000 has triggered broad weakness across major altcoins, with market data showing losses extending beyond BTC into the broader market. While short-term price action hasThe post Bitcoin sell-off ripples through altcoins as market cap contracts appeared first on AMBCrypto. дальше »

2026-1-30 02:56 | |

|

|

Polkadot’s smart contracts hub is live, but DOT remains stuck - Why?

Polkadot [DOT] has rolled out its native smart contracts hub, a big step for the network. Has this influenced the native token's price at all? Polkadot's smart contracts hub goes live The post Polkadot’s smart contracts hub is live, but DOT remains stuck - Why? appeared first on AMBCrypto. дальше »

2026-1-29 04:00 | |

|

|

Hyperliquid becomes 'most liquid venue for crypto price discovery'- What does it mean?

Hyperliquid has recorded remarkable traction in equity and crypto perpetuals (perps). Perps are contracts that allow traders to speculate on price movements without a fixed maturity. The recentlyThe post Hyperliquid becomes 'most liquid venue for crypto price discovery'- What does it mean? appeared first on AMBCrypto. дальше »

2026-1-27 19:00 | |

|

|

DOGEBALL Presale 2026: The Best New Crypto Presale to Join With 50x Potential

DOGEBALL presale 2026 offers a live ETH L2 gaming blockchain, playable game, audited contracts, and 50x potential before its $0.015 launch. дальше »

2026-1-27 14:30 | |

|

|

Crypto Charts are Down, But Bitcoin Price Bets Surge on Polymarket

Prediction markets are seeing heavy activity on crypto price outcomes. Tens of millions in volume have been spent on Bitcoin’s January price alone, alongside high-volume contracts for Ethereum, XRP, and Solana. дальше »

2026-1-27 23:14 | |

|

|

Matcha Meta Suffers $16.8 Million Drain In SwapNet Exploit

Decentralized trading platform Matcha Meta is reeling after a major security incident involving its SwapNet contracts led to an estimated $16.8 million in stolen assets. Blockchain security firm PeckShield first flagged the exploit, revealing that the attacker rapidly converted large portions of the stolen funds into Ethereum before beginning to bridge the assets across chains. [...] дальше »

2026-1-28 19:39 | |

|

|

An On-Chain DEX Aggregator Just Lost $17 Million in Major Smart Contract Attack

On-chain decentralized exchange (DEX) aggregator, SwapNet, has suffered a major smart contract exploit that drained nearly $16. 8 million in crypto assets. The incident highlights persistent security risks tied to token approvals and third-party routing contracts in decentralized finance (DeFi). дальше »

2026-1-26 08:21 | |

|

|

Why Chainlink’s CCIP Is Turning LINK Into a Financial Infrastructure Play

For a long time, Chainlink was mainly known as “the oracle project,” the network that feeds real-world data into smart contracts. But that description no longer really fits. Based on the tweet Altcoin Buzz shared, Chainlink is now shifting into something much bigger, positioning itself as a global financial orchestration layer rather than just a […] The post Why Chainlink’s CCIP Is Turning LINK Into a Financial Infrastructure Play appeared first on CaptainAltcoin. дальше »

2026-1-26 00:00 | |

|

|

States Embrace MA Legal Playbook as Kalshi Sports Markets Remain (For Now)

A judge delayed implementing injunction barring sports event contracts in light of Kalshi’s emergency motion filing The post States Embrace MA Legal Playbook as Kalshi Sports Markets Remain (For Now) appeared first on DeFi Rate. дальше »

2026-1-24 02:07 | |

|

|

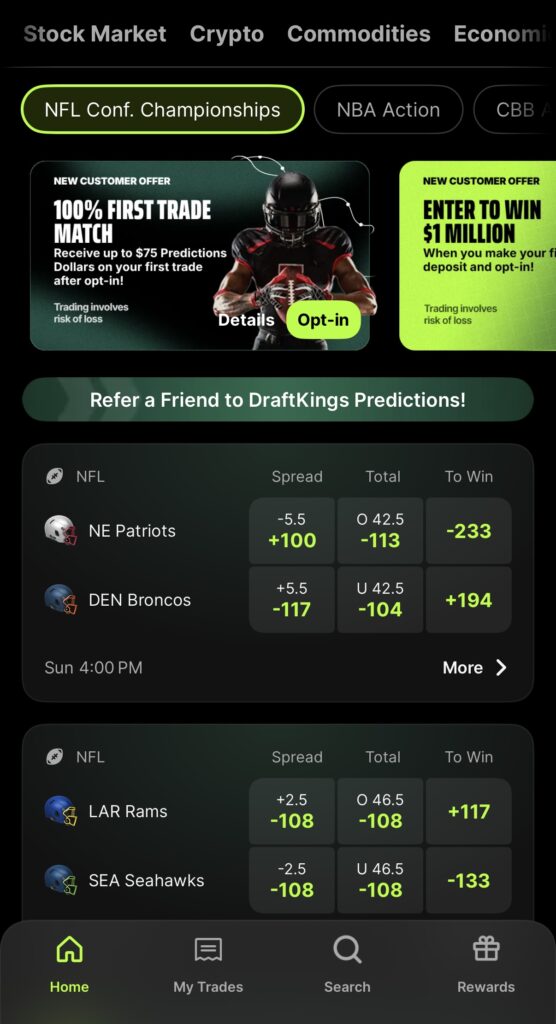

CME, Kalshi Deepen Sports Push With Super Bowl TD Props and Olympic Markets

FanDuel and DraftKings Predictions will offer CME's new self-certified contracts on Super Bowl touchdowns and more sports, as Kalshi certifies tennis in-game markets and Winter Olympics. The post CME, Kalshi Deepen Sports Push With Super Bowl TD Props and Olympic Markets appeared first on DeFi Rate. дальше »

2026-1-24 19:21 | |

|

|

Neynar Takes Over Farcaster in Strategic Shift After $150M Buildout Falls Short

Key Takeaways: Neynar is acquiring Farcaster, including its protocol contracts, core app, codebase, and Clanker. Farcaster’s original leadership is stepping back after five years, citing the need for new direction. дальше »

2026-1-22 16:36 | |

|

|

As crypto markets stall, some investors turn to asset-backed contracts generating over 3,000 XRP in daily settlements

As crypto returns grow uncertain, investors shift focus toward capital protection and transparent income models like the one provided by SolStaking. Global cryptocurrency markets continue to face sustained volatility. дальше »

2026-1-21 19:00 | |

|

|